The inflation adjusted 4% rule is a common retirement spending strategy. To follow the rule, you spend 4% of your portfolio in your first year of retirement and then increase your spending every year thereafter by 3% to account for inflation.

To see if this retirement spending strategy is right for you, ask yourself these questions.

1.) ARE YOU COMFORTABLE WATCHING YOUR NEST EGG DECLINE AS YOU GET OLDER?

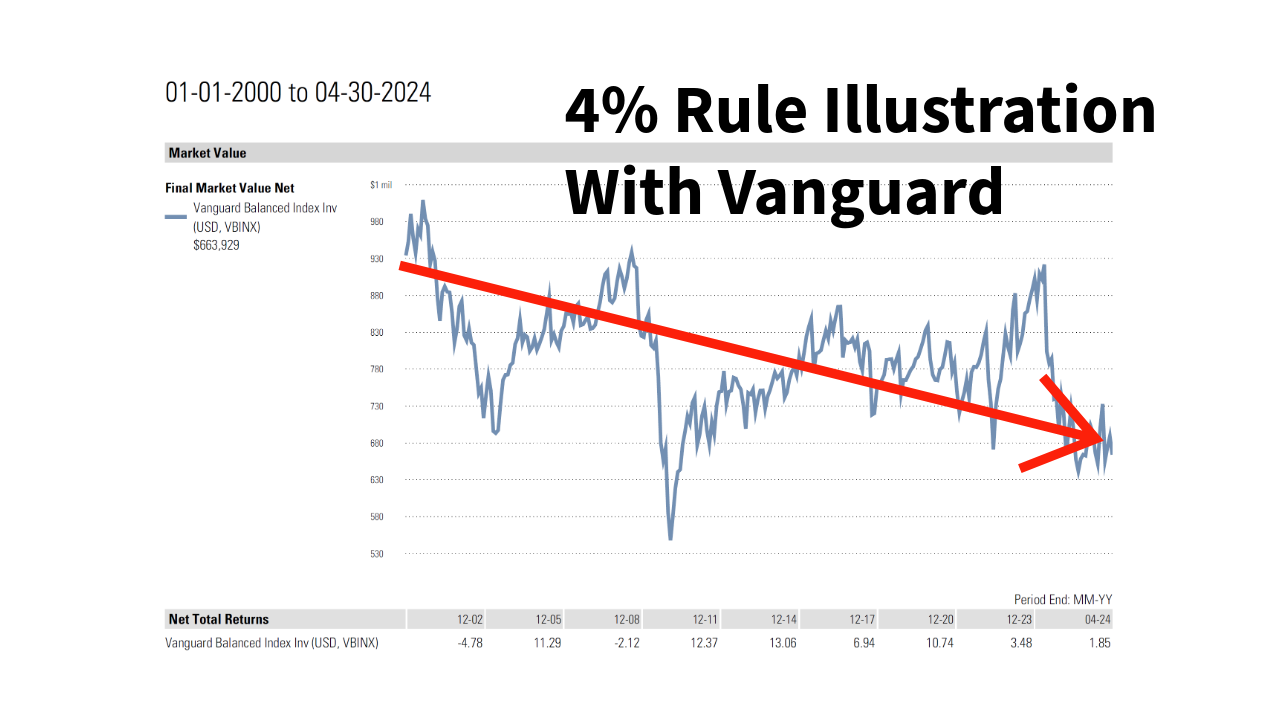

When using the inflation adjusted 4% retirement spending strategy, there is a good chance that your portfolio will decline throughout your retirement. To visualize how much you might lose throughout your retirement, let’s take a look at historical results from 2000 – 2024 for the Vanguard Balanced Index Fund.

In this example, a retiree invests $1m in the Vanguard Balanced Index fund when she retires on 01/01/2000. The retiree then takes $40,000 (4%) out of the fund at the end of January, every year. The annual distribution is inflated by 3% to account for inflation. In this illustration, the retiree takes a total of 25 distributions which is equivalent to a typical retirement. If the retiree was 65 in the year 2000, she would now be 89 years old.

The impact of bad timing, retiring right before the 2001 recession, then sequence of negative returns in 2000, 2001 and 2002, coupled with the 4% inflation adjust spending resulted in the retiree’s portfolio declining throughout retirement.

The retiree’s $1m portfolio has been depleted to the current value of $663,929.

How would you feel, watching your nest egg decline as you age? Not everyone is comfortable watching their retirement portfolio drop in value. In this example, the inflated distribution for 2024 is $81,312 which is over 12% of the portfolio value. If this retiree were to live to age 95 or older, there is a very real chance she might run out of money too.

2.) DO YOU WANT TO LEAVE AN INHERITANCE TO YOUR CHILDREN OR GRANDCHILDREN?

If leaving an inheritance to your children or grandchildren is important to you, the inflation adjusted 4% retirement spending rule may not be for you. As you can see from the illustration above, this retirement spending strategy is likely to deplete your nest egg over time. At the end of your retirement, there may not be much left for your beneficiaries.

3.) DO YOU HAVE THE DISCIPLINE TO STAY INVESTED?

The inflation adjusted 4% retirement spending rule assumes you will stay invested throughout your retirement. Poor market timing decisions could potentially ruin your retirement.

For example:

The period of 2000 – 2013 was a difficult time for the S&P 500. Nearly all retirement portfolios will have some exposure to the S&P 500. In fact, your best odds of success when using the 4% rule are when you invest in a balanced portfolio.

But would you be able to stay invested after large drops like we saw from 2000 – 2003 or 2008 – 2009? If you had panicked and sold at the bottom, you would have been forced to buy back in at higher prices. Market timing mistakes can cause you to run out of money very quickly if you are on the wrong side of the market timing.

Ethan S. Braid, CFA

President

HighPass Asset Management

Denver, CO

This article is for education and illustrative purposes and is not tax, legal or financial advice. Your broker or advisor will charge you fees or commissions to make investments and therefore your returns will be less than indexes. For example, if you invest in the S&P 500 ETF, SPY, you will pay a fee to the company managing the ETF, State Street Global Advisors. Your return on the S&P 500 ETF, SPY, will be less than the SS&P 500 Index TR because of the fee paid to State Street Global Advisors. Additionally, you may pay a fee or a commission to your broker or financial advisor, further reducing your return, below the index. Consult your advisor or broker for a detailed list of their fees or commissions before you invest. Investing involves risk and you can lose money.