There are many mistakes you can make when selecting an asset allocation strategy for your retirement. In this article we will review two serious mistakes an investor can make with their asset allocation strategy.

Selecting an asset allocation that does not match your risk tolerance.

Selecting an asset allocation strategy you will stick with during periods of investment volatility is a critical step in the retirement planning process. If your asset allocation does not match your risk tolerance, you may panic and sell your investments when the market drops, and you may ruin your retirement plan. All retirement planning software assumes that you will stay invested for the duration of your retirement. Therefore, the importance of selecting an asset allocation you are comfortable with cannot be overstated. If you panic and sell your portfolio at the bottom of a market rout, you might as well throw your financial plan away.

Recessions are real and they occur about every seven years on average. Eventually, you will experience a recession and a likely drop in the investment markets. To make sure your asset allocation matches your risk tolerance, review how your asset allocation performed in prior recessionary periods.

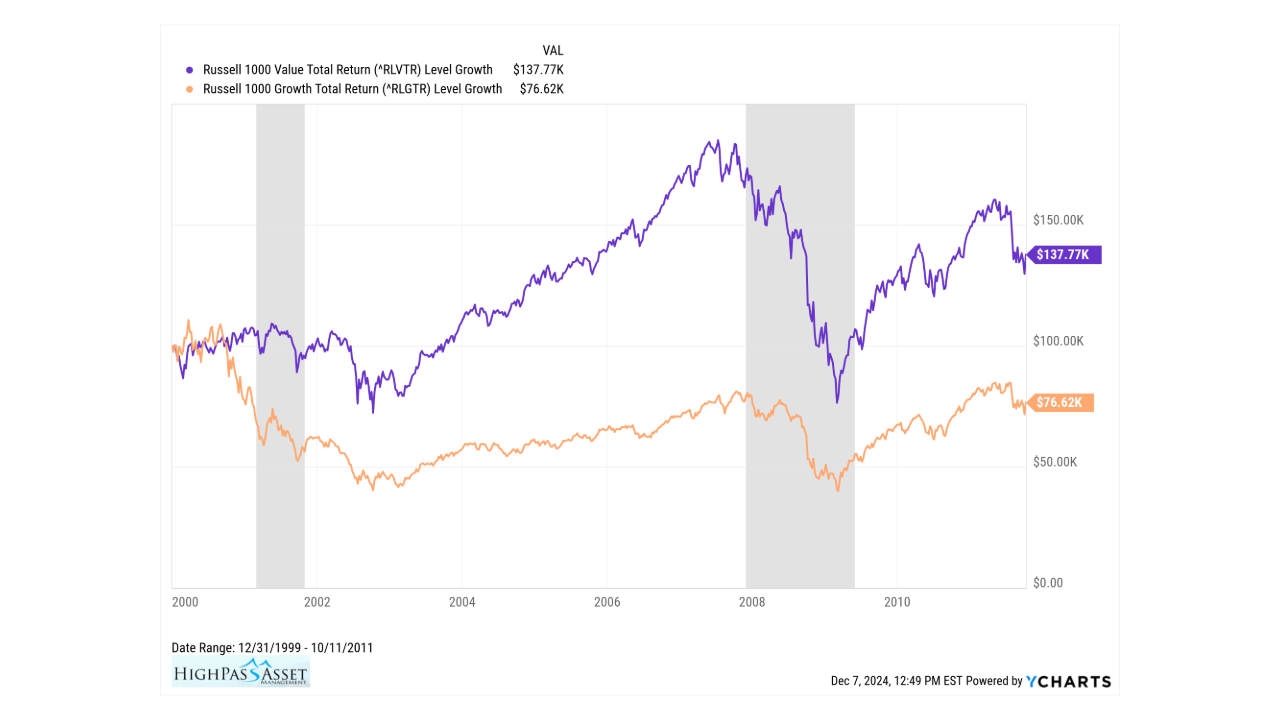

The table below shows the losses from 2008 for various stock/bond asset allocations using the S&P 500 Index total return proxy, SPY ETF and the Bloomberg Aggregate Bond Index total return proxy, AGG ETF.

What asset allocation strategy feels most comfortable, for you? While past performance is no guarantee of future results, reviewing historical losses for different asset allocations can give you some insight into what to expect in the next recession. For example, if you know that you cannot tolerate a loss of more than -15% in any given year, then choosing a risk score of 6 and a corresponding 60/40 equity/fixed asset allocation would not be appropriate.

Overweighting the Wrong Style of Investment at the Wrong Time

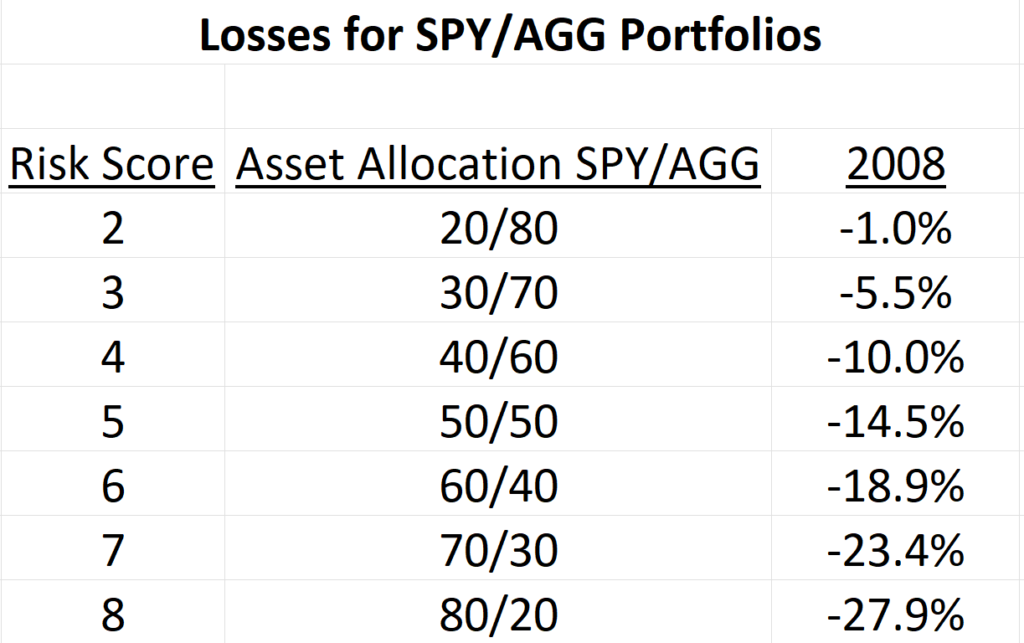

The chart below shows the difference between in performance between the Russell 1000 Value Total Return Index and the Russell 1000 Growth Total Return Index for the period 12/31/99 – 10/11/2011. During the first decade of the 2000s, if you had an overweight to growth style investing, you would have been unhappy with your results. The first decade of the 2000s was marked by two recessions and a lot of volatility in the stock market. During recessionary periods, you want to move away from growth stocks and focus on value stocks.

Since 2011 growth stocks have been on fire.

During economic expansion, growth stocks tend to produce better results.

Learn the Business Cycle!

The business cycle is real. Bull markets eventually end and turn into bear markets and then the cycle repeats over and over again. You can easily see the business cycle in the chart below. Judging where we are in the business cycle can help you decide which style of investment to favor in your asset allocation strategy.

Ethan S. Braid, CFA

President

HighPass Asset Management

Denver, CO

Your broker or advisor will charge you fees or commissions to make investments and therefore your returns will be less than indexes. For example, if you invest in the S&P 500 ETF, SPY, you will pay a fee to the company managing the ETF, State Street Global Advisors. Your return on the S&P 500 ETF, SPY, will be less than the S&P 500 Index TR because of the fee paid to State Street Global Advisors. Additionally, you may pay a fee or commission to your broker or financial advisor, further reducing your return, below the index. Consult your advisor or broker for a detailed list of their fees or commissions before you invest. Investing involves risk and you can lose money.