Investors looking for safety often put their money into certificates of deposit, aka CDs. But many of them would be better off if they purchased T-bills instead of CDs. In this article we will compare T-bills to CDs across three categories; taxes, fees and risk.

Taxes on CDs and T-bills

Unless you live in a state with no income tax, if you own CDs in an after-tax account, you will be responsible for paying ordinary income tax at both the Federal and State level on any interest you earn from a CD. When you buy T-bills, however, you are only responsible for paying income tax at the Federal level. T-bill interest is state tax exempt.

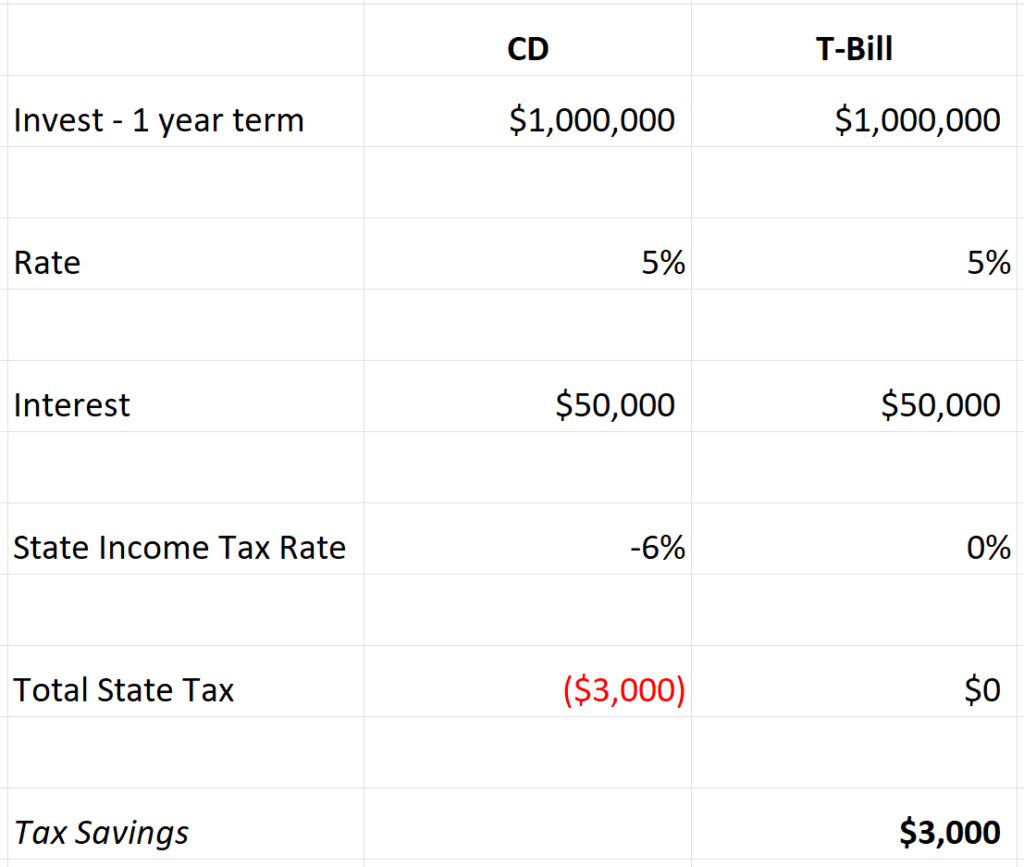

In the table below, a person who lives in a state with an income tax rate of 6%, would pay $3,000 more in taxes on $50,000 of CD interest vs $50,000 of T-bill interest. All other things equal, T-bills will put more money in your pocket if you live in a state with an income tax.

Fees on CDs and T-bills

Over the last 25+ years of working as a financial advisor, I have met with over 300 wealthy families. I have seen dozens of situations where investors were sold CDs by a stockbroker using his series 7 license to sell CDs with hidden commissions. Generally, the investor would have been better off in T-bills both from a yield and tax perspective. But the commissions on CDs are much higher than on T-bills. Consequently, brokers like to sell CDs to their customers because the broker can get paid more. The next time a broker tries to sell you a CD, you need to ask, “is this in my best interest?” “How do CDs compare to T-bills, and which one would be better for me when analyzing my tax situation?” For investors who manage their own funds, you should know that T-bills can be purchased with no fees or commissions if you buy them from Treasury Direct.

Risk

FDIC insurance on CDs gives a sense of comfort to CD investors. CDs are certainly low risk investments. When you buy a CD, you are loaning your money to a bank. When you buy a T-bill, you are loaning your money to the Federal Government. Which do you feel more comfortable with? In a doomsday scenario, with banks failing and FDIC running out of money, where would you be more likely to receive at least some of your money back? A failed bank or the Federal Government? The government has the unique ability to print money and raise taxes. I perceive T-bills to be less risky than CDs.

Ethan S. Braid, CFA

President

HighPass Asset Management

Denver, CO

This article is for education and illustrative purposes and is not tax, legal or financial advice. Your broker or advisor will charge you fees or commissions to make investments and therefore your returns will be less than indexes. For example, if you invest in the S&P 500 ETF, SPY, you will pay a fee to the company managing the ETF, State Street Global Advisors. Your return on the S&P 500 ETF, SPY, will be less than the SS&P 500 Index TR because of the fee paid to State Street Global Advisors. Additionally, you may pay a fee or a commission to your broker or financial advisor, further reducing your return, below the index. Consult your advisor or broker for a detailed list of their fees or commissions before you invest. Investing involves risk and you can lose money.