The recent research paper, Beyond The Status Quo: A Critical Assessment of Lifecycle Investment Advice, has created a lot of buzz since the paper was published. The authors advise an optimal retirement portfolio that is 100% equities with 33% in domestic stocks and 67% in international stocks. While many are hailing this research article as evidence that retirees should be more aggressive with their retirement portfolio, we think the research is flawed and will harm many retirees who follow the researcher’s advice.

The Author is Biased Towards a Bull Market

Professor Anarkulova graduated from college in 2013. She has never managed money during a secular bear market like the 2000 – 2013 period or the 1968 – 1982 period. She cannot relate to a stock market drawdown of 50%; she has no experience with a loss of this magnitude. Her lack of experience with a real bear market creates a bias toward risk taking with stocks. She has not met with investors, in the moment, who have lost 50% or more during a stock market crash. She cannot appreciate how investors react to severe market drawdowns and how their risk tolerance changes during times of uncertainty. She has never experienced true investor panic or seen the concern on their faces as they wonder about their future. If she had these experiences, she might not advocate for a 100% equity retirement portfolio.

The Paper’s Advice is Dangerous

Most retirees have no business in an all-equity retirement portfolio. I have been managing money for retirees for over 25 years and have met with over 300 wealthy families. In my experience, most retirees will state that they are a ‘5’ on a 1 – 10 risk scale. They want to limit annual volatility to much less than the stock market. Even with an asset allocation portfolio that is properly aligned with their risk tolerance, retirees often panic during downturns and sell their investments at the bottom. I witnessed this behavior in 2002, 2009 and the spring of 2020. Convincing retirees that they should invest in an all-equity retirement portfolio strategy is not suitable for most retirees and downright dangerous. Only a very small number of retirees have the necessary wealth or risk tolerance to use an all-equity portfolio in retirement.

The Paper’s Risk Analysis is Flawed.

The paper states that the average maximum drawdown for a 60/40 equity/fixed balanced portfolio has identical average maximum real loss when compared to the optimal all-equity portfolio. The researchers say that the average maximum real loss will be -54% for the 60/40 portfolio and -55% for the optimal all-equity retirement portfolio. These numbers appear flawed. The researchers are making the case that the 60/40 portfolio has the same risk as the all-equity portfolio but with less upside. Additionally, the researchers believe that the 60/40 portfolio has a greater range of worst-case outcomes and higher standard deviation than the optimal all-equity portfolio. This finding is not consistent with historical patterns.

Past Worst-Case Drawdown 60/40 vs All-Equity

The 2008 stock market crash was a 2+ standard deviation even for the stock market. A rare event that does not happen very often, maybe twice in a person’s life. Since the professor is making the case that the 60/40 portfolio is equally as aggressive as the all-equity portfolio, let’s examine the 2008 – 2009 drawdowns for the 60/40 portfolio vs the S&P 500.

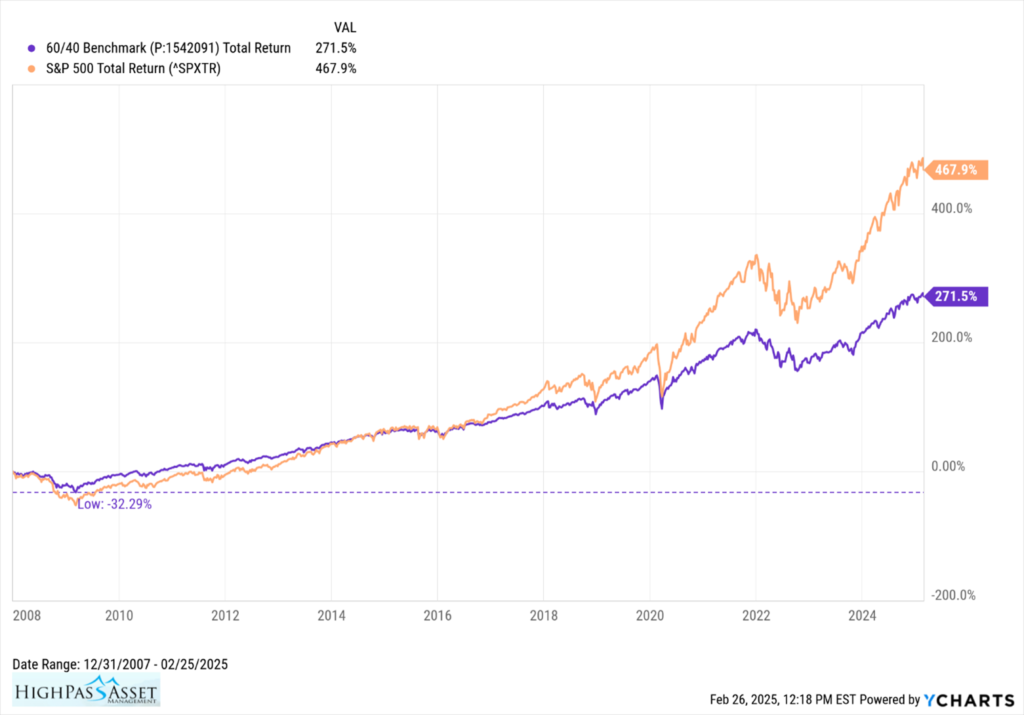

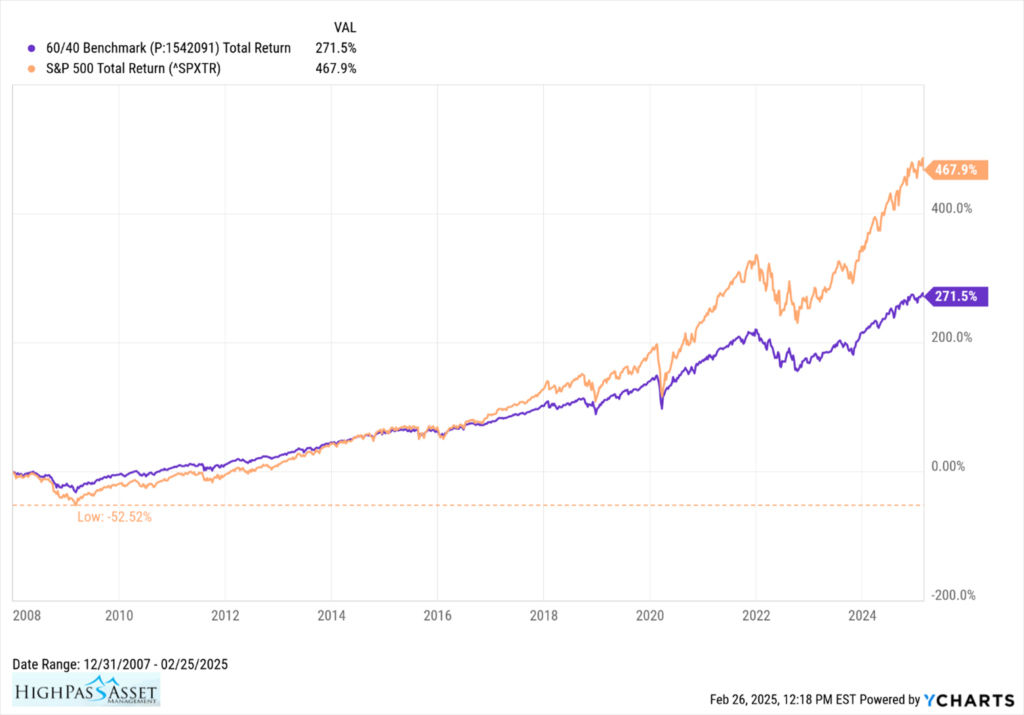

In the charts below, we are comparing the 60/40 S&P 500TR/Bloomberg Agg Bond TR, annually rebalanced, to the S&P 500TR.

For a retiree who retired on 01/01/2008, by early 2009 the 60/40 portfolio had declined -32.29%. The loss for the S&P 500, however, was -52.52%. In the past 2+ standard deviation drawdown for the investment markets, the 60/40 did not come anywhere near the researcher’s proposed -54% maximum average worst-case scenario.

There is Nothing New in This Paper

The authors of the paper demonstrate that by having an all-equity portfolio during retirement, retirees will accumulate more wealth. While this is true, there is nothing game changing with that position. Dr. Siegel wrote his excellent book in 1994, Stocks for The Long Run. He clearly detailed how stocks provide superior long term returns relative to other asset classes. We have known for decades that if you concentrate in stocks, you are likely to have superior long-term returns.

The problem for most retirees is that they cannot tolerate the volatility that comes with an all-equity retirement portfolio. To convince retirees to be more aggressive in retirement is bad advice. What the researchers are underestimating is the reaction most retirees have to stock market losses. Many retirees will panic and sell when they see their investments drop during a crash, abandoning their financial plan and crippling their retirement finances.

Ethan S. Braid, CFA

President

HighPass Asset Management

Denver, CO

Your broker or advisor will charge you fees or commissions to make investments and therefore your returns will be less than indexes. For example, if you invest in the S&P 500 ETF, SPY, you will pay a fee to the company managing the ETF, State Street Global Advisors. Your return on the S&P 500 ETF, SPY, will be less than the S&P 500 Index TR because of the fee paid to State Street Global Advisors. Additionally, you may pay a fee or commission to your broker or financial advisor, further reducing your return, below the index. Consult your advisor or broker for a detailed list of their fees or commissions before you invest. Investing involves risk and you can lose money.