What does twenty years of owning a variable annuity do to your ability to accumulate wealth for retirement? I think a lot of investors do not realize just how much a variable annuity can set them back when planning for their retirement. Variable annuities are commonly sold as retirement income solutions with guaranteed annual withdrawal & death benefit riders added to the annuity contract. The total cost to own a variable annuity with a guaranteed annual withdrawal & death benefit rider can be 3% or even 4%, per year!

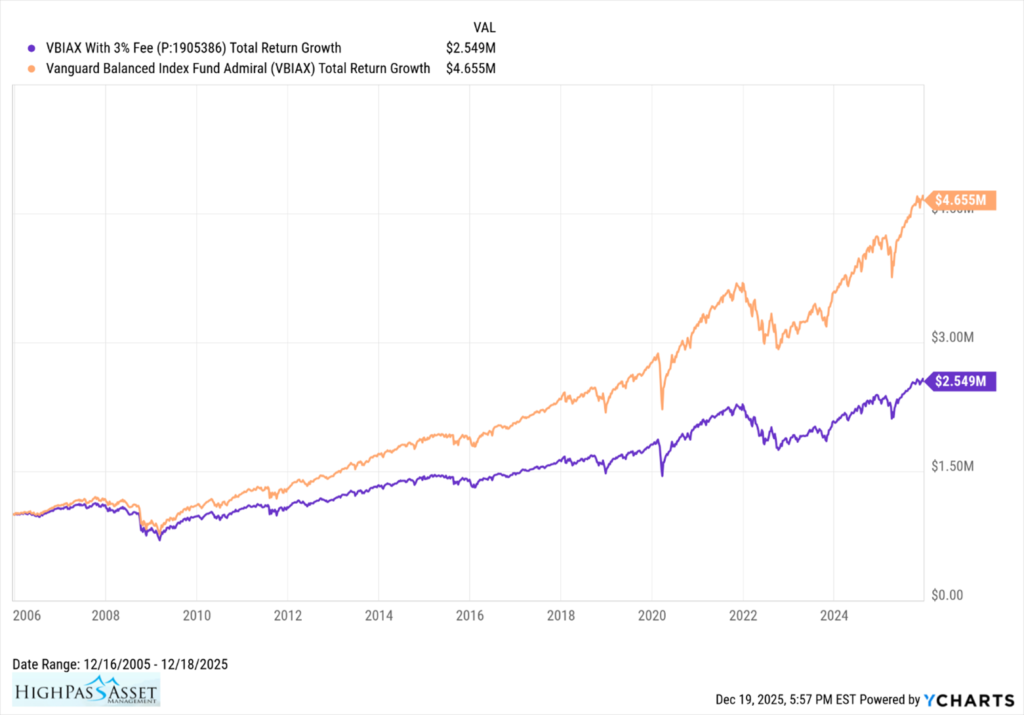

In this article I will illustrate how much a typical 3% annual variable annuity fee can cost you over a twenty year period. To replicate the cost burden of a variable annuity fee, I have prepared a twenty-year, total return illustration using the vanguard balanced index fund, and added a 3% annual fee to the fund. This fund is widely used by retirees and has a 60/40 equity/fixed asset allocation. The illustration is for a $1m investment made twenty years ago. The orange line is the Vanguard Balanced Index Fund total return performance with no additional fees. The purple line is the Vanguard Balanced Index Fund total return performance with a additional 3% annual fee. Investors who purchase variable annuities typically use a balanced investment strategy inside the annuity, especially if they bought a guaranteed annual withdrawal benefit rider. The purple line is meant to illustrate what paying a 3% annual variable annuity fee on your investments does to long-term performance. After twenty years of paying a 3% annual fee, there is a performance difference over $2 million dollars between the two illustrations!

When someone tries to sell you an annuity, think long and hard before signing the paperwork. What long term benefits are you getting and are they worth the price? In addition to high fees, there are many other reasons to avoid buying annuities. Taxation issues, no stepped-up basis and contingent deferred sales charges are just a few.

Ethan S. Braid, CFA

President

HighPass Asset Management

Denver, Colorado

This article is for educational and illustrative purposes and is not tax, legal or financial advice. Your broker or advisor will charge you fees or commissions to make investments and therefore your returns will be less than indexes. For example, if you invest in the S&P 500 ETF, SPY, you will pay a fee to the company managing the ETF, State Street Global Advisors. Your return on the S&P 500 ETF, SPY, will be less than the S&P 500 Index TR because of the fee paid to State Street Global Advisors. Additionally, you may pay a fee or commission to your broker or financial advisor, further reducing your return, below the index. Consult your advisor or broker for a detailed list of their fees or commissions before you invest. Investing involves risk and you can lose money.