The number of years a $1 million dollar portfolio will last a person in retirement will depend on the following four factors:

- Asset Allocation

- Spending Rate Percentage

- Investment Selection & Performance

- Behavior

ASSET ALLOCATION

Asset allocation is a critical decision when planning your retirement. If you are too aggressive you could ruin your retirement. If you are too conservative, you could also have a problem. For example, many people invest in the S&P 500 during their working years. But if you are planning to use your retirement portfolio for income and are heavily invested in the S&P 500 during retirement, then you could have a big problem.

Portfolio Too Aggressive

The chart above shows what would have happened to a retiree who attempted to use the 4% retirement spending rule with an asset allocation of 100% stocks. In this example we are making a $1 million investment in the S&P 500 on 01/01/2000 and then distributing 4% every year and raising the distribution by 3% for inflation. After 22 years, the portfolio was exhausted.

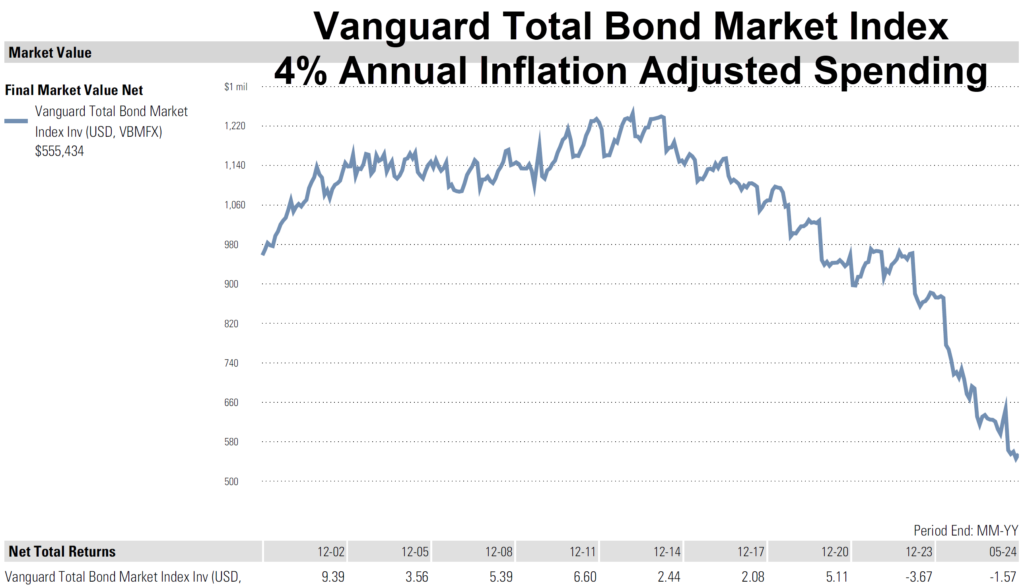

Portfolio Too Conservative

Now let us see what happens when you have a very conservative portfolio.

The chart above is an illustration for a $1 million dollar investment on 01/01/2000 in the Vanguard Total Bond Market Index. Using the 4% rule and adjusting for inflation, after 25 distributions, the portfolio is down to $555,434. While this result is better than having all your money in the stock market, the portfolio is nearly half of what it was at the beginning of the illustration; not all retirees would be pleased with this outcome.

SPENDING RATE PERCENTAGE

The spending rate percentage you choose for your retirement portfolio is another critical factor for a solid retirement plan. The difference between spending 3%, 4% or 5% of your retirement portfolio is massive.

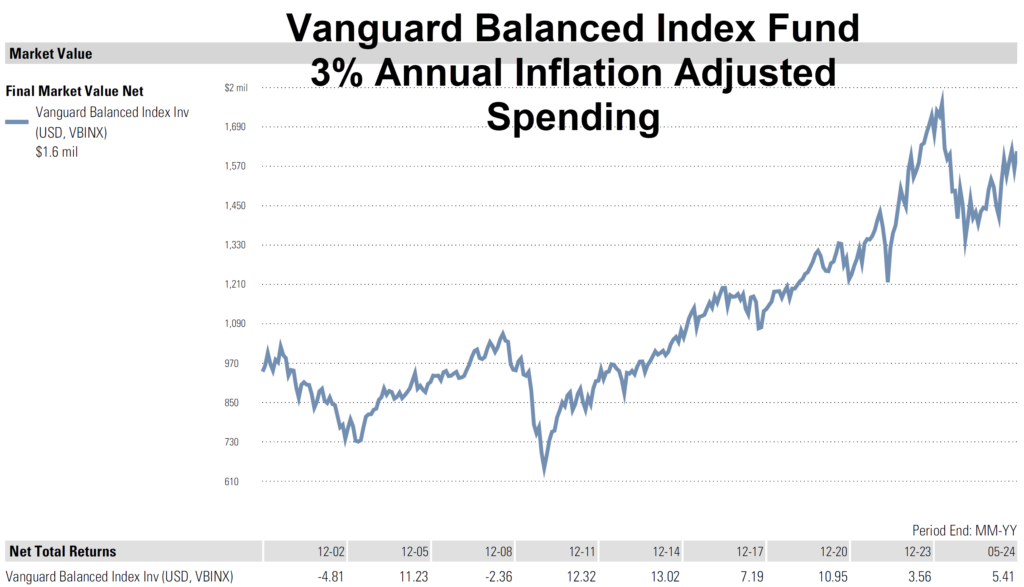

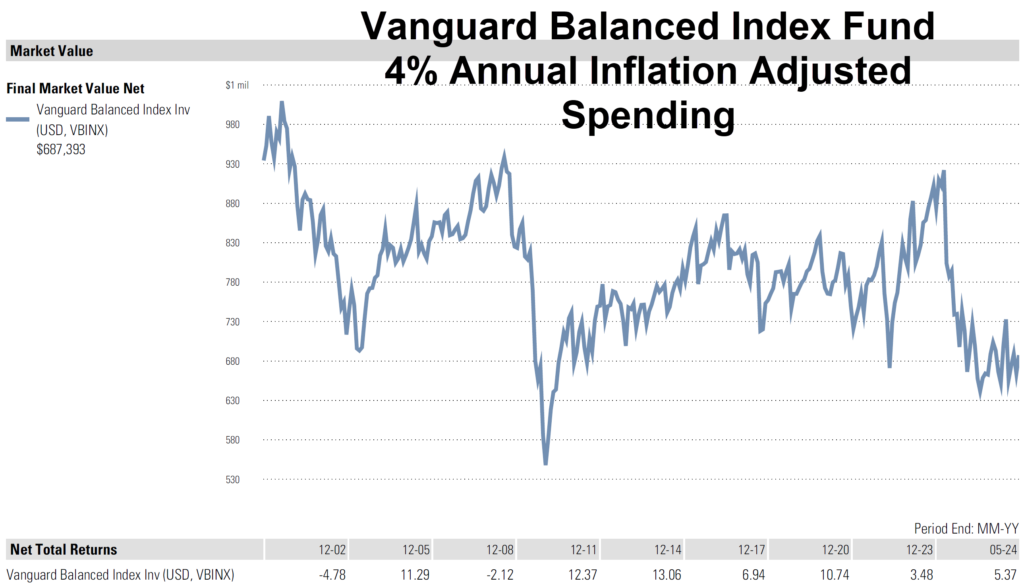

The next three charts will be illustrations for a $1 million investment made on 01/01/2000 in the Vanguard Balanced Index Fund, a popular retirement investment. The illustrations will model a 3% annual spending rate, 4% annual spending rate and 5% annual spending rate; all adjusted for inflation.

3% Inflation Adjusted Spending

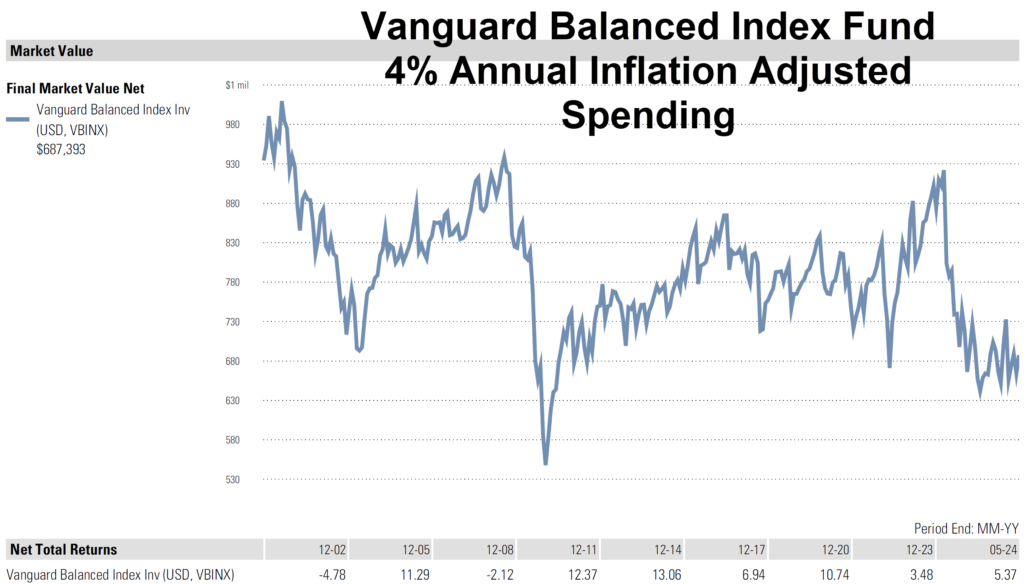

4% Rule – Inflation Adjusted

5% Inflation Adjusted Spending

After reviewing the charts, you can see that increasing your spending rate by just 1% can have profound consequences for your retirement portfolio. In the 5% spending illustration, the portfolio was exhausted after 23 years. At the 3% and 4% spending rate, all spending needs were covered for 25 years but with vastly different ending values. If you want a stress-free retirement and would like to grow your portfolio in retirement, spend less than 4% inflation adjusted.

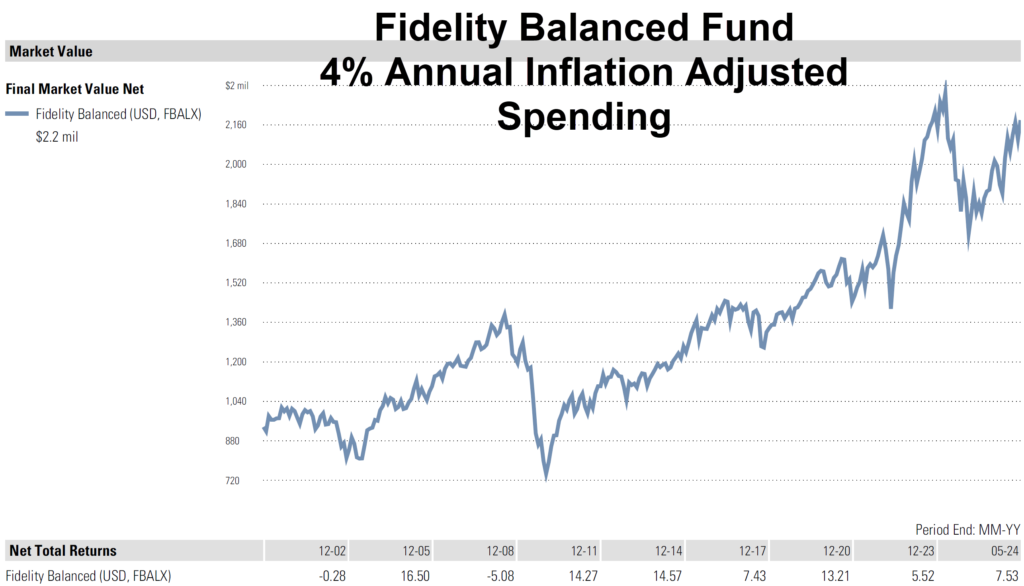

INVESTMENT SELECTION & PERFORMANCE

Once you have decided upon an asset allocation and a spending rate, you need to choose investments. In the following illustrations, we are going to compare two popular retirement funds over the last twenty-five distribution years. The funds we are comparing are the Fidelity Balanced Fund and the Vanguard Balanced Index Fund. In both illustrations, we are distributing 4% annually adjusted for inflation. Both funds are categorized the same as moderate allocation funds and they both use the same asset allocation of 60/40 equity/fixed income. Fees are different with Fidelity charging .47% and Vanguard charging .18%.

The end results are incredibly different. Despite all the marketing for low fees, the Vanguard fund performed significantly worse than the higher cost, Fidelity fund.

The good news is that by selecting a proper asset allocation and spending rate, this retirement plan worked. Even though Vanguard had mediocre performance, the retirees had $687,393 in their retirement portfolio after 25 distributions.

Market timing can be devastating for your retirement if you make bad trades. Over my 25+ year career in financial advice, I have met many people who lost their nerve during a downturn and sold their portfolio. If you sell after a crash you may end up buying back in at higher prices or never get back in and incur permanent losses.

With sound investment selection, however, a retiree can improve their retirement plan. In this example, the investment selection decision of choosing Fidelity Balanced Fund vs Vanguard Balanced Index Fund added over $1.5m to the bottom line!

BEHAVIOR

I cannot overstate the importance of developing a retirement plan, asset allocation, spending rate percentage and investment strategy that you, the retiree, have confidence in. You need to know beforehand the potential for volatility with your retirement investments and be prepared to stay invested during a downturn. Without a thorough plan and an appreciation for what can happen in a downturn, you might be tempted to sell at the bottom. Think you will not do it? Think again. I have watched cardiologists, engineers, entrepreneurs and attorneys, all sorts of very smart people, commit this mistake.

We have been in a bull market for a long time, as I write this article in the late spring of 2024. We may be in a new bear market now or about to enter one in the next few years.

The stock market has quite an easy to identify trend over time; a stair-case pattern. The stock market moves from boom to bust to boom bust, over and over in long-term, decade-plus, cycles.

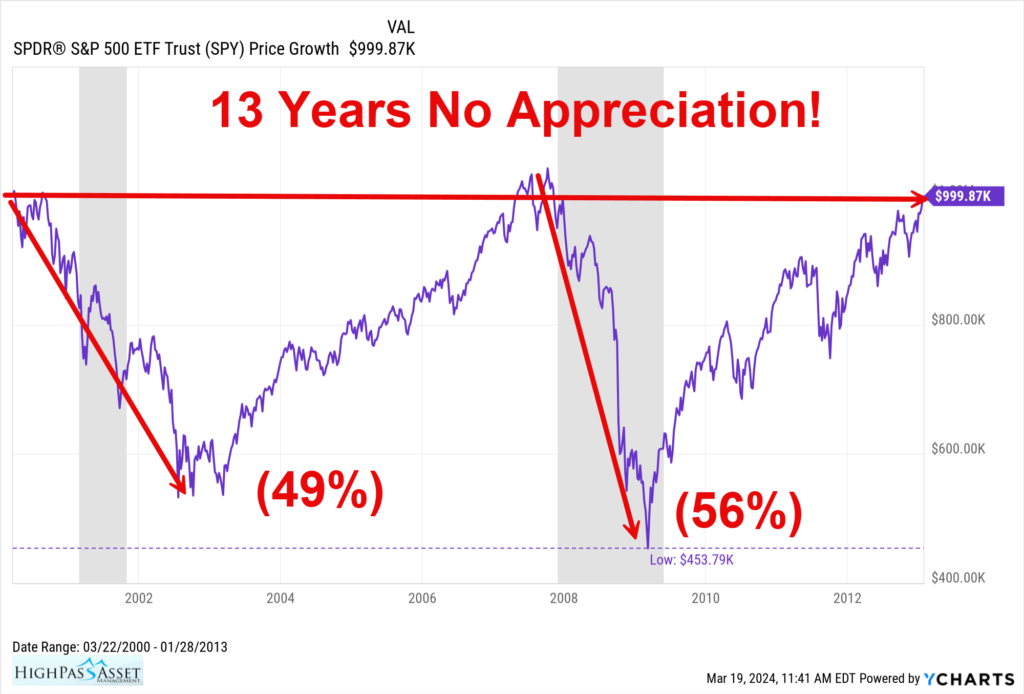

In the chart below you can see that we have had two major bear markets in the last 70+ years. Both were well over a decade long where there was zero return from stocks for over 10 years. Along the way investors experienced significant drops.

Since we have been in a tremendous bull market for over a decade, you should be preparing yourself, mentally, for the inevitable bear market ahead.

Here is what a bear market looks like up close:

If you had $1 million in the S&P 500 (SPY) in March of 2000 and did not reinvest dividends, 13 years later you were still at $1 million. Thirteen years is a long time to lose money. Along the way, there were two serious market crashes.

Your mindset and willingness to tolerate risk at age 65 or 70 is different from age 40 or 50. Do not underestimate how your feelings will change as you progress through retirement.

A solid financial plan, competent financial advisor, and investment strategy you understand are the keys to avoiding market timing mistakes in retirement.

Ethan S. Braid, CFA

President

HighPass Asset Management

Denver, CO

Your broker or advisor will charge you fees or commissions to make investments and therefore your returns will be less than indexes. For example, if you invest in the S&P 500 ETF, SPY, you will pay a fee to the company managing the ETF, State Street Global Advisors. Your return on the S&P 500 ETF, SPY, will be less than the S&P 500 Index TR because of the fee paid to State Street Global Advisors. Additionally, you may pay a fee or commission to your broker or financial advisor, further reducing your return, below the index. Consult your advisor or broker for a detailed list of their fees or commissions before you invest. Investing involves risk and you can lose money.