The stock market has been in an incredible bull market since 2009. We all hope it keeps going but history shows that secular bull markets eventually end and turn into secular bear markets.

There are two types of Bear Markets

- Secular Bear Markets

- Short-Term Bear Markets

Secular Bear Markets

The chart below shows us that the S&P 500 has a very easy-to-identify long-term pattern cycling back and forth between secular bull and secular bear markets. The green arrows on the chart are secular bull markets and red arrows are secular bear markets. During secular bear markets, the stock market may not provide any appreciation for over ten years. Along the way, you can expect to experience substantial periods of volatility, with short-term bear markets occurring and potentially large stock market losses like what occurred in 2002 and 2008. If your timing is bad and you invest at the beginning of a secular bear market, you may not have any return from stocks for as long as ten years and possibly longer.

Short-Term Bear Markets

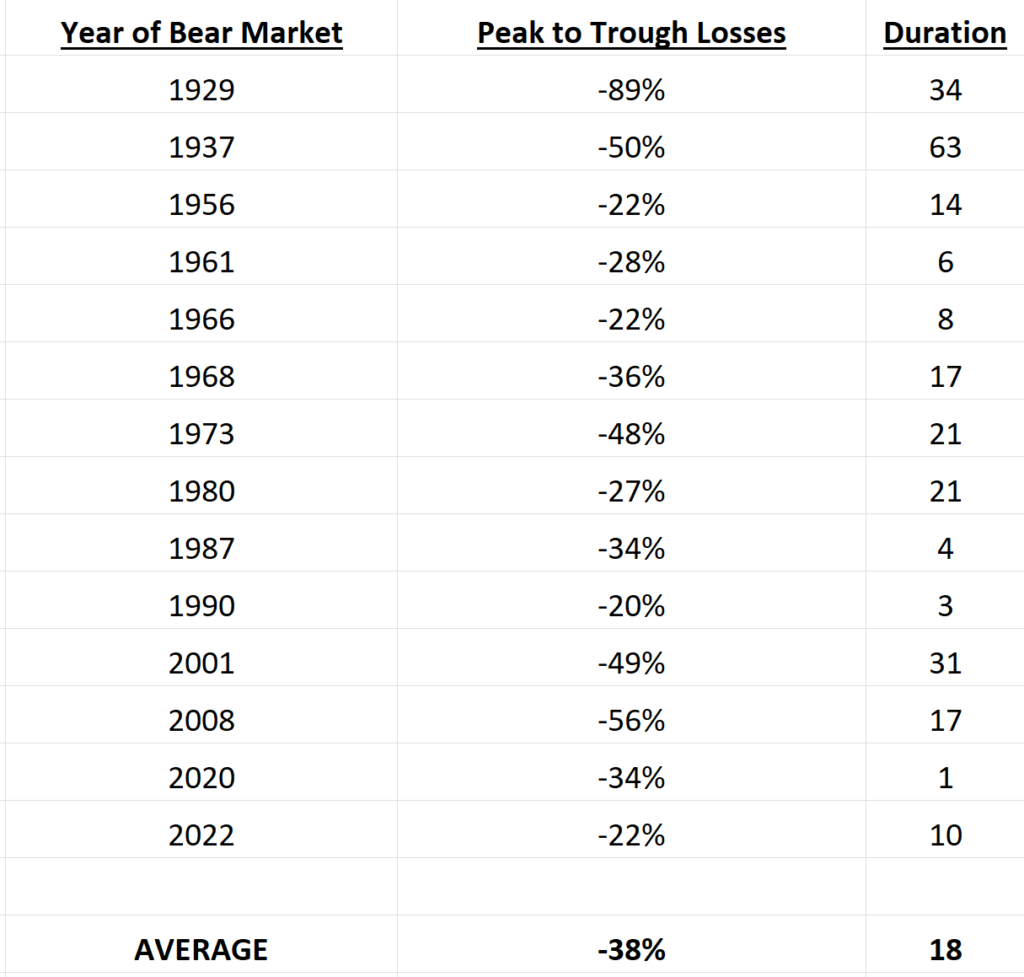

Most people define a short-term bear market as a loss of 20% or more in the stock market. In the last century, we have had fourteen short-term bear markets. Short-term bear markets show up around every seven years on average. In the table below, we can see that the average loss in a short-term bear market is -38%.

Short-term bear market losses are far greater than the average calendar year loss for the stock market. Since 1871 there have been thirty-nine negative return years for stocks on a total return basis. The average total return loss for the stock market for calendar years is only -12%. But as we can see from the table above, short-term bear market losses average three times greater than average calendar year losses.

Many investors will be caught off guard by a loss of this magnitude. The reason that short-term bear market losses exceed the calendar year average losses is due to the duration of the selling. Notice that short-term bear markets average eighteen months in length, i.e. longer than one year. These bear markets introduce sequence of returns risk to an investor’s portfolio. When you get back-to-back negative return years for example, your losses compound quickly.

In early 2025, we are late-stage secular bull market. When times are good, that is when you should re-assess your risk tolerance and determine how much you might lose, when the inevitable shift in the business cycle eventually takes place.

Now is the time to make sure you are comfortable with the potential for losses in your portfolio. If you know what to expect whenever the next downturn arrives, you will be more likely to stay invested. Staying invested is the key to successful long-term investing.

Ethan S. Braid, CFA

President

HighPass Asset Management

Denver, CO