How do you build your own guaranteed cash flow stream, but without the fees of an annuity? Today I am going to show you how to build your own annuity for two different objectives. Method one will be to provide a guaranteed cash flow. Method two will be to provide a death benefit. To build an annuity guaranteed cash flow stream we will use zero coupon US treasury bonds and the stock market. To replicate a death benefit, we can use either zero-coupon US treasury bonds or term life insurance. For a $1 million dollar investment, what I am about to show you could save you over $300,000 in fees over a 10-year time period. By taking control of your money, and building your own guaranteed annuity cash flow stream, the fees you save vs paying an insurance company, result in a lot more money for your retirement

Method 1 Provide a Guaranteed Annual Withdrawal

Many variable annuities are sold with a guaranteed annual withdrawal benefit rider of 5%. The rider is not an income payment from the insurance company, instead, the rider is a promise to maintain your 5% distribution from the annuity contract, if, you were to run out of money. Guaranteed annual withdrawal benefit riders only provide you with income from the insurance company if your policy accumulation value were to go to zero. Unless your policy accumulation value declines to zero, the insurance company does not pay you anything, they just meter your own money out to you. The policies typically have an all in cost of 3% or more. For a $1 million dollar contract, you could be paying over $30,000 per year in total fees.

Instead of paying the annuity company over $30,000 a year in fees, why not build your own annuity? Here is how you do it. You first need to determine how long you want to receive payments and what amount the payments should be. The payments should be between 3% – 5% of the original portfolio value and the time period can be ten, fifteen and or even twenty years with the process I am going to show you. Today we are going to look at a ten-year strategy for 5% guaranteed payments.

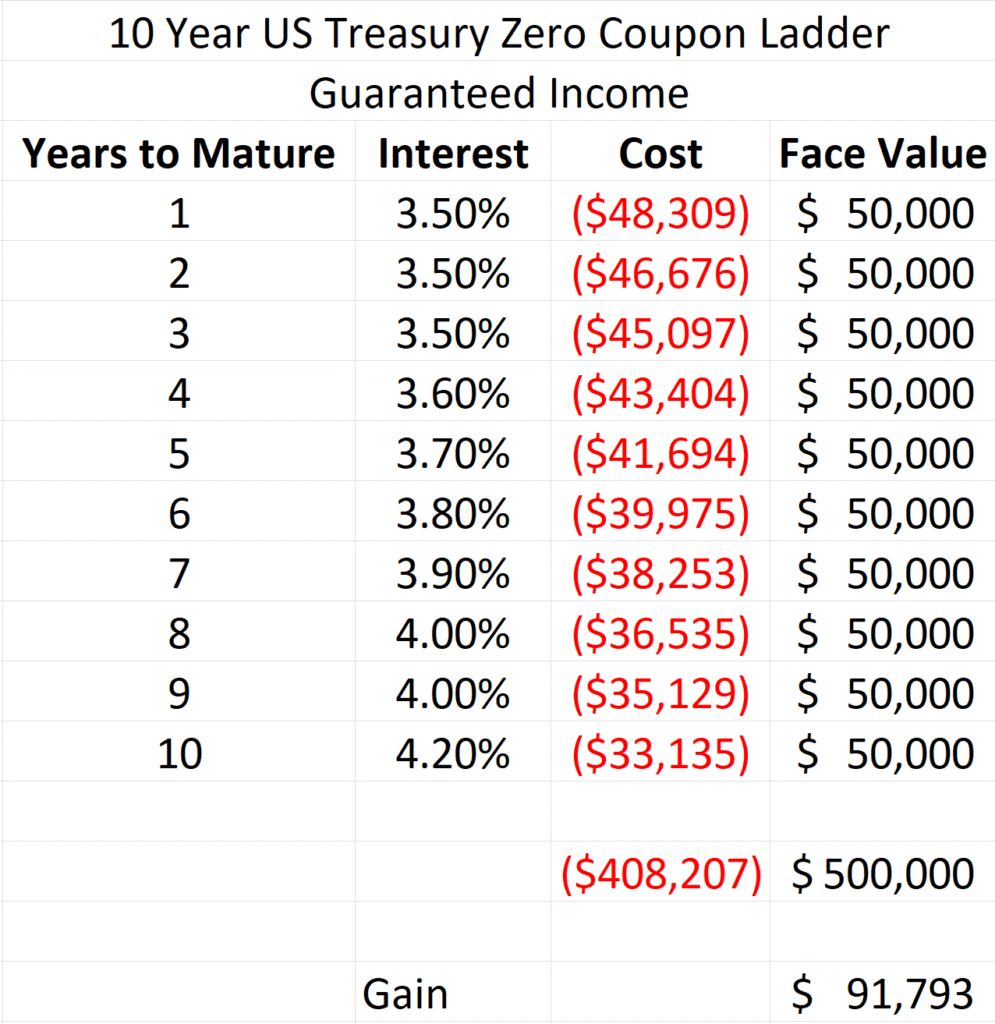

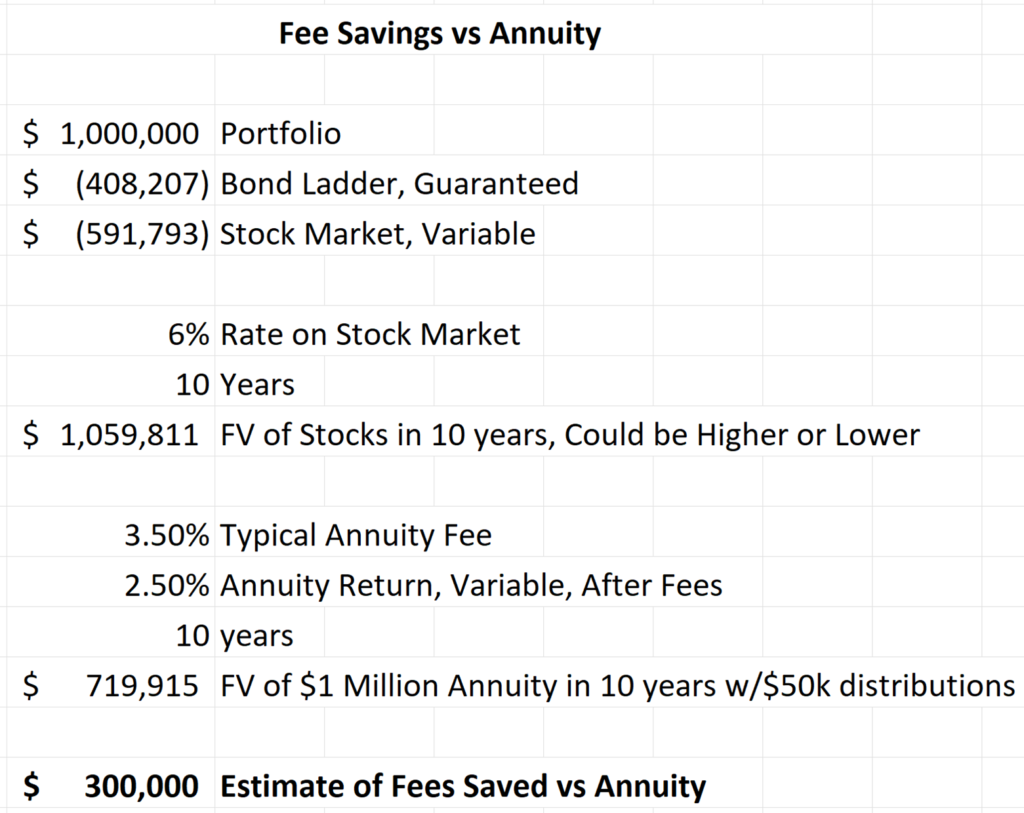

Five percent payments on an initial $1 million dollar portfolio equal $50,000 per year. To guarantee payments of $50,000 per year for the next 10 years, you simply purchase zero coupon US treasuries maturing every year for the next 10 years. We will review these numbers when we get to the spreadsheet presentation, but the cost today for 10 years of $50k annual guaranteed cash flows using US zero coupon treasuries, is $408,207 dollars. What that means is you are paying $408,207 today, to receive a total of $500,000 in cumulative guaranteed payments over the next decade.

Once you have your 10 years of guaranteed cash flows secured, you invest the remaining funds in the stock market. In this example, if you started with $1 million dollars, and invested $408,207 in US zero coupon treasury bonds, that leaves $591,793 to invest in the stock market.

Potential Growth and Fee Savings

At a 6% rate of return, the money in the stock market could grow to $1,059,811 over a ten year period. Variable annuities with guaranteed annual withdrawal and death benefit riders can easily cost 3.5% per year in fees. When forecasting annuity returns, these fees will have a huge impact on long term performance. In the example above, we can see how the high fees in the variable annuity result in a huge potential performance gap over a ten year period. Note: your performance will be impacted by your investment selection and the fees you pay, or do not pay, on your investments. This illustration is a good baseline and shows the potential for improvement when reducing annuity fees.

While the stock market is volatile and you can lose money, history shows that the probability of making a positive return in stocks when held for a decade is 96%. With this strategy, you can use your dividend cash flow from the stock investments to keep adding to your guaranteed cash flows from the US zero coupon treasury bond ladder. In other words, as the dividends from the stocks are paid, you can use those dividends to buy more US treasury zero coupon bonds and extend your guaranteed cash flow bond ladder.

Alternatively, you can reinvest your stock dividends and then evaluate selling some of your stock investments between years 7 – 10. The proceeds can be used to buy more zero-coupon bonds and extend your bond ladder at that time.

Method 2 – Creating a Death Benefit

Many people purchase variable annuities for death benefits. They like the idea of investing their money in more aggressive, stock market investments inside the annuity contract with the comfort of knowing there is a guaranteed death benefit for their beneficiaries, even if their investments lose money.

There are two ways to add a death benefit to your portfolio.

- Buy term life insurance

- Buy zero coupon US treasuries

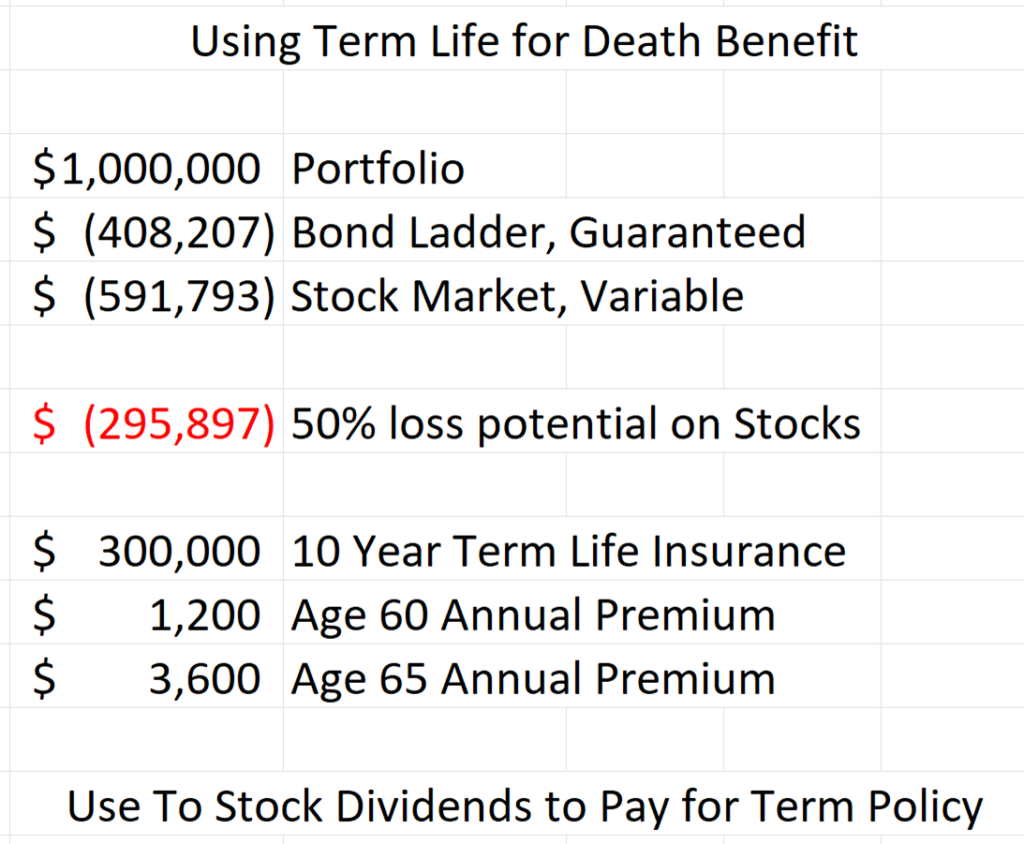

Buying Term Life Insurance

Purchasing term life insurance allows you to cover potential portfolio losses for a specified period. A simple way to determine how much term insurance to buy is to assess how much you might lose in a stock market crash. Multiply the amount of your portfolio in the stock market by 50%. The S&P 500 lost 50% in the 2001 recession and the 2008 recession and it could certainly happen again. In our example for a $1 million dollar portfolio with $591,793 invested in the stock market, you need to purchase approximately $300,000 in term life insurance. The average cost for a $300,000 term policy is $1,200 a year for a 60 year old and $3,600 a year for a 65 year old.

The term insurance covers you for the first 10 years of the investment plan when you are most vulnerable to market losses. After 10 years, the insurance will go away. At that point, you are expecting to no longer need the insurance. Some people will not like the insurance going away in 10 years and they may want to investigate longer, term policies.

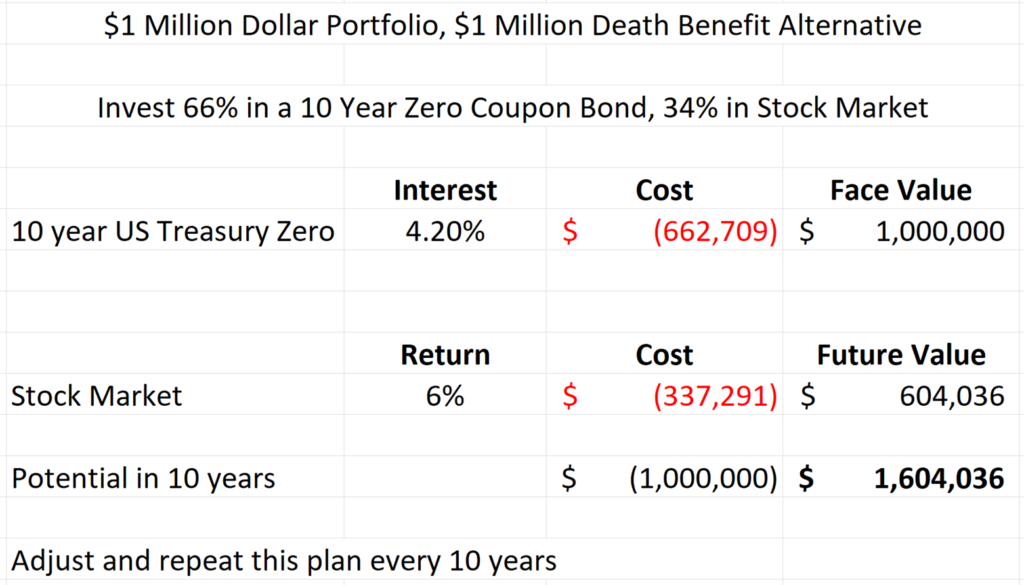

Buying Zero Coupon US Treasuries

The second way to add a death benefit to your portfolio is to determine the guaranteed amount you want your beneficiaries to ultimately receive and then protect them by purchasing the face value amount of US zero coupon treasuries equivalent to the amount you want to guarantee will go to your beneficiaries. For example, if you have a $1 million dollar portfolio and you want to protect $1 million dollars for your beneficiaries, you could purchase 10-year US zero coupon treasuries with a face value of $1 million for $662,709. Your remaining $337,291 could be invested in the stock market. If you were to pass away, your beneficiaries are guaranteed to eventually receive $1 million when the bonds mature.

The primary drawback to this approach is that depending upon when you die, your beneficiaries might need to wait for years before the bonds come due. The bonds could be sold prior to maturity but that would result in the beneficiaries receiving less than the intended $1 million dollars. The best way to guarantee the beneficiaries receive the full $1 million would be for them to hold the bonds until maturity.

For an investor pursuing this death benefit idea, they will want to re-evaluate the need for a death benefit when the original US treasury zero coupon bonds come due. At that time, an investor might consider buying more zeros and repeating the process.

Building your own annuity can save you $100s of thousands of dollars in fees over a ten, or twenty-year period. Instead of paying hefty fees for guaranteed annual withdrawal and death benefit riders, you could use a portion of your portfolio to invest in zero coupon US treasuries or term life insurance, or both. While you won’t be able to perfectly replicate an annuity and get the lifetime guarantees annuities offer, you can certainly secure a ten or even twenty-year cash flow and death benefit. The keys to succeeding with building your own annuity are staying committed to the long-term, avoiding market timing and using a disciplined investment strategy.

Ethan S. Braid, CFA

President

HighPass Asset Management

Denver, Colorado

This article is for education and illustrative purposes and is not tax, legal or financial advice. Your broker or advisor will charge you fees or commissions to make investments and therefore your returns will be less than indexes. For example, if you invest in the S&P 500 ETF, SPY, you will pay a fee to the company managing the ETF, State Street Global Advisors. Your return on the S&P 500 ETF, SPY, will be less than the SS&P 500 Index TR because of the fee paid to State Street Global Advisors. Additionally, you may pay a fee or a commission to your broker or financial advisor, further reducing your return, below the index. Consult your advisor or broker for a detailed list of their fees or commissions before you invest. Investing involves risk and you can lose money.