Investors looking for alternatives to Fidelity Government Cash Reserves fund, FDRXX should consider i-shares SGOV etf. SGOV may provide a better return, especially for taxable accounts. In this article we will compare FDRXX to SGOV to demonstrate why SGOV is the better choice, especially for investors who plan to hold it for one year or longer.

Yield and Fees – SGOV Leads

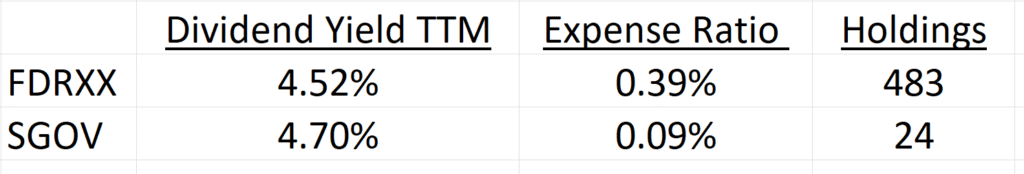

As of May 13, 2025, the dividend yield on FDRXX was 4.52% with an expense ratio of .39%. In comparison, SGOV had a better yield at 4.70% and a much lower expense ratio of .09%.

Yield is your only source of return with a short-term investment like SGOV or FDRXX. Therefore, the higher yield and lower expense of SGOV are very desirable for someone seeking better performance on a short-term investment.

Returns – SGOV Leads

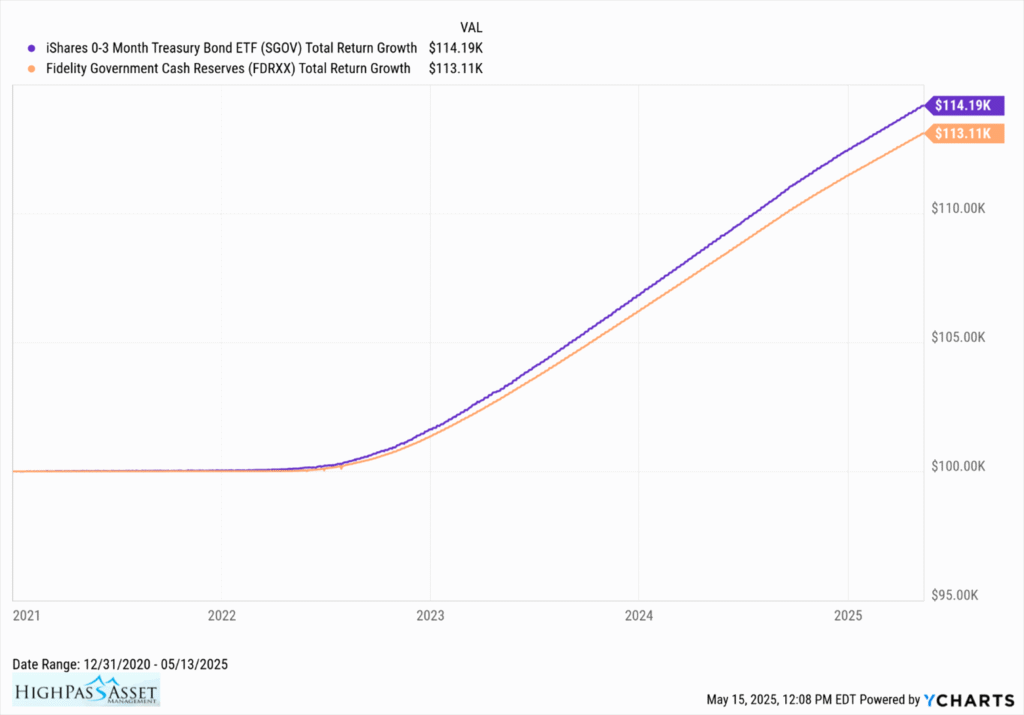

Since 2021 SGOV has provided more total return than FDRXX. The illustration below shows how much an investor would have made for a $100,000 investment in FDRXX vs SGOV between January 1st of 2021 and May 13, 2025. All dividends were reinvested for this illustration.

Taxes – SGOV is Better

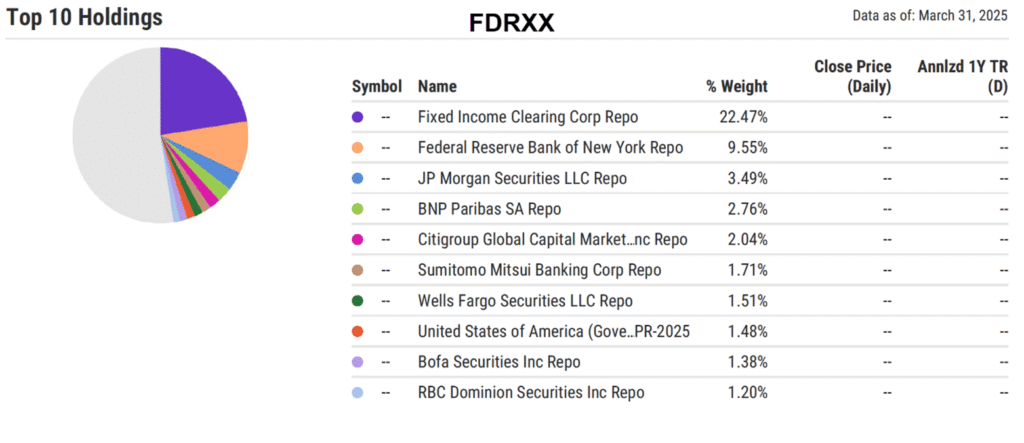

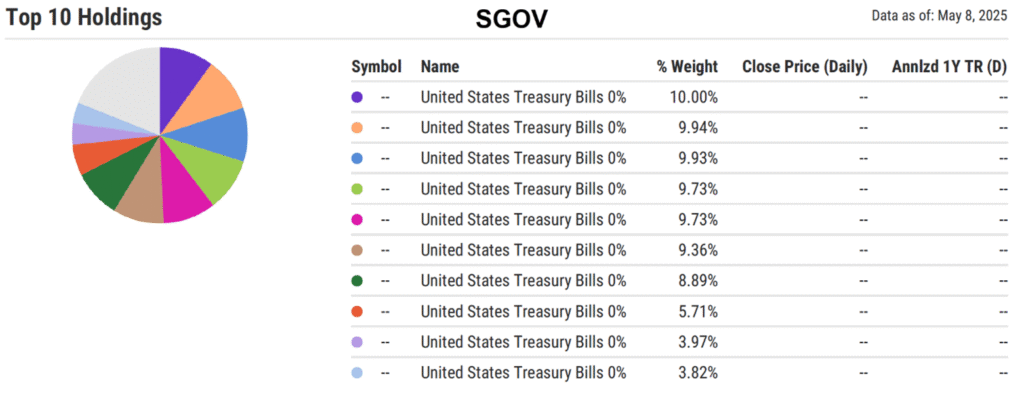

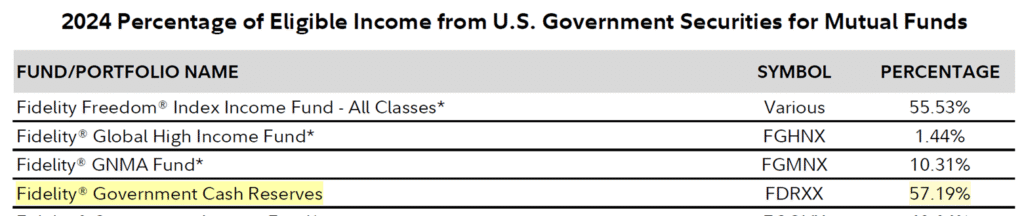

SGOV is 100% invested in T-bills. FDRXX invests in both T-bills and repurchase agreements (repos). T-bill interest is tax-free at the state level. Repos however are taxable at the state level. In 2024 approximately 43% of the ordinary dividend from FDRXX was generated from repos while only 57% of the dividend was generated from T-bills. The result is FDRXX investors had to pay state income tax on 43% of their money market dividends. SGOV dividends on the other hand are completely tax-free at the state level. The extra tax burden investors get with FDRXX makes SGOV more desirable, especially for investors in higher tax brackets.

Portfolio Composition – FDRXX Repos

Reviewing the top holdings of FDRXX and SGOV clearly show why FDRXX lags SGOV in terms of tax favorability. Nearly all the top holdings in FDRXX are repos that will be taxable at the state level.

Tax Return Filing Problems – FDRXX Headaches

SGOV is simple. The etf only owns T-bills. You can be confident that 100% of your fund dividend will be tax-free at the state level. FDRXX however is complicated. Fidelity will send you a 1099 but the 1099 will not show you how much of your FDRXX ordinary dividend came from US Government securities. To properly file your state tax return, you need to go to Fidelity’s tax library and research FDRXX every year to see what amount of the FDRXX dividend was from US Government securities. Once you have determined the percentage of your FDRXX dividend that came from US Government securities, you can then calculate your state tax exemption. Most investors and their accountants fail to perform this necessary research on FDRXX and end up paying state tax on their entire dividend.

Share Price Volatility

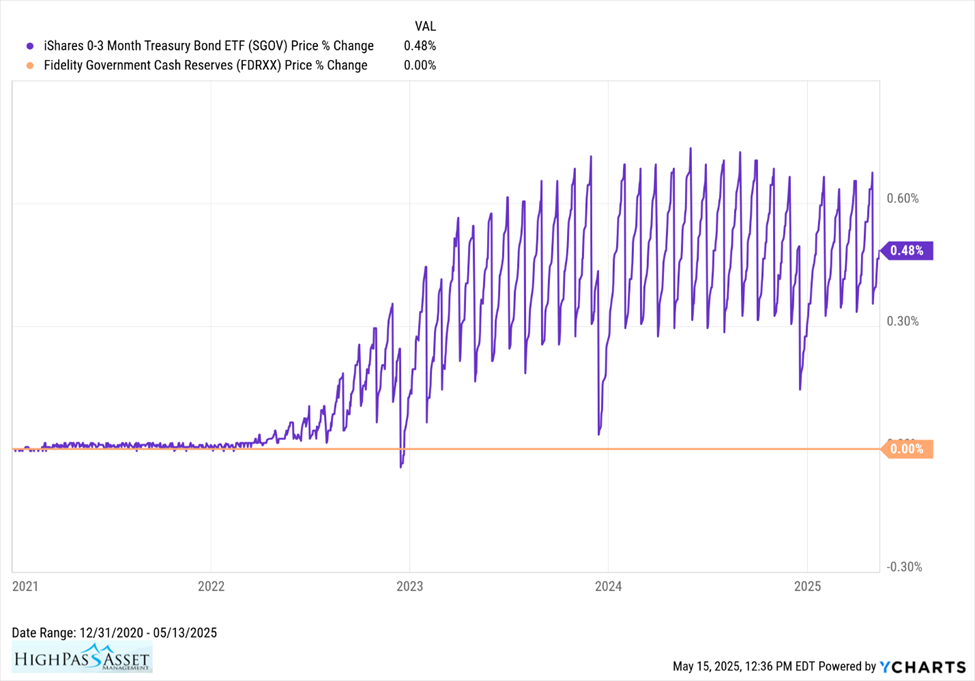

FDRXX is managed by Fidelity to keep the share price at a static $1 per share. In contrast, SGOV will have a minor amount of price volatility. SGOV pays a monthly dividend. When the SGOV monthly dividend is paid the share price will be adjusted downward to reflect the dividend. Then the share price will begin to move back up as the T-bills in the portfolio accrue interest. At the next monthly dividend, the share price will be adjusted down again. Large movements up or down with short-term interest rates can also affect the fund causing a minor amount of gain or loss.

In the chart below we see the price volatility comparison between SGOV and FDRXX. Investors who cannot tolerate volatility, even if extremely minor, should be aware that there can be some minimal volatility with SGOV.

Ethan S. Braid

President

HighPass Asset Management

Denver, Colorado

This article is for education and illustrative purposes and is not tax, legal or financial advice. Your broker or advisor will charge you fees or commissions to make investments and therefore your returns will be less than indexes. For example, if you invest in the S&P 500 ETF, SPY, you will pay a fee to the company managing the ETF, State Street Global Advisors. Your return on the S&P 500 ETF, SPY, will be less than the SS&P 500 Index TR because of the fee paid to State Street Global Advisors. Additionally, you may pay a fee or a commission to your broker or financial advisor, further reducing your return, below the index. Consult your advisor or broker for a detailed list of their fees or commissions before you invest. Investing involves risk and you can lose money.