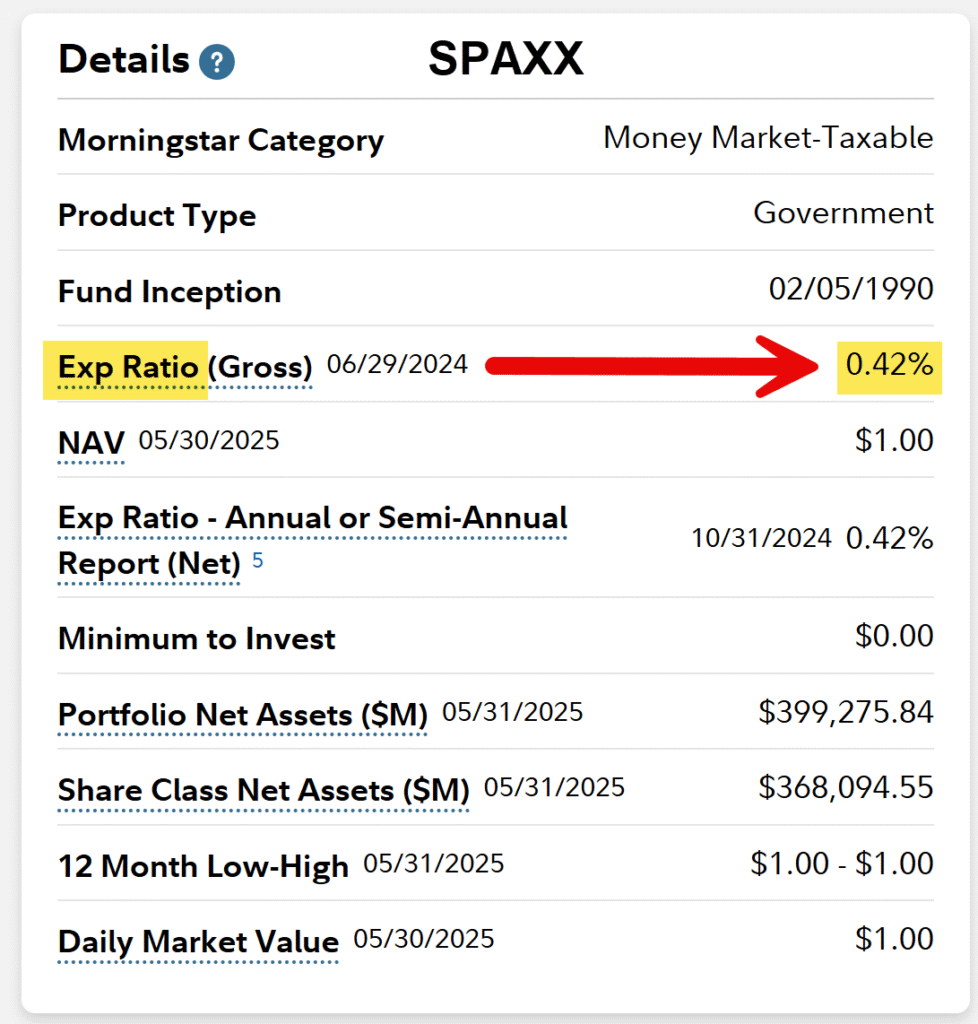

Fidelity government money market SPAXX is widely used by investors with $400 billion in the fund. I have often wondered how many of these investors realize they are paying .42% per year in invisible fees?

High Fees

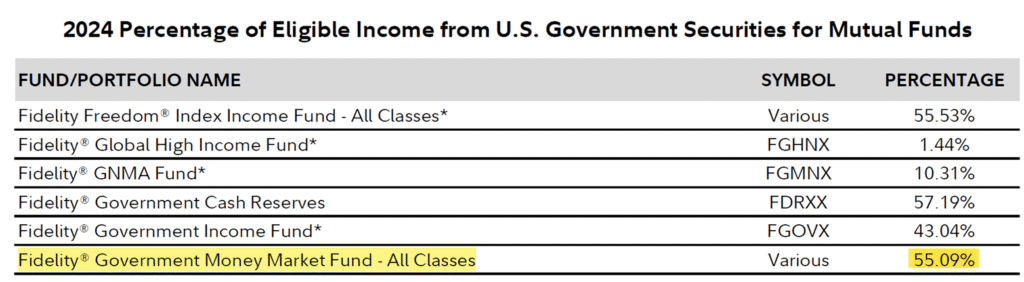

High Taxes

The problem with SPAXX is not just limited to high fees, the fund is also tax inefficient. Despite the name “government money market,” in 2024 only 55% of the fund’s ordinary dividends were generated from U.S. Government securities. The remaining 45% of the fund’s dividends were earned from repos which are taxable at the state level.

Alternatives to SPAXX

- Buy T-Bills

- Buy SGOV

T-Bills

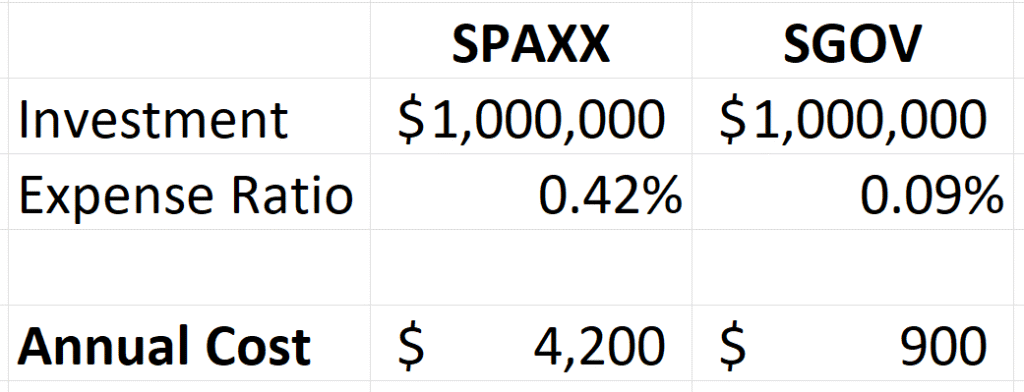

You can buy T-Bills for no fees at Treasury Direct and save yourself the .42% annual fee you pay Fidelity to manage your cash in SPAXX. If you have $1 million in SPAXX, you are paying Fidelity $4,200 per year in fees. Purchasing T-Bills on your own at Treasury direct cuts out the intermediary. T-Bill interest is state income tax-exempt. In 2024 45% of the SPAXX dividend was taxable at the state level. By moving your cash out of SPAXX and into T-Bills, 100% of your interest earned on T-Bills will be state income tax exempt; a significant improvement over SPAXX.

SGOV

The i-Shares SGOV ETF is invested exclusively in T-Bills. The fund is cheap with an expense ratio of .09%. Because the fund is invested only in T-Bills, 100% of the fund’s dividend will be state income tax exempt.

SPAXX vs SGOV on Cost

The cost savings for SGOV vs SPAXX are compelling. For a $1 million investment, SPAXX costs $4,200 per year while SGOV costs only $900.

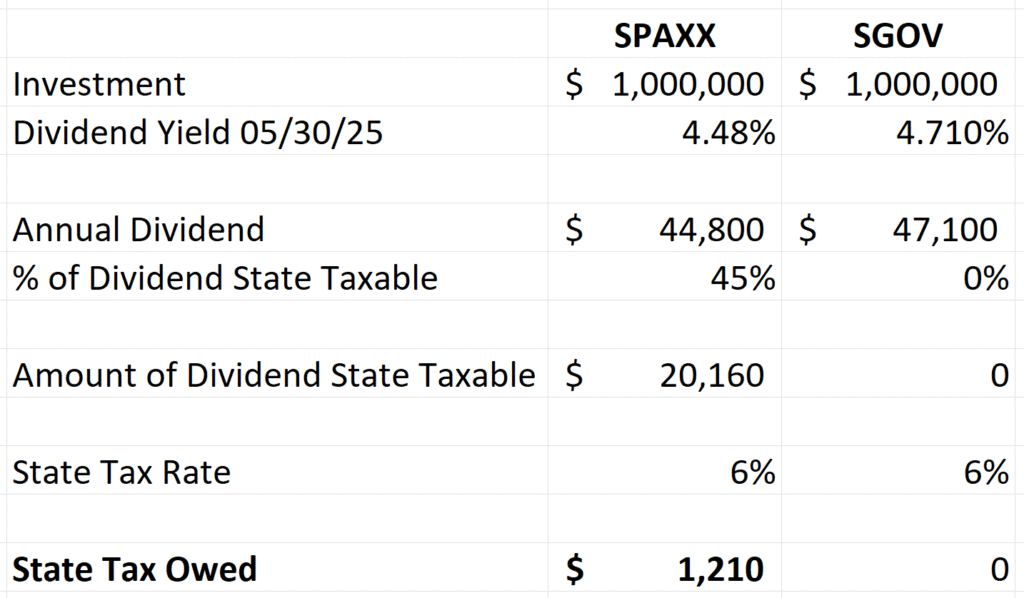

SPAXX vs SGOV on Taxes

In the illustration above, we are using the 05/30/25 dividend yields on SGOV and SPAXX to assess what taxes might look like for a $1 million investment assuming you live in a state with a 6% income tax rate. The actual dividends received going forward are likely to be lower than the trailing twelve-month dividend yield, but the tax issue will be the same regardless of the amount of dividend received.

If Fidelity continues to manage SPAXX like they did in 2024 with 45% of the dividend being taxable at the state level, then for an investor who earns $45k in dividends on SPAXX, they will need to pay taxes at the state income tax on $20k. The result is a tax bill of $1,200.

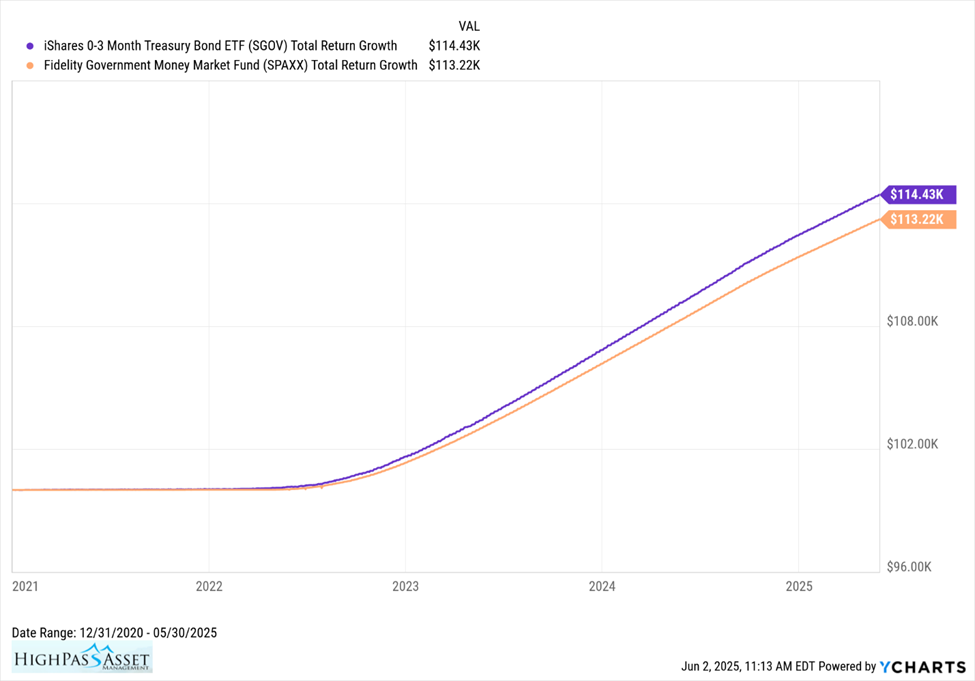

SPAXX vs SGOV on Past Returns

The chart above shows the total return for a $100,000 investment in SGOV vs SPAXX.

Conclusion

Comparing SPAXX to T-Bills or SGOV is a no-brainer. With SPAXX you have higher fees and higher taxes. You can improve your returns by lowering your fees and paying less in taxes.

Ethan S. Braid, CFA

President

HighPass Asset Management

Denver, CO

This article is for education and illustrative purposes and is not tax, legal or financial advice. Your broker or advisor will charge you fees or commissions to make investments and therefore your returns will be less than indexes. For example, if you invest in the S&P 500 ETF, SPY, you will pay a fee to the company managing the ETF, State Street Global Advisors. Your return on the S&P 500 ETF, SPY, will be less than the SS&P 500 Index TR because of the fee paid to State Street Global Advisors. Additionally, you may pay a fee or a commission to your broker or financial advisor, further reducing your return, below the index. Consult your advisor or broker for a detailed list of their fees or commissions before you invest. Investing involves risk and you can lose money.