SGOV is a great alternative to traditional money market mutual funds like Fidelity SPAXX or Schwab SWVXX. If you are new to investing in an ETF like SGOV, you may be caught off guard by the price movement of the shares. SGOV uses the fair market value of the underlying investments to price the shares of the fund. Traditional money market mutual funds like SPAXX and SWVXX, use a special accounting method called amortized cost accounting to value the shares of the fund. This unique account valuation practice helps keep the share price of a money market mutual fund at static, $1 per share with the share price rarely dropping below $1. ETFs like SGOV will exhibit daily price volatility based upon the price change of the securities in the underlying portfolio.

While SGOV, SPAXX and SWVXX all invest in US treasury bills, the accounting differences in SPAXX and SWVXX keep the daily price movements of underlying investments hidden. With SGOV, you will see how the underlying investment price movements impact your shares.

Two Main Forces Driving SGOV Share Price

- Dividend Declaration

- US Treasury Bills Advancing Towards Par Value

Dividends Affect SGOV Share Price

SGOV generally declares a dividend on the 1st of the month and that dividend is typically paid around the 4th to the 6th of the month. When the dividend is declared, the price of SGOV shares will be adjusted downward to reflect the declared dividend.

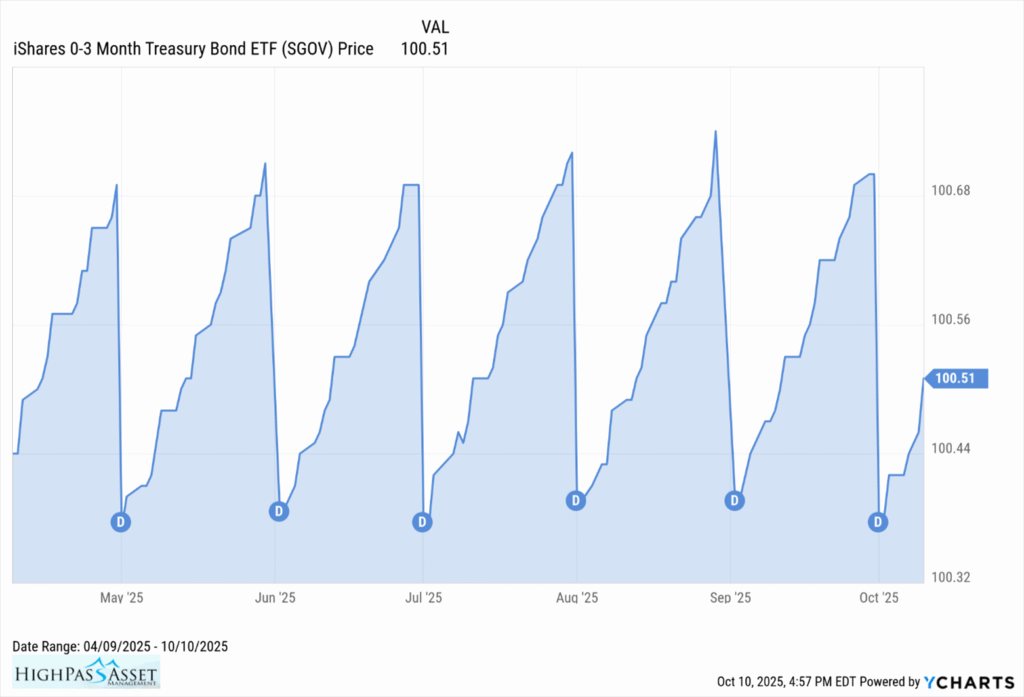

The chart above shows the price of SGOV from April 9, 2025 to October 10, 2025. A clear pattern is visible. On the 1st of the month, the share price drops when the monthly dividend (blue circle with a ‘D’) is declared. After the dividend is declared, the share price begins to move back up until the next monthly dividend is declared. When that dividend is declared the share price drops again and the cycle repeats.

US Treasury Bills Moving Towards Par Value

SGOV is invested almost entirely in US treasury bills. The fund focuses on 0 – 3 month maturities. With such short maturities, the portfolio holdings do not have much time to wait until they reach par value. As the treasury bills get closer to maturity and par value, the fair market value follows, resulting in the pattern above showing a consistent monthly rise in the share price of SGOV.

For a quick refresher on treasury bills, they are zero coupon investments. You buy them at a discount, and they mature at par value. Par value is $1,000 per bill. For example, you pay $950 for a US treasury bill and when the bill matures you receive $1,000. The difference between the $950 you paid and the $1,000 maturity payment you received is your interest.

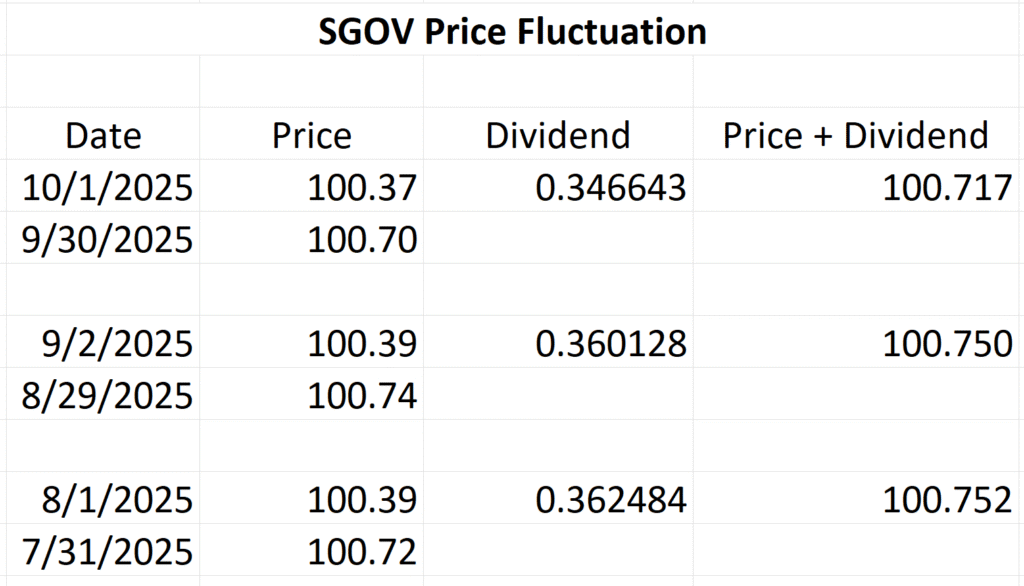

Add the Declared Dividend to the Share Price

Even though SGOV share price will drop once the monthly dividend is declared, investors in SGOV are typically not losing money in the process. The table below shows the month end pricing for SGOV for July, August and September of 2025. If you add the adjusted share price to the declared dividend the net amount is higher than the previous days’ month end share price for all three months. This pattern is typical for SGOV.

Ethan S. Braid, CFA

President

HighPass Asset Management

Denver, Colorado