With half of 2024 in the rear-view mirror, the obsession for mega-cap growth stocks is alive and well. Enthusiasm for a handful of mega-cap stocks has yet to slow down. As investors continue to pile into Apple, Microsoft, Amazon, Nvidia et al, this extremely concentrated market just goes higher.

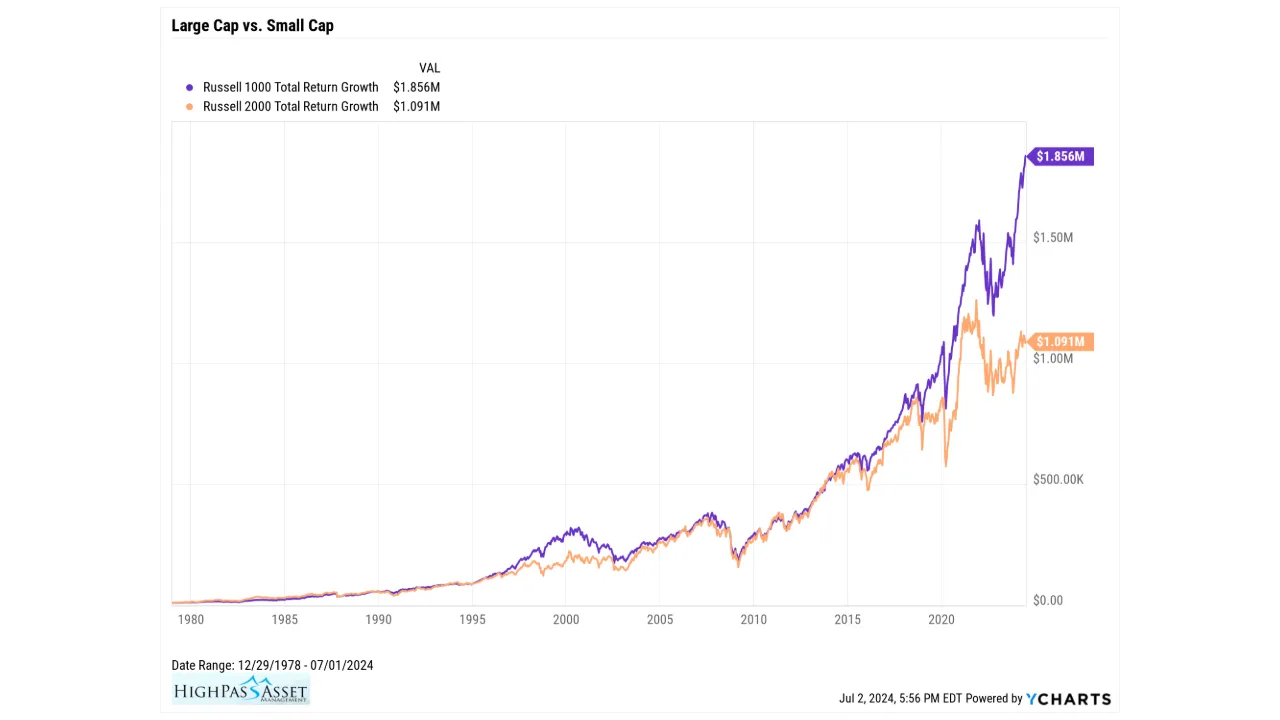

Start Looking at Small Caps

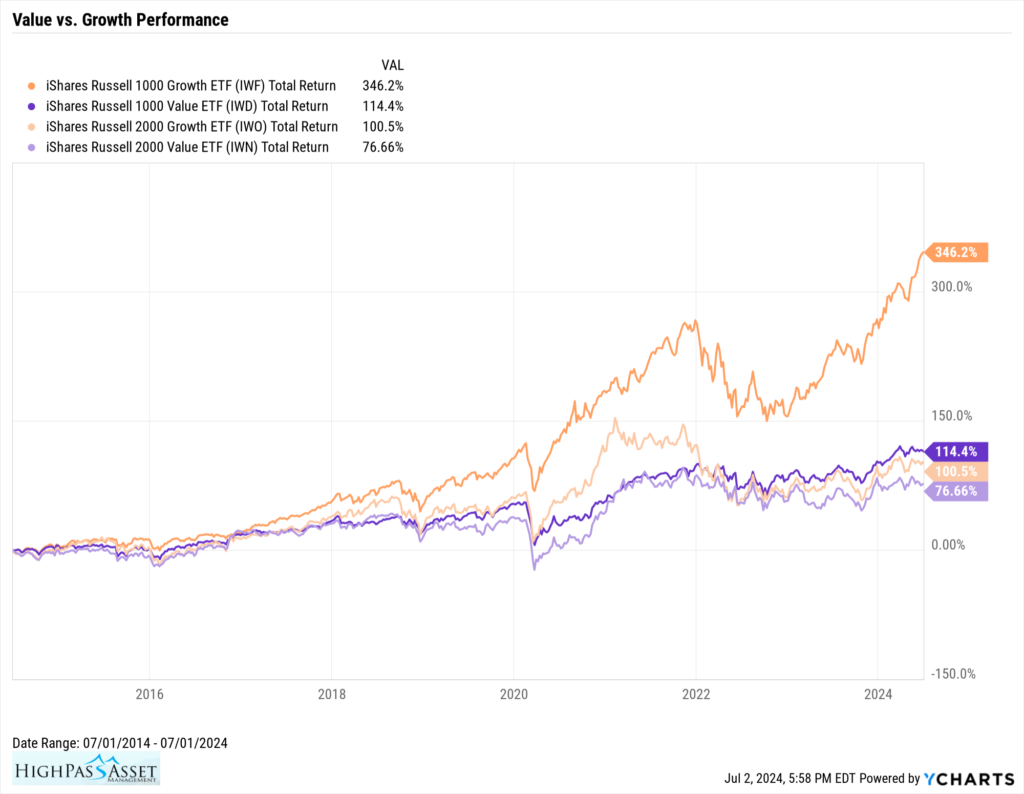

After trillions of COVID relief dollars were unleashed and loans were free, growth stocks saw a considerable gain over the last four years. Looking at the chart above we can see that large cap growth stocks represented by the Russell 1000 Growth ETF, have been on fire since pandemic. Meanwhile, small caps and value stocks have been boring in comparison to mega-cap growth.

The Trend May Reverse

Since the pandemic, the outperformance of mega-cap stocks vs small cap stocks has been considerable. We saw a similar pattern during the tech mania of the late 1990s. We think this trend is due to change and the time to own small caps is now.

If you own them for several decades, growth stocks and value stocks tend to offer similar performance. But along the way, these two styles of investment tend to move back and forth regarding which style is outperforming.

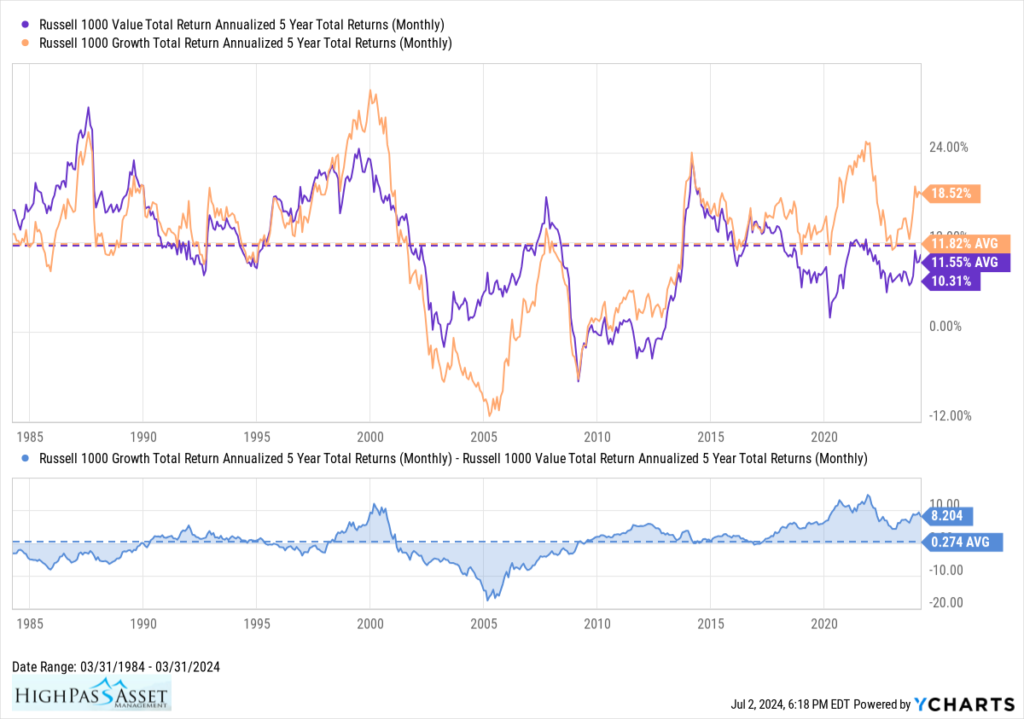

Growth vs Value Alternate Back and Forth Over Time

In the chart above, we can see distinct periods where growth has outperformed value and vice versa. In general, growth will outperform value when credit is plentiful, the economy is strong, and IPOs are easy to sell. When recession hits the investment landscape reverses and value takes the lead.

While we cannot say definitively if a recession will arrive or pick the exact timing, we still think there is a greater than 50% chance of recession within the next twelve months.

Stocks are Expensive

The S&P 500 is extremely expensive when measured by the Shiller CAPE ratio. Given that interest rates are poised to stay higher for longer, we are surprised that valuations have not adjusted. Investors appear to think that expected Fed rate cuts justify current high valuations; but we are not convinced. If the Fed does cut rates, we think rate cuts are more likely to happen due to a recession than anything else. Cutting rates is stimulative and likely to reignite inflation if done too soon when the economy is still strong.

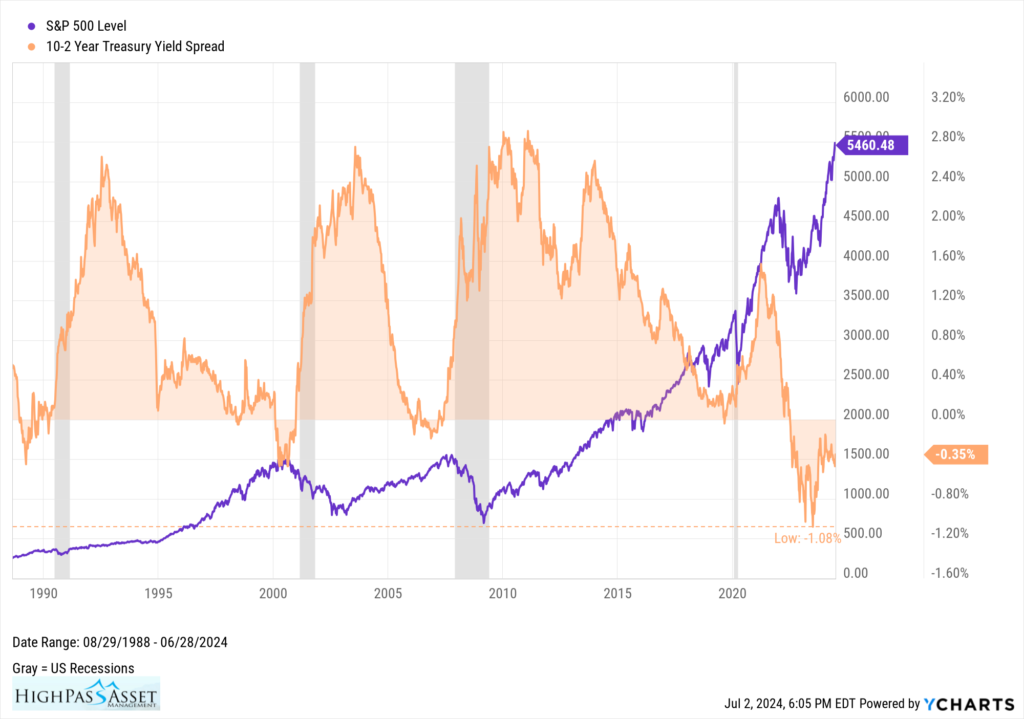

Yield Curve Inversion

Yield curve inversion has historically been an exceptionally accurate recessionary indicator. Despite the massive yield curve inversion, no recession yet and mega-cap growth stocks keep marching higher. The only other time this pattern happened, yield curve inversion and stocks exploding higher, was 1929.

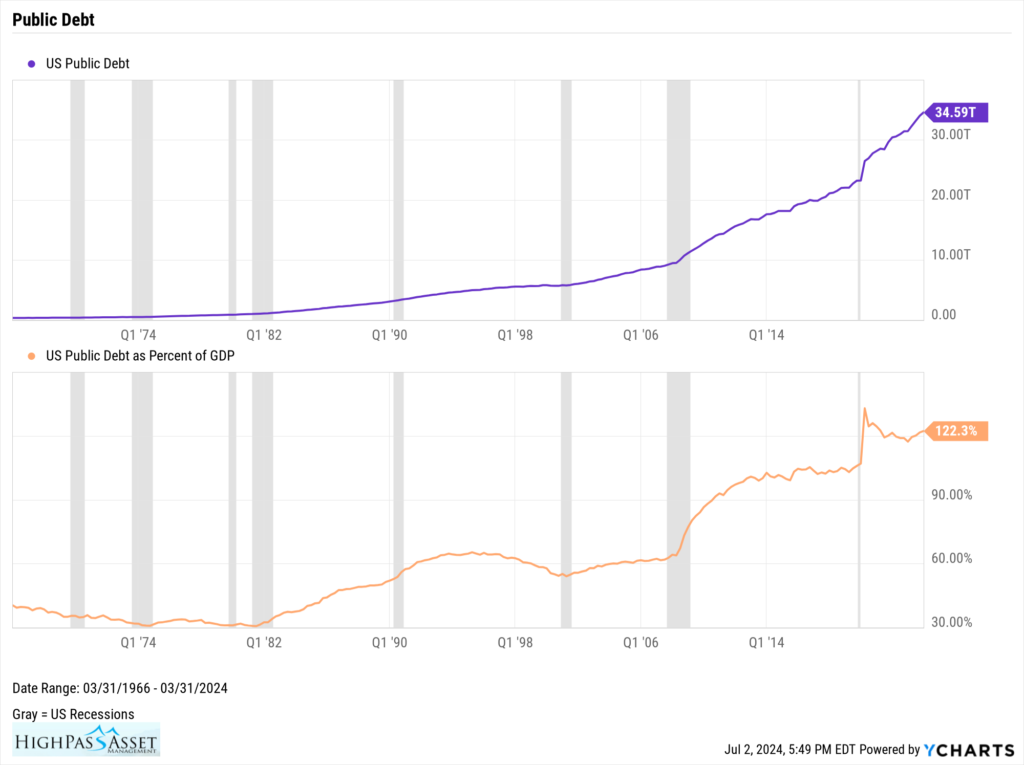

Debt Gone Wild

At some point we will need to deleverage as a nation. When and how deleveraging happens is anyone’s guess, but we can be sure that deleveraging will eventually happen.

To protect yourself against the possibility of growth falling out of favor, recession hitting and an eventual deleveraging of the United States, we recommend moving up in credit quality with respect to equities. Concentrate on value over growth and include small caps which trade at reasonable prices vs mega-caps.

Ethan S. Braid, CFA

President

HighPass Asset Management

Denver, CO