Retirement timing matters. The year you retire can make or break your retirement plan. Will you retire at a good time or a bad time? You cannot really know if you have bad timing until after the fact. If you retire at a bad time, right before a recession and crash in the stock market, you won’t know until it is too late!

What are the Odds of Bad Retirement Timing?

In the last century there have been fifteen recessions. We get a recession every seven years on average. The odds of a recession in any given year are 15% based upon past data.

What happens if your Retirement Timing is Bad?

If you retire at the beginning of a stock market crash, you are likely to struggle. If your portfolio is invested too aggressively, you may run out of money. The stress of seeing your portfolio diminishing in retirement is like a coat of bricks for most retirees.

Examples of Good and Bad Retirement Timing

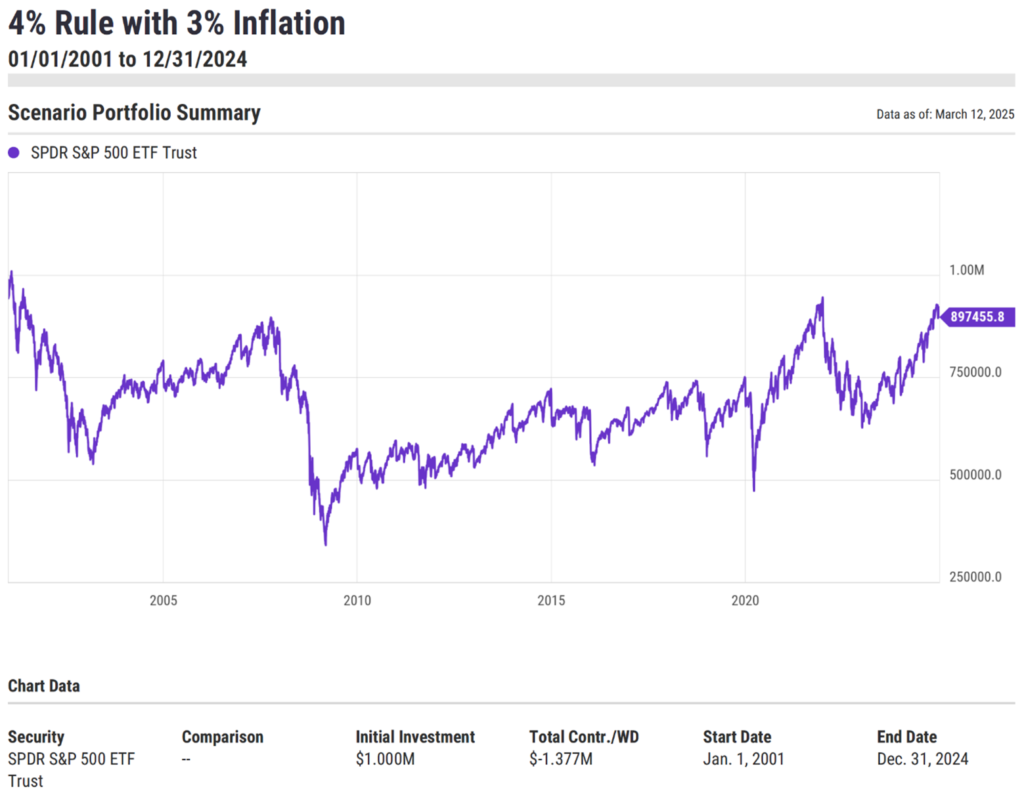

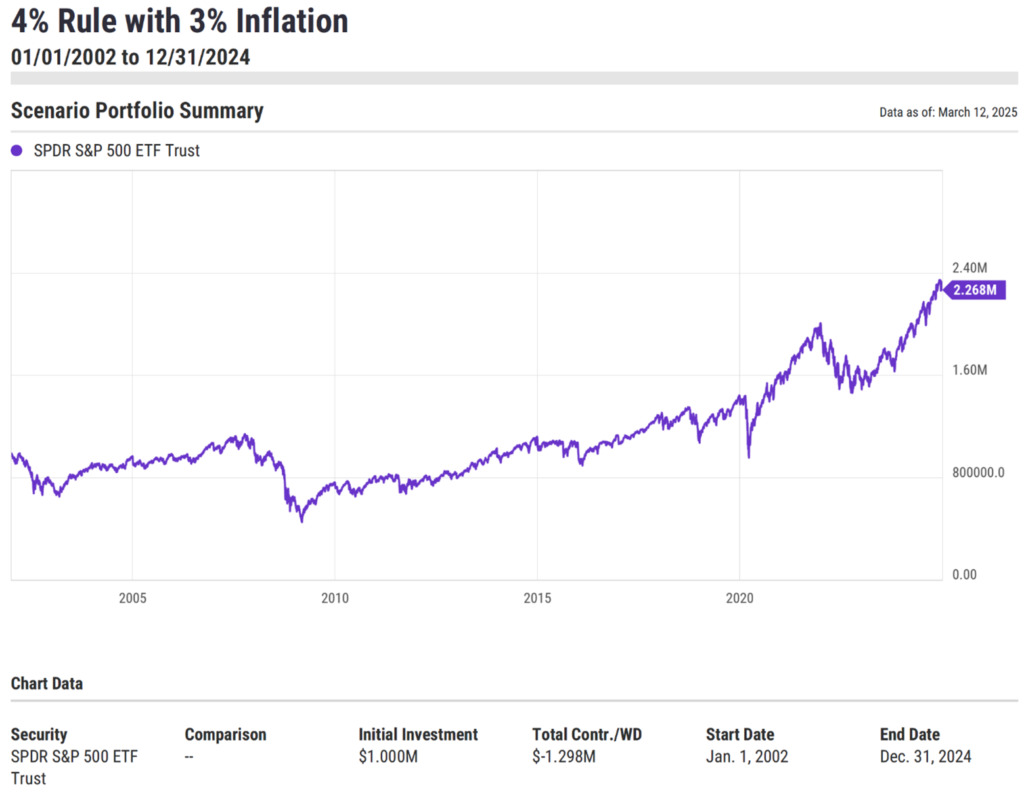

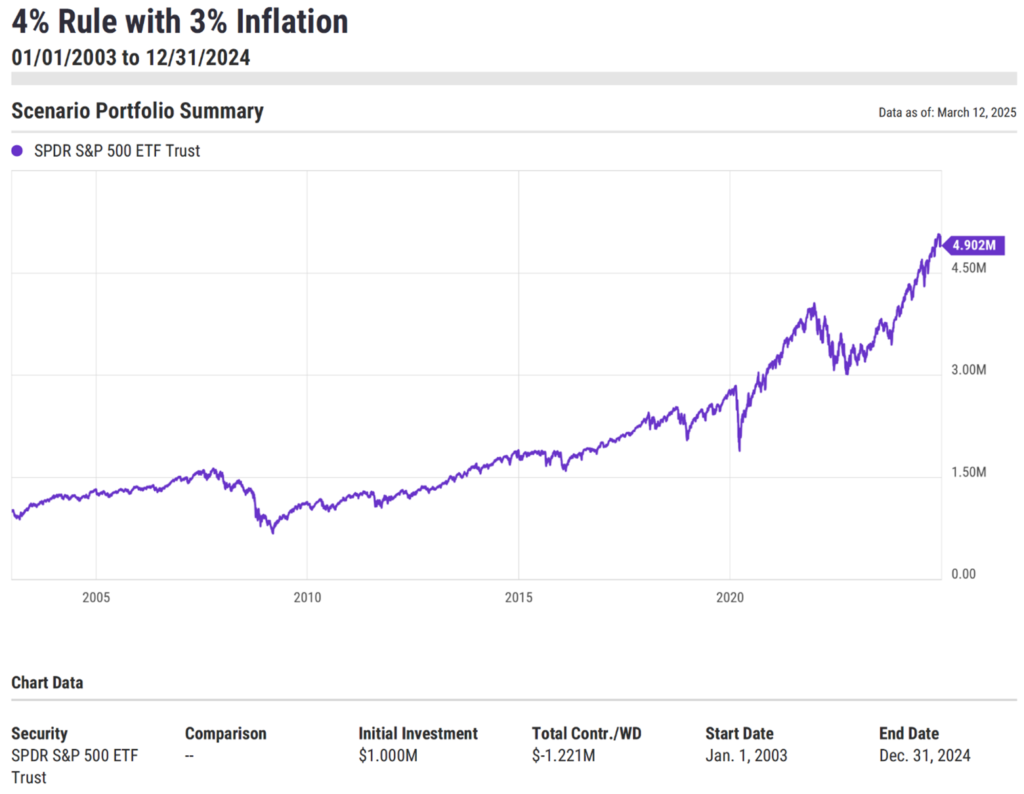

To demonstrate what good and bad retirement timing looks like, I have produced six illustrations for a hypothetical retirement beginning in 1998, 1999, 2000, 2001, 2002 and 2003. In each illustration the retiree begins retirement with a $1 million dollar portfolio. The portfolio is invested in the S&P 500 proxy, SPY ETF. The 4% rule is used for retirement spending and the distributions are inflated by 3% every year for inflation. I am intentionally using an all-equity portfolio to demonstrate what happens when you use an all-equity portfolio in retirement. At the time of this writing, there are many investors who are convinced that an all-equity portfolio in retirement is a good idea. This risk seeking behavior was recently supported by the research paper titled, “Beyond the Status Quo: A Critical Assessment of Lifecycle Investing.” I disagree with the advice in the so-called research paper. My illustrations below show the dangers of an all-equity retirement portfolio.

Good Timing – 1998

Bad Timing – 1999

Bad Timing – 2000

Ok Timing – 2001

Good Timing – 2002

Great Timing – 2003

When You Retire Matters

The year you retire will have a huge impact on the success of your retirement plan. As we can see from the illustrations above, retiring in 1999 or 2000 was not good for an investor with a heavy allocation to the stock market. However, for an investor who had great timing and retired in the year 2003, after the stock market crash, they had the wind at their back and excellent returns in retirement. Buy low, sell high!

How Can You Protect Yourself?

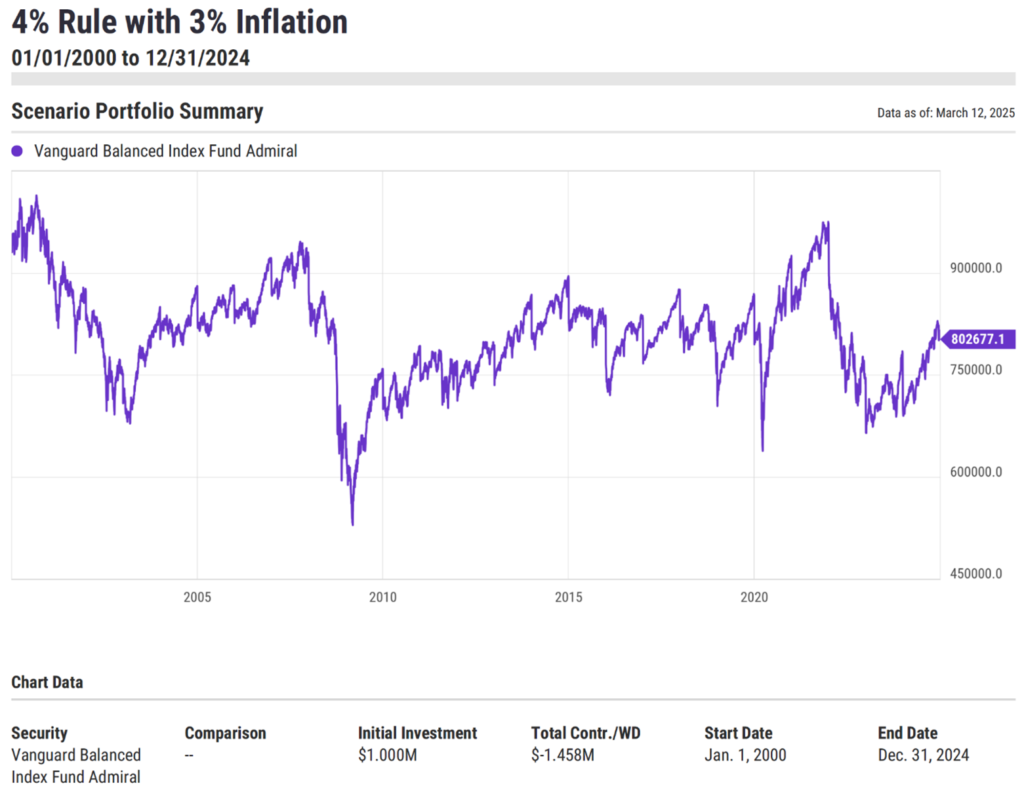

Since you cannot know if your retirement timing will be bad until it is too late, you should use asset allocation to protect yourself. Since we know that the year 2000 was a bad time to retire, let’s look at how an asset allocation portfolio would have held up for someone retiring in the year 2000. In this illustration, we are using the same distribution pattern of 4% annually grown for 3% inflation and a $1 million initial portfolio value. The investment in our illustration is a 60/40 equity/fixed balanced mutual fund: The Vanguard Balanced Index Fund Admiral Share Class.

What a difference the asset allocation portfolio made for the retiree who retired in the year 2000 when compared to an all-equity portfolio. Not only did the asset allocation portfolio survive the sequence of negative returns from 2000 – 2002 but the portfolio also survived the 2008 stock market crash. While your long-term returns may not be as high with an asset allocation portfolio, the lower volatility may help prevent you from running out of money if you retire right before a recession.

Ethan S. Braid, CFA

President

HighPass Asset Management

Denver, CO

This article is for education and illustrative purposes and is not tax, legal or financial advice. Your broker or advisor will charge you fees or commissions to make investments and therefore your returns will be less than indexes. For example, if you invest in the S&P 500 ETF, SPY, you will pay a fee to the company managing the ETF, State Street Global Advisors. Your return on the S&P 500 ETF, SPY, will be less than the SS&P 500 Index TR because of the fee paid to State Street Global Advisors. Additionally, you may pay a fee or a commission to your broker or financial advisor, further reducing your return, below the index. Consult your advisor or broker for a detailed list of their fees or commissions before you invest. Investing involves risk and you can lose money.