Municipal Bonds, are they right for your portfolio? I am going to show you a process to determine if municipal bonds are a good deal for you.

We are going to focus on two areas:

- Taxable Equivalent Yield

- Liquidity

What Are Muni Bonds?

First, let’s quickly go over what municipal bonds are. Municipal bonds are debt issued by State and Local governments. Municipal bonds can provide federally tax-free interest. Additionally, municipal bonds can be state tax-free if you are a resident of the state issuing the municipal bonds you own in your portfolio. Because some municipal bonds are taxable, it is important that you check the tax status of any municipal bond before buying the bond.

Taxable Equivalent Yield (TEY)

The process I am going to show you is applicable to all investors in all states.

To determine if a municipal bond makes sense in your portfolio, you need to calculate the taxable equivalent yield you would receive from a municipal bond and compare that yield to the pre-tax yield you would receive on a comparable term and credit taxable bond. The taxable equivalent yield is the pre-tax yield you would need to receive from a taxable bond, to equal the tax-free yield you are receiving from a municipal bond.

If the taxable equivalent yield on a municipal bond is more than what you could get for a comparable term and credit quality taxable bond, then the municipal bond is a good deal. If the taxable equivalent yield on a municipal bond is less than a comparable term and credit quality taxable bond, then the municipal bond is not a good deal.

Here is how we calculate the taxable equivalent yield on a municipal bond. This is a very simple calculation. The formula is to divide the municipal bond yield by (1 – tax rate).

To determine your tax rate, you start with your highest marginal tax bracket. Then you add any other taxes that you might have to pay on your bond interest. Other taxes would be the net investment income tax (NIT) and state income taxes.

Let’s look at a real example with an actual municipal bond.

This example is for a resident of the state of Colorado who is in the highest tax bracket and is investing in tax exempt Colorado municipal bonds.

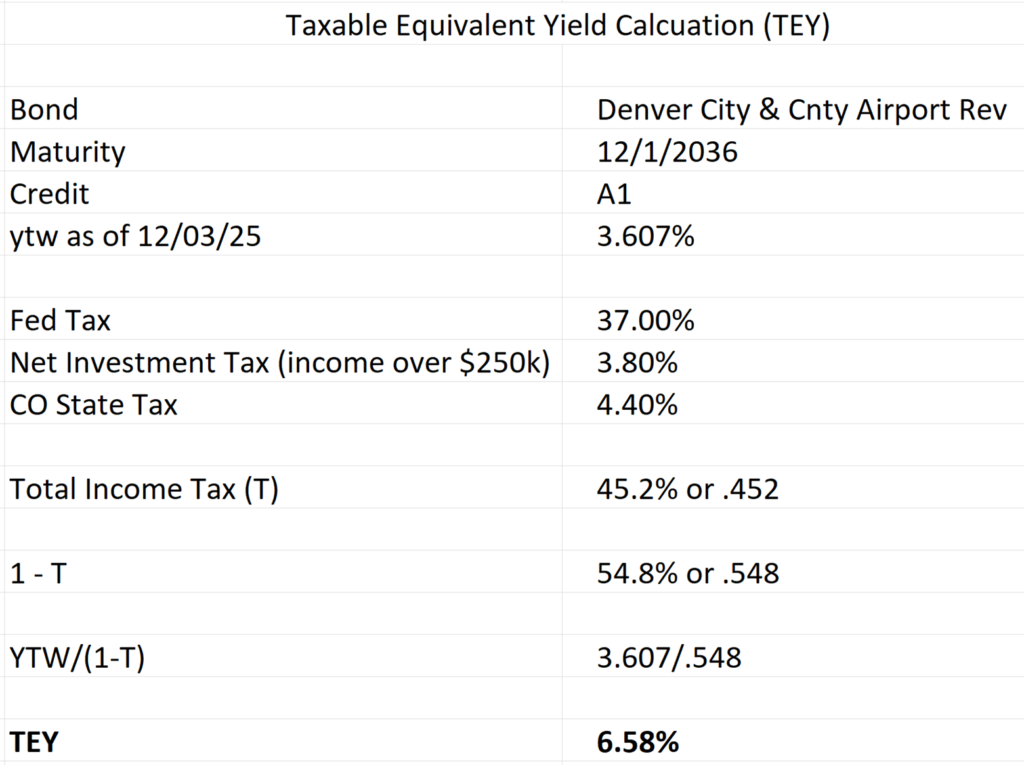

This bond is a Denver City & County Airport Revenue bond. The maturity is in 11 years, December 1st of 2036. The credit is A1 and yield to worst as of 12/03/25 is 3.607%. Yield to worst is the lowest possible yield an investor could receive when adjusting for any call features.

The tax rate is calculated by adding the highest marginal tax bracket of 37% to the 3.8% net investment income tax and the Colorado State income tax of 4.40%. The total tax this resident would pay on a taxable bond interest would be 45.20% or .452. Subtracting .452 from 1 results in a divisor of 54.80% or .548.

Once you have calculated your divisor, you can easily calculate the taxable equivalent yield for any bond or fund you are looking at.

In this example we divide the ytw of 3.607% by the divisor of .548 and our TEY is 6.58%.

Now we can determine if this bond is a good deal or not. This Colorado municipal bond is providing our example investor with the equivalent of a 6.58% pre-tax yield for an A1 rated, 11 year bond. Can you find an 11 year bond with A1 credit that offers a pre-tax yield of 6.58% or higher? If not, then the Colorado municipal bond is a good deal. As of December 3rd, 2025, according to Google, taxable bonds with A1 credit due in 11 years are paying an average of 4.69%. Therefore, in this bond example, our investor in the highest tax bracket has a compelling reason to purchase municipal bonds over taxable bonds.

Liquidity

There are approximately 1.5 million different municipal bond issues outstanding with a debt value over $3 trillion. Many of these issues are very small in size. Sometimes only $200 million.

When you purchase municipal bonds your expectation should be to hold the bonds until maturity. However, this is not always the case. If you end up in a situation where you might need to sell your municipal bonds before maturity, then liquidity is a serious concern that you need to consider.

When I say liquidity, I am referring to your ability to sell the bond quickly and for a price close to market value.

Only some issues, the largest issues, will have liquidity. When you purchase small issues, you may not be able to sell your bond at all, or you may be forced to accept a significant discount to sell your bond. Just pay attention to issue size and recent trading history.

Small issues with limited liquidity often have higher yields than large issues or municipal bond ETFs. While the extra yield on small issues is enticing, If you think you might have to sell your bonds before maturity make sure you avoid small municipal bond issues that could have liquidity problems.

Ethan S. Braid, CFA

President

HighPass Asset Management

Denver, Colorado