Leverage loans also known as bank loans, offer investors a great opportunity for above average interest rates. This guide will introduce you to leveraged loans and give you an overview of important factors that must be considered when investing in leveraged loans.

What are Leveraged Loans?

Leveraged loans are bank loans that are typically made to mid-cap size companies with below investment grade credit. These loans are generally five to seven years in term. Loan payments are made quarterly with a small amount of principal amortization over the life of the loan. Usually about 1% of principal is repaid on an annual basis. The interest rate one earns on a leveraged loan is a floating rate. The benchmark interest rate for leveraged loans is SOFR (secured overnight financing rate). A static spread over the SOFR benchmark will be added to each quarterly payment. The spread over SOFR will be determined at the time the loan is written. At maturity for a leveraged loan the lender may be paid off, or the borrower may choose to amend and extend the loan. If the loan is extended, there will be a negotiation between the lender and the borrower and the spread over SOFR may change.

Loan Payment Example for SOFR + 350 basis points

If SOFR (secured overnight financing rate) is 5%, then your total interest payment on a leveraged loan would be 500 basis points + 350 basis points = 850 basis points, or 8.50% (annualized rate).

Who Buys Leveraged Loans?

- Mutual Funds

- ETFs

- Hedge Funds

- Pensions

- Asset Managers

- Banks

- Insurance Companies

- CLOs

What is Easiest Way to Invest In Leveraged Loans?

- Purchase a mutual fund or an ETF that specializes in leveraged loan investing.

- Fidelity Advisor Floating Rate High Income Fund Z (FIQSX) and Franklin Senior Loan ETF (FLBL) are two examples of leveraged loan funds.

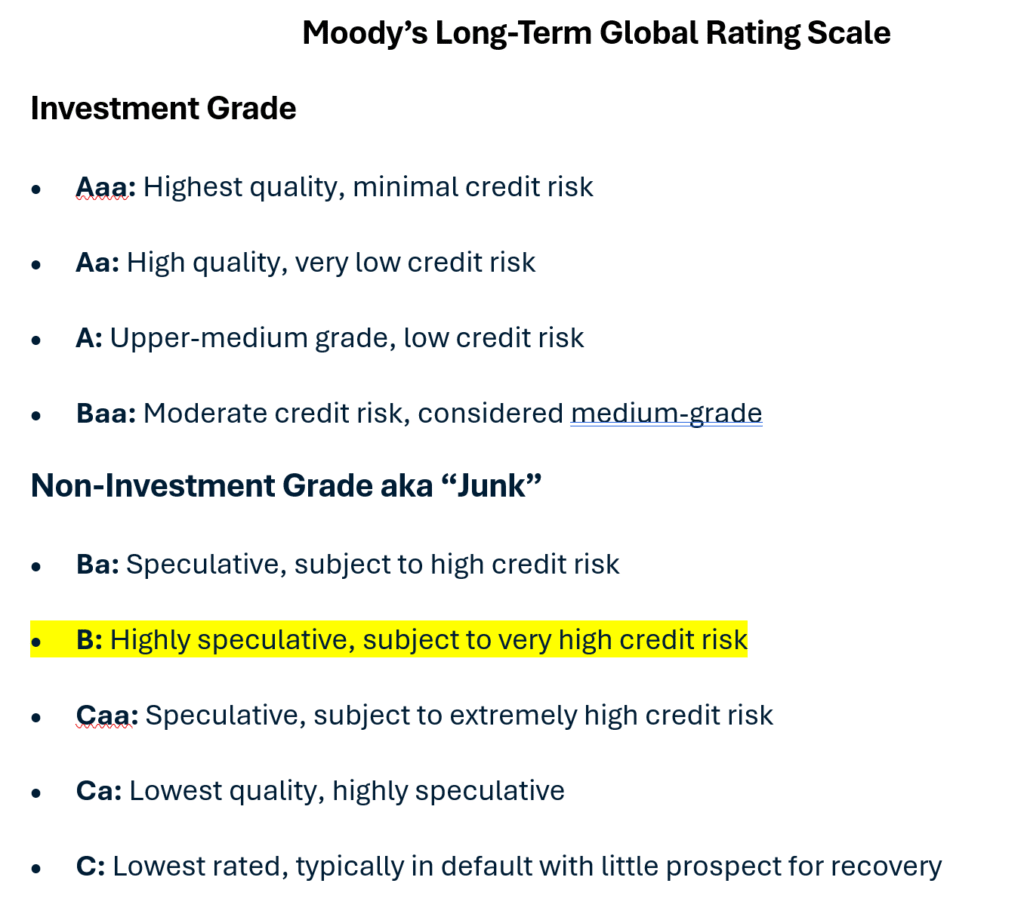

What is the Average Credit Score for a Leveraged Loan Fund?

- Leveraged Loan portfolios often have an average credit score of ‘B.’

- According to Moody’s, ‘B’ credit is highly speculative.

What Returns Can Leveraged Loans Provide?

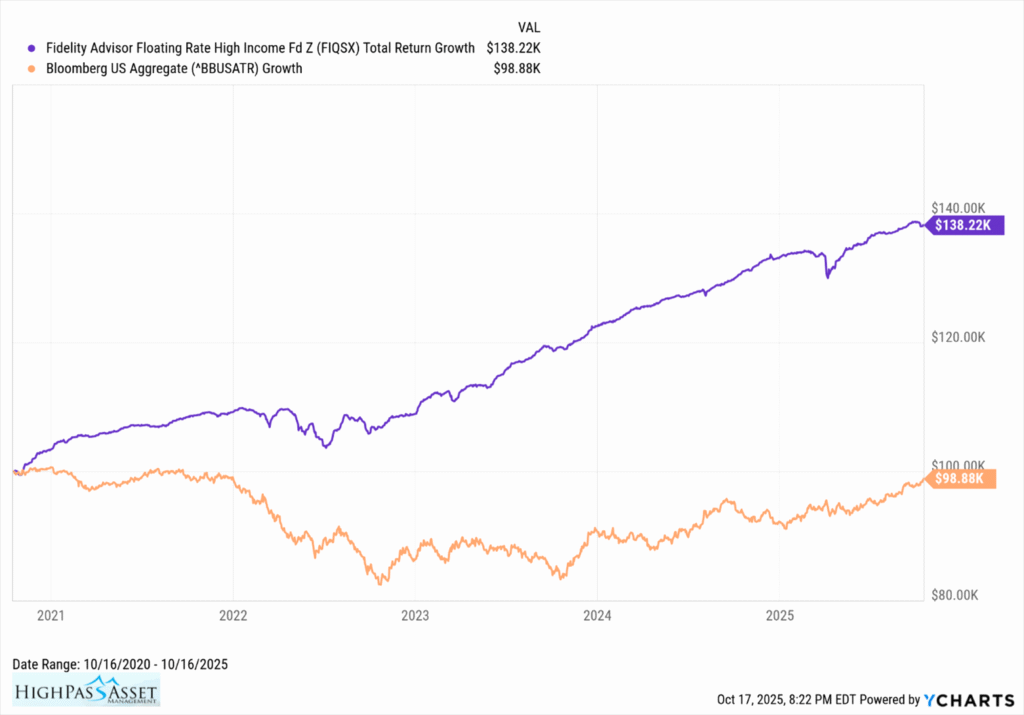

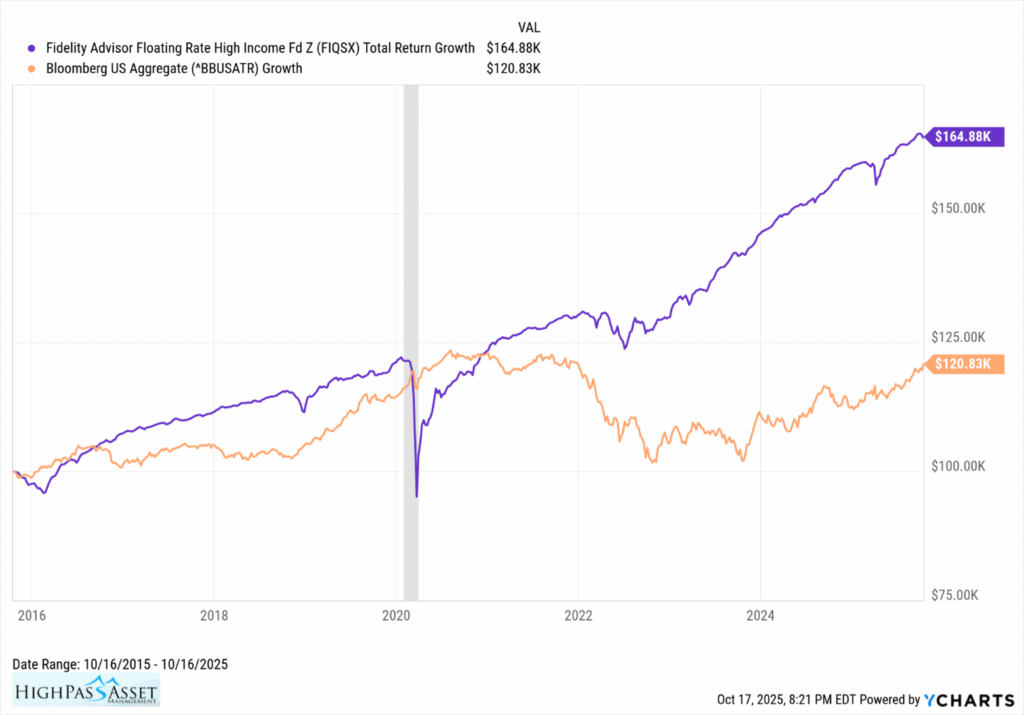

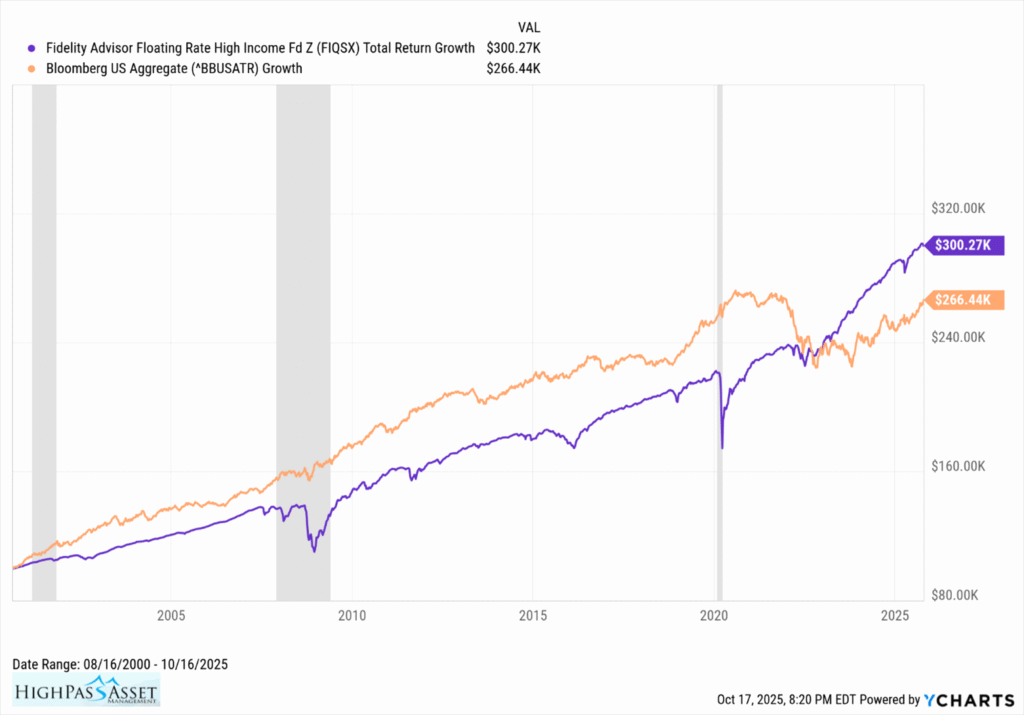

Leveraged loans can provide returns that beat the bond market as a whole. The chars below compare the Fidelity Advisor Floating Rate High Income Fund Z (FIQSX) to the Bloomberg US Aggregate Bond Index over the past 5, 10 and 25 years. The illustrations are for a $100,000 initial investment with reinvested dividends. The leverage loan fund beat the bond market, significantly, in all three time periods.

What Risks Come with Leveraged Loans?

- Credit risk: Leveraged loans are made to companies that are heavily in debt and therefore below investment grade.

- Default risk: Leveraged loans have a higher risk of default when compared to investment grade securities.

- Spread risk: Spreads for below investment grade credit may widen substantially, like 2008, which reduces the market value of leveraged loans.

- Liquidity risk: Leveraged loans are generally not as liquid as traditional loans and bonds. While leveraged loans can be traded, a seller may have to discount the loan significantly to get a sale.

Spread Risk Example

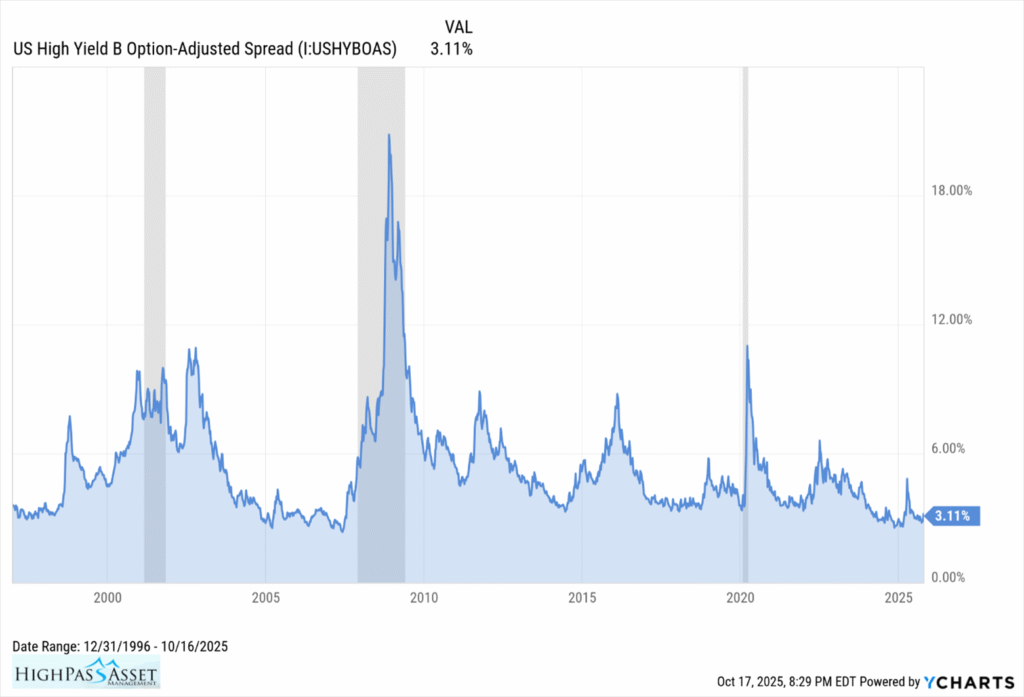

The chart below shows the long-term picture for the US High Yield B Option Adjusted Spread (OAS) spread. The US High Yield B OAS is the extra yield that B rated securities provide over comparable term treasuries. This spread will directly influence the fair market value of leveraged loans. In 2008 and again in 2020 the US High Yield B OAS moved up rapidly. In both instances, leveraged loans took a significant price hit with many loan funds falling 20% or more.

How do Leveraged Loans Compare to High Yield Bonds?

- Loan investors are ahead of bond holders in the event of a bankruptcy.

- Loan investors can expect greater recovery rates than bond holders of the same company.

- Loan investors have minimal interest rate risk due to the extremely low duration of loan funds. High yield bond investors will have much higher interest rate risk due to the higher duration associated with fixed coupon high yield bonds.

- Loan maturities are typically shorter than bond maturities.

What is the Historical Default Rate for Leveraged Loans?

- Information varies by source, but the long-term average default rate is a little under 3%.

- The default rate can fluctuate significantly. In good economic years, the default rate may be under 2%. During a deep recession with many bankruptcies like 2008, the default rate can go as high as 10% or even higher.

What is the Historical Recovery Rate for Leveraged Loans:

- Long term average recovery rate for leveraged loans is between 65% – 70%.

- The recovery rate for leveraged loans fluctuates like the default rate.

- The recovery rate for leveraged loans will also be heavily influenced by the assets of a company and the industry the company operates in.

Despite the Risks, Why are Leveraged Loans Attractive?

- Senior Credit. Leveraged Loans are ahead of bondholders and equity holders in the event of bankruptcy. Leveraged loan investors will have a higher recovery rate on a defaulted loan than bond investors in the same company. Compared to junk bonds, which are in the same non-investment grade credit category as leveraged loans, the higher recovery rate of leveraged loans vs junk bonds, is a desirable feature.

- The yield premium (spread) that leveraged loans pay over comparable term treasuries is substantial. Often 3% or more.

- Limited Duration. Leveraged loan funds have very low duration which means low-interest rate risk. If we have another inflation event and interest rates go up, leveraged loans may not take as much of a hit as traditional fixed coupon bonds with high duration.

Ethan S. Braid, CFA

President

HighPass Asset Management

Denver, CO

This article is for education and illustrative purposes and is not tax, legal or financial advice. Your broker or advisor will charge you fees or commissions to make investments and therefore your returns will be less than indexes. For example, if you invest in the S&P 500 ETF, SPY, you will pay a fee to the company managing the ETF, State Street Global Advisors. Your return on the S&P 500 ETF, SPY, will be less than the SS&P 500 Index TR because of the fee paid to State Street Global Advisors. Additionally, you may pay a fee or a commission to your broker or financial advisor, further reducing your return, below the index. Consult your advisor or broker for a detailed list of their fees or commissions before you invest. Investing involves risk and you can lose money.