HOW MUCH CAN I SPEND IN RETIREMENT?

This question is one of the most common questions people ask me when working on their retirement plan. I have often had people tell me that they were planning to spend 5% of their portfolio during retirement. For some reason, many people believe that a 5% spending rate is perfectly safe. The truth, however, is that spending 5% of your portfolio in retirement can lead to a disastrous outcome.

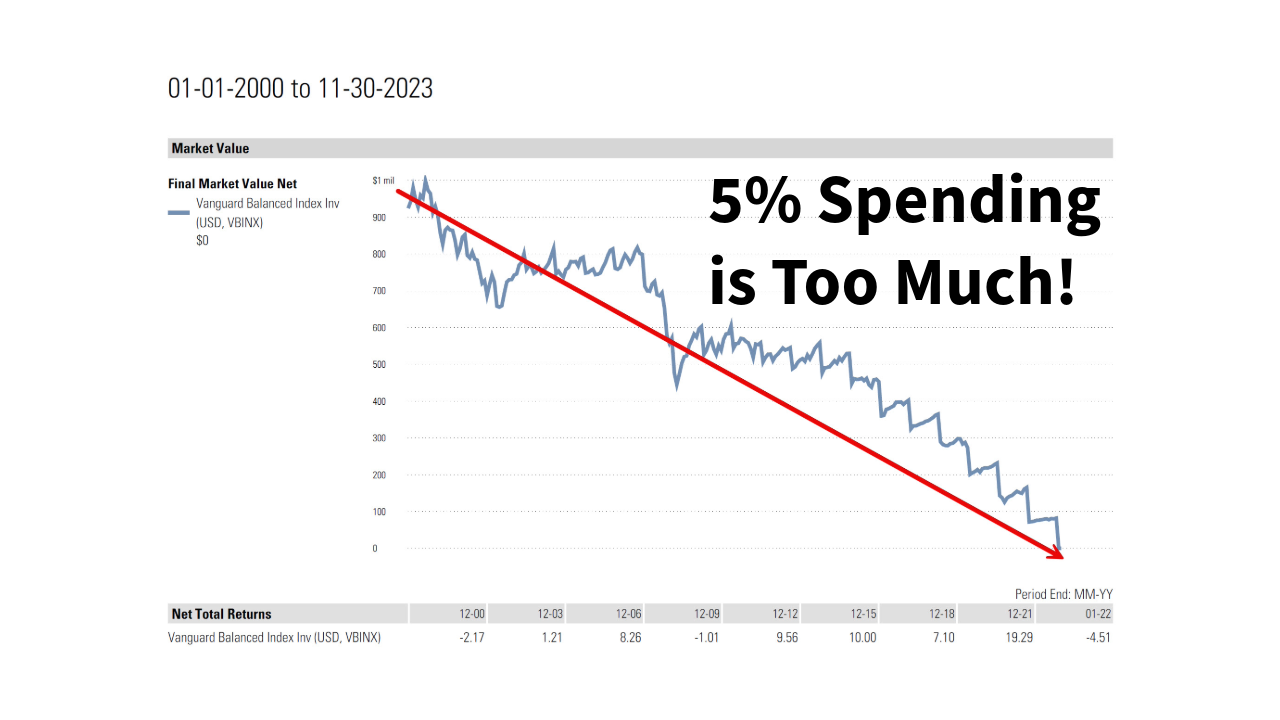

5% Spending Rate Historical Results

Let us review an illustration with historical results for a 5% spending plan over the past 25 years, a typical retirement. For this illustration we are going to use the Vanguard Balanced Index Fund, a popular retirement investment. We will begin the illustration on 01/01/2000. Our initial investment will be $1m and we will spend $50,000 (5%) of the portfolio at the end of January, every year from 2000 through 2024. We will increase our annual portfolio distribution by 3% every year to compensate for inflation.

Here are the results:

5% Spending Was too Much

5% inflation adjusted spending on this retiree’s portfolio was just too much. The impact of bad timing, retiring right before the 2001 recession and sequence of negative returns during 2000, 2001 and 2002 was more than the portfolio could handle when using such a high spending rate. By 2022 the portfolio was completely exhausted. Let’s take a look at the annual distributions to see how the 5% portfolio spending compared to the income of the fund.

You can track the 5% annual retirement spending under the distribution/withdrawal column. Notice that every year, the distribution goes up by 3% to account for inflation. The actual income of the fund, dividends from stocks and interest from bonds, can be tracked under the total reinvestment column.

The fund income was less than the 5% annual spending, specifically, the retiree is spending more than the fund is earning. The primary problem for anyone attempting to spend 5% of their portfolio in retirement is that they will be spending more than the income they are earning. Most balanced portfolios will not be able to generate 5% income from interest and dividends. Therefore, a retiree planning to spend 5% of their portfolio will need to rely upon capital gains and principal to supplement portfolio dividends and interest.

CAPTIAL GAINS CANNOT BE RELIED UPON FOR INCOME

In this illustration, the Vanguard Balanced Index fund lost money in 2000, 2001, and 2002. Since income from the fund did not cover the retiree’s spending needs, the retiree was forced to spend principal to reach their annual spending needs. Spending principal during a recession amplifies your losses and can speed up the demise of your portfolio.

SPEND 4% OR LESS TO IMPROVE YOUR ODDS OF SUCCESS

Many studies have shown that spending 4% or less of your retirement portfolio results in a spending strategy with high odds of success. If you want less stress in retirement, plan on spending 4% of your portfolio. If you want no stress in retirement, spend 3% of your portfolio.

Ethan S. Braid, CFA

President

HighPass Asset Management

Denver, CO

Your broker or advisor will charge you fees or commissions to make investments and therefore your returns will be less than indexes. For example, if you invest in the S&P 500 ETF, SPY, you will pay a fee to the company managing the ETF, State Street Global Advisors. Your return on the S&P 500 ETF, SPY, will be less than the S&P 500 Index TR because of the fee paid to State Street Global Advisors. Additionally, you may pay a fee or commission to your broker or financial advisor, further reducing your return, below the index. Consult your advisor or broker for a detailed list of their fees or commissions before you invest. Investing involves risk and you can lose money.