Over the last 25 years I have advised hundreds of wealthy families with their estate plans. In my experience, around 80% of the time, there will be mistakes with trust funding. The most common mistake is simply not funding the trust. Many wealthy families assume that once their attorney has drafted their trust and they have signed the trust, the work is complete. I cannot count the times I have met wealthy families who believed their assets were in their trust when in fact, their trust was not funded!

If you do not fund your trust, the assets you own without designated beneficiaries will ultimately pass through probate. For example, if you own a rental home in an LLC and you are the owner of the LLC and not your trust, when you die, your heirs will probate your LLC assets even though you have a trust.

One of the primary benefits of a trust is avoiding probate. Therefore, if you want your family to attain this trust benefit, it is critical that you fund your trust while you are alive.

1. MAKE A LIST

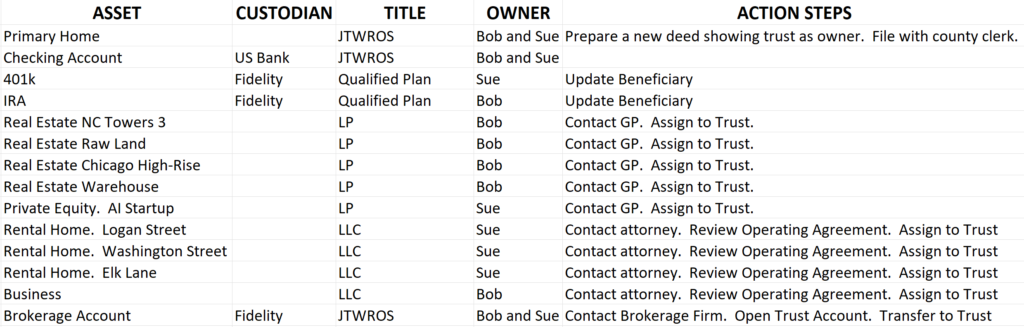

The first step in trust funding is to simply make a list of every asset you own. You can use the format in the example above. You will want to know how every asset you own is currently titled, the custodian of the asset and the current owner(s).

2. CONTACT ALL CUSTODIANS, COUNTY CLERK AND YOUR ATTORNEY

Each asset you own may have a different series of steps to move the asset into your trust. Because you go through different steps to fund your trust depending upon the asset type, you will need to contact each custodion who holds the asset, your county clerk or your attorney.

For example, with a brokerage account, you will need to open a new account in the name of your trust and then transfer your existing brokerage account into the new trust account. But with your home, you will need to prepare a new deed showing the trust as owner and then file this deed with your county clerk. With an LLC you will need to review your operating agreement to make sure your agreement allows you to transfer your interest to a trust; then assign your interest to your trust.

3. COMPLETE ALL PAPERWORK & SIGNATURES THEN REVIEW

The final step in trust funding is completing the paperwork required to update the title of your assets to reflect your trust as the owner.

Once you have completed all the paperwork, you will want to review every asset to make sure the asset is properly re-titled to the trust. In the example below, I have demonstrated how your statement from a brokerage firm should appear. The address line of the statement will tell you immediately if your trust is funded or not funded.

Ethan S. Braid, CFA

President

HighPass Asset Management

Denver, CO