The all-equity retirement portfolio strategy can certainly work for some retirees. There are three areas you need to focus on to win with this retirement investment strategy.

1). Downturns.

2). Distributions.

3). Taxes.

Downturns

The business cycle is real and eventually, a downturn happens. In my twenty-five+ years in wealth management I have seen the S&P 500 drop by about 50% twice and I am sure I will see it happen again.

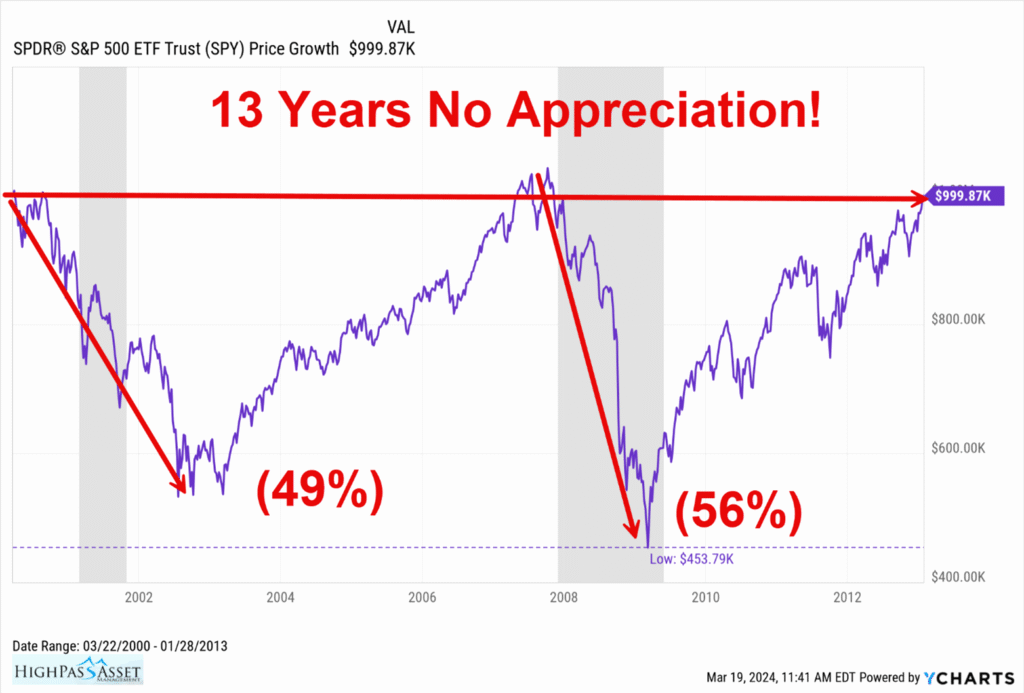

In the chart below you can see the wild ride that occurred for SPY (S&P 500 ETF) from 2000 – 2013. The chart below shows the price change in value for a $1 million dollar investment in SPY, with no dividends re-invested. In this illustration, we are assuming that the dividends were spent.

Would you be comfortable watching your $1 million retirement portfolio decline to a low of $453,000? If you plan to use the all-equity retirement strategy, you must be comfortable with this level of volatility.

For nearly seventeen years we have been a spectacular bull market. Nobody knows how much longer this bull market will continue but eventually a recession will show up. Because the stock market is very expensive by historical standards, the losses are likely to be larger than people expect.

For a retiree using the all-equity retirement portfolio strategy, it is critical that you prepare yourself now, to be willing to accept a loss of at least 50% or more of your principal. It is equally important that you stay invested during a downturn and avoid market timing. Many investors simply cannot handle seeing their portfolio decline by 50% or more and lose their nerve and sell at the bottom. If you experience a large decline in the stock market and then cash out at the bottom, your retirement is ruined.

Frequently I meet couples who have different views on portfolio risk. One spouse may be more aggressive than the other. For married couples, when selecting the all-equity retirement portfolio strategy, it is critical that both partners agree to the risk of an all-equity retirement portfolio. Couples should go through a modeling process where they stress their portfolio by a hypothetical decline of 50% to gauge their comfort level with such a loss.

Distributions

The best way to succeed with the all-equity retirement strategy is to invest in equities that pay dividends and only spend the dividends you receive on your portfolio. By spending only dividends, you allow the principal to grow. If there is a downturn, you will not put pressure on the principal by spending it when the value is down.

If you cannot cover your budget spending only dividends, then you will need to make sure your distribution from the portfolio is sustainable. Limit your distribution to 4% of the portfolio for your best odds of success. The 4% rule can work with an all-equity retirement portfolio but if you have bad timing, it is possible that you can run out of money.

All-Equity Retirement Portfolio Illustrations

Here are some examples of how the timing of your retirement is impacted when using the all-equity retirement portfolio strategy.

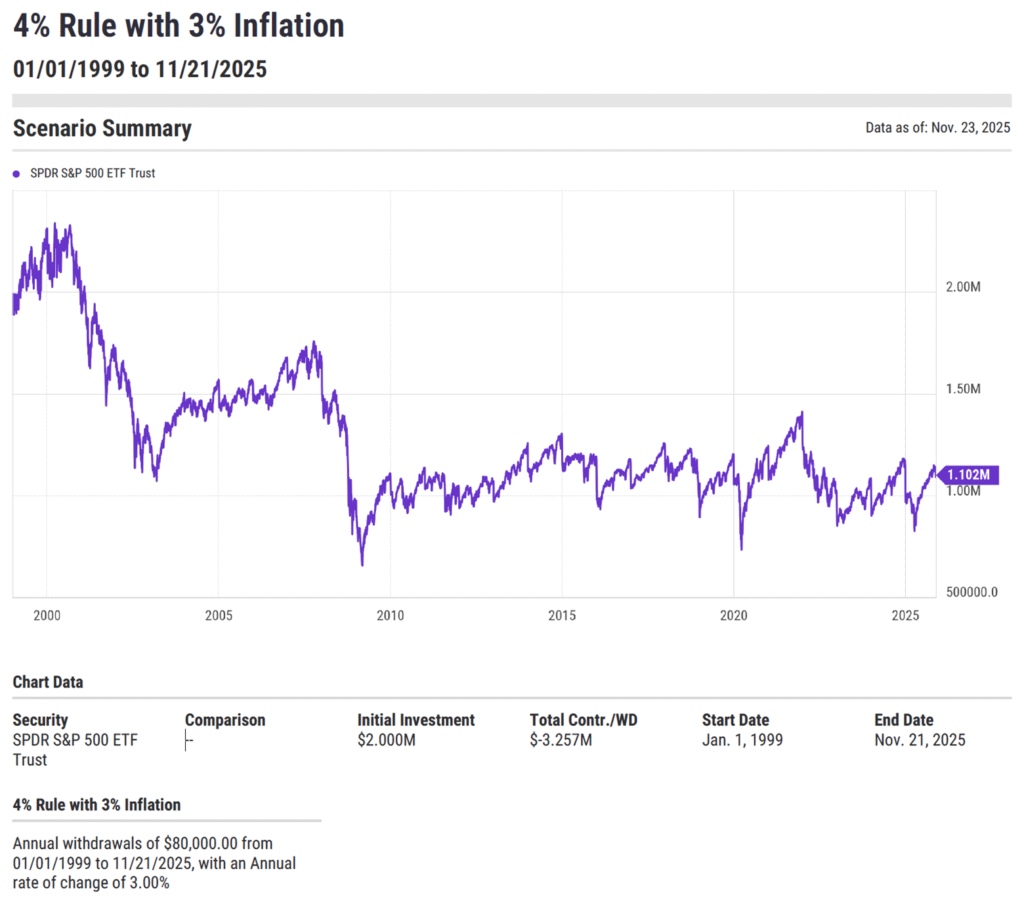

For a retiree who invested $ 2 million in SPY on 01/01/1999 and used the 4% rule adjusted for 3% inflation, by November of 2025 the portfolio was down to $1.10 million.

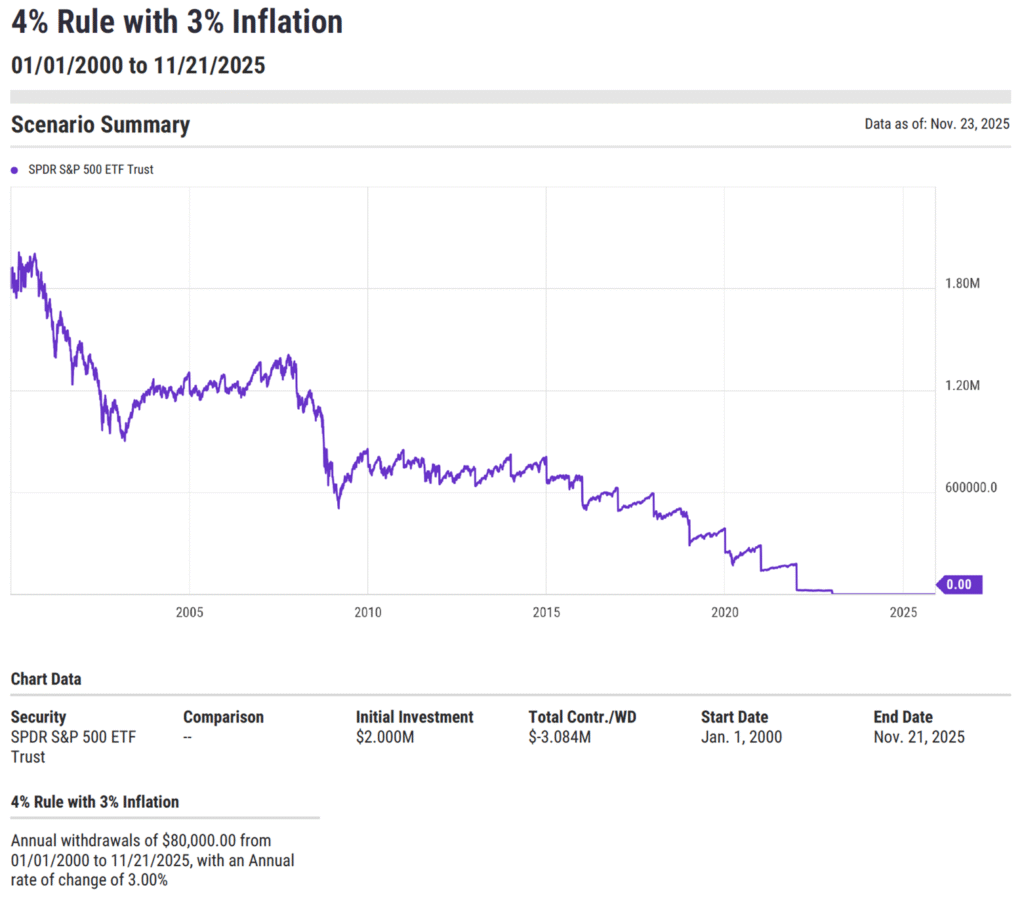

For a retiree who invested $ 2 million in SPY on 01/01/2000 and used the 4% rule adjusted for 3% inflation, by 2023, the portfolio ran out of money.

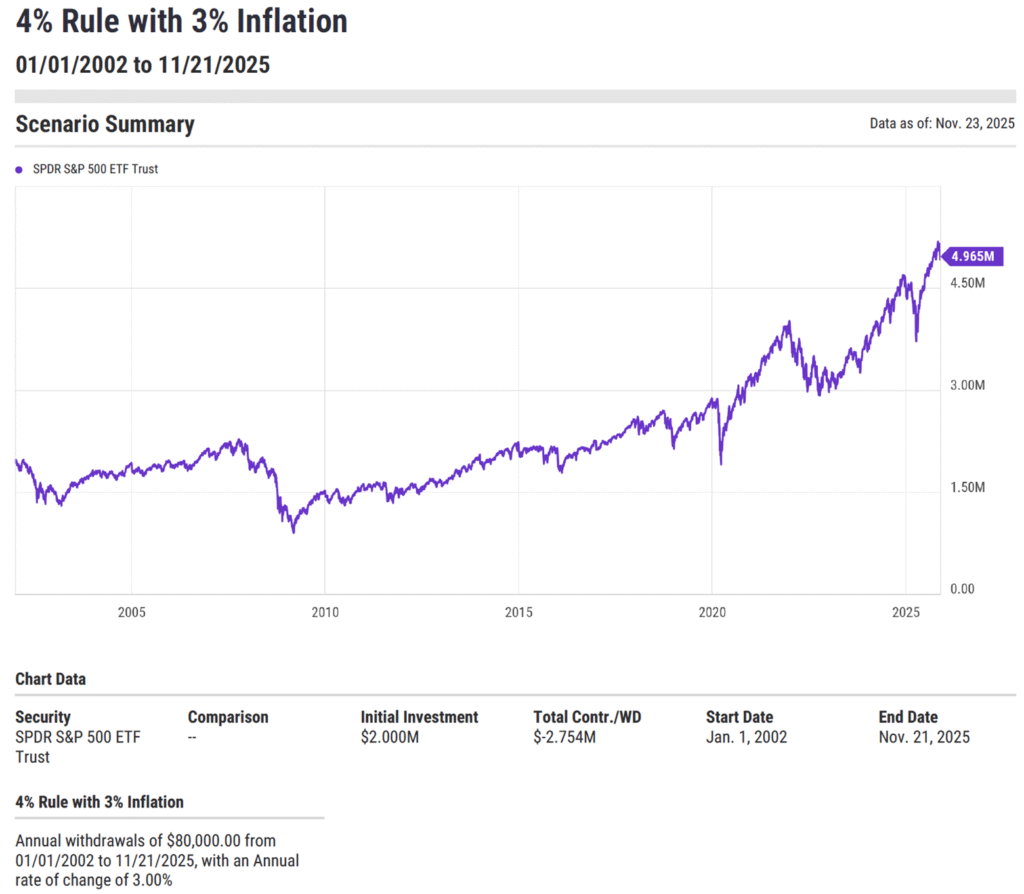

For a retiree who invested $ 2 million in SPY on 01/01/2002 and used the 4% rule adjusted for 3% inflation, by November of 2025 the portfolio was up to $4.96 million.

What you can learn from these charts is that the timing of your retirement has a huge impact on how successful the all-equity retirement portfolio strategy will be for you. Since you cannot know if your retirement timing is good or bad until after the fact, you will need to focus on managing your distributions properly.

Pay attention to downturns. If there is a sudden downturn of 20% or more in your portfolio, can you get by just spending dividends for a while? Try to avoid spending principal whenever there is a drop of 20% or more. This action step will help your portfolio to recover from market losses.

Taxes

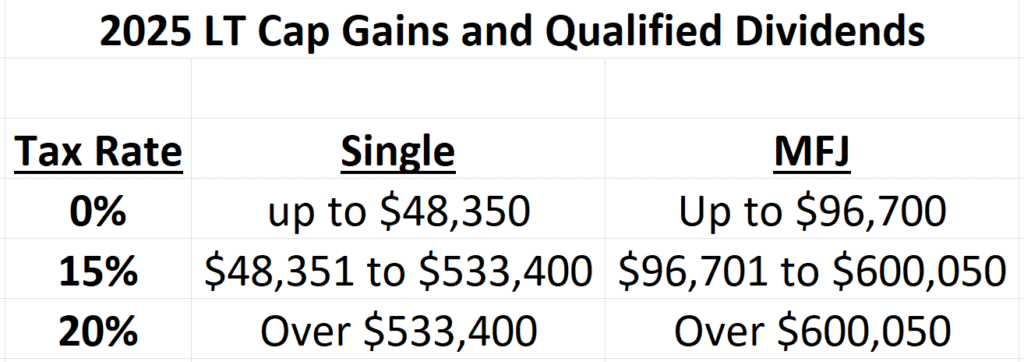

If your all-equity retirement portfolio is in an after-tax brokerage account, the dividends you receive will be taxed as qualified dividends, subject to the same preferential tax rates as long-term capital gains. Long-term capital gains are taxed at 0%, 15% and 20%.

If you need to sell investments to fund your retirement distributions, pay attention to the unrealized capital gains or losses before you sell. Also review the time you have held the investment. To qualify for long-term capital gains, you must hold an investment for a year. If you own an investment that was made at different times, then you should review the purchase dates for all the different purchase lots. You can instruct your broker to sell a specific lot. Specifying which lots to sell can help lower your taxes by selling lots with lower appreciation, losses and lots that have been held for longer than one year.

When using the all-equity retirement portfolio strategy in an IRA account, you have much less flexibility with taxes. All distributions from an IRA will be taxed as ordinary income. If you are in this situation, pay attention to tax brackets and try to manage your distributions to stay in the lowest bracket you can.

Ethan S. Braid, CFA

President

HighPass Asset Management

Denver, Colorado

This article is for education and illustrative purposes and is not tax, legal or financial advice. Your broker or advisor will charge you fees or commissions to make investments and therefore your returns will be less than indexes. For example, if you invest in the S&P 500 ETF, SPY, you will pay a fee to the company managing the ETF, State Street Global Advisors. Your return on the S&P 500 ETF, SPY, will be less than the SS&P 500 Index TR because of the fee paid to State Street Global Advisors. Additionally, you may pay a fee or a commission to your broker or financial advisor, further reducing your return, below the index. Consult your advisor or broker for a detailed list of their fees or commissions before you invest. Investing involves risk and you can lose money.