Today we’re going to look at how much federal tax you pay for $150,000 of retirement income. This is going to be a very helpful tax planning and retirement planning article.

For those of you who are trying to get a handle on how much tax you are going to pay at the federal level for your retirement income stream. I’m going to show you several different scenarios ranging from tax free to low tax, middle tax, and high tax on a $150,000 retirement income stream.

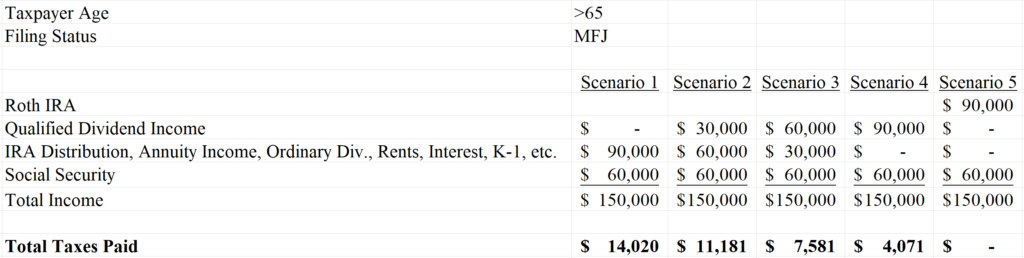

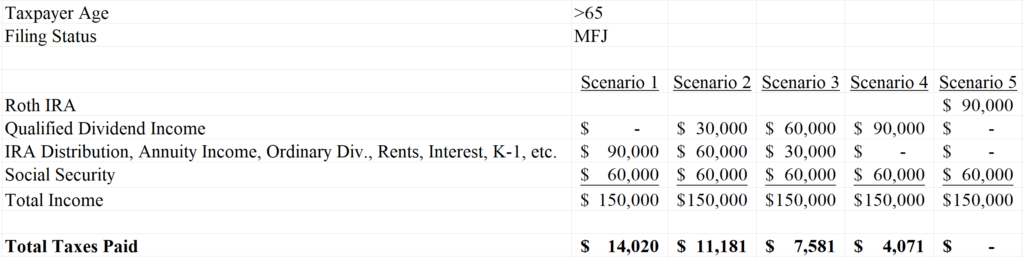

After you read this article, you’ll have a much better grasp of how much of your retirement income you’ll be able to keep after you pay taxes to the federal government. Here is a high-level summary of five different scenarios that we are going to review for a couple that is married filing joint 65 years or older.

Five Scenarios for $150k of Retirement Income

Notice that in all scenarios, income is the same $150,000, but the amount of taxes that we’re paying ranges from $14,000 to $0. Your taxes on $150,000 depend upon the character of the income, IE Social Security IRA, distribution, qualified dividend, Roth IRA, etc.

The tax can range anywhere from $14,000 to $0 if you have a $60,000 Social Security base; depending on the character of the income outside social security.

For example, if you only have Roth IRA and Social Security income and retirement, you won’t have any federal income taxes pay! But notice what happens as we start increasing the amount that this couple is receiving from an IRA distribution, ordinary dividends, rental income, interest, et cetera. As that number starts going up, so do the taxes, they go up and up as well. Notice also that if we start to increase qualified dividend income, as we go left to right and increase the qualified dividend income, look at the taxes going down.

So right away you can see that for the average couple receiving $60,000 a year of Social Security and $150,000 a year of total retirement income, their federal tax bill could range anywhere from zero to over $14,000 a year. The federal tax bill is going to be determined by the character of the income outside Social Security. What is the amount coming from rent in ordinary dividends or an IRA distribution verse qualified dividends or a Roth IRA?

Now let’s take a look at some of these scenarios in a little bit deeper detail so that you can see how changing the character of the income that you’re receiving in retirement will affect your tax bill.

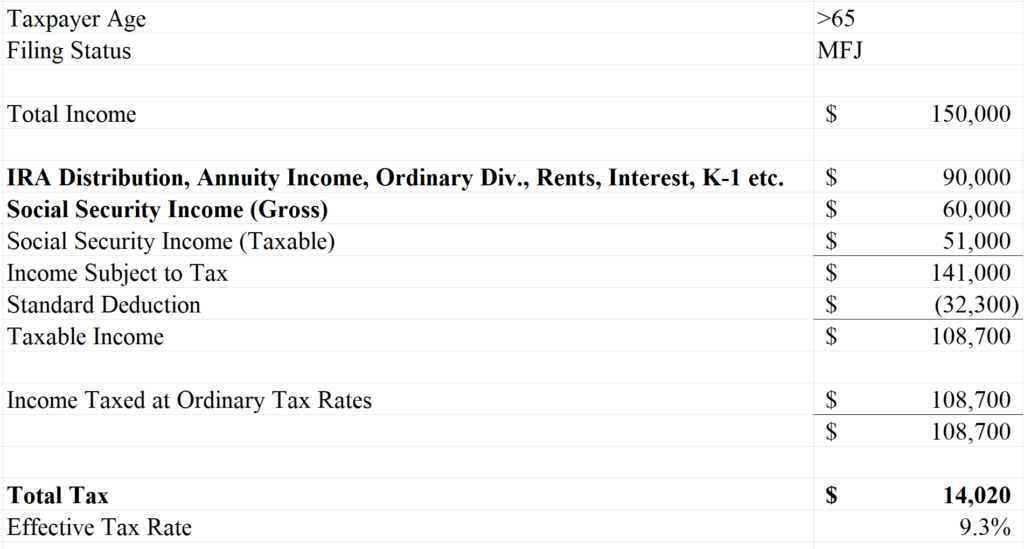

$90k Ordinary Income with $60k Social Security

Our first illustration will be the high tax example where this couple pays $14,020.00 in federal tax on their $150,000 retirement income.

They’re receiving $60,000 of Social Security and $90,000 from rental income, IRA distribution, annuity income, etc. All of these income sources are taxed the same way, ordinary income. Receiving this $90,000 of income in addition to Social Security causes most of their Social Security to become taxable. You can see that Social Security income subject to taxation is $51,000. They receive their standard deduction and their taxable income is going to be $108,700. Their effective tax rate is 9.3% on their $150,000 retirement income stream.

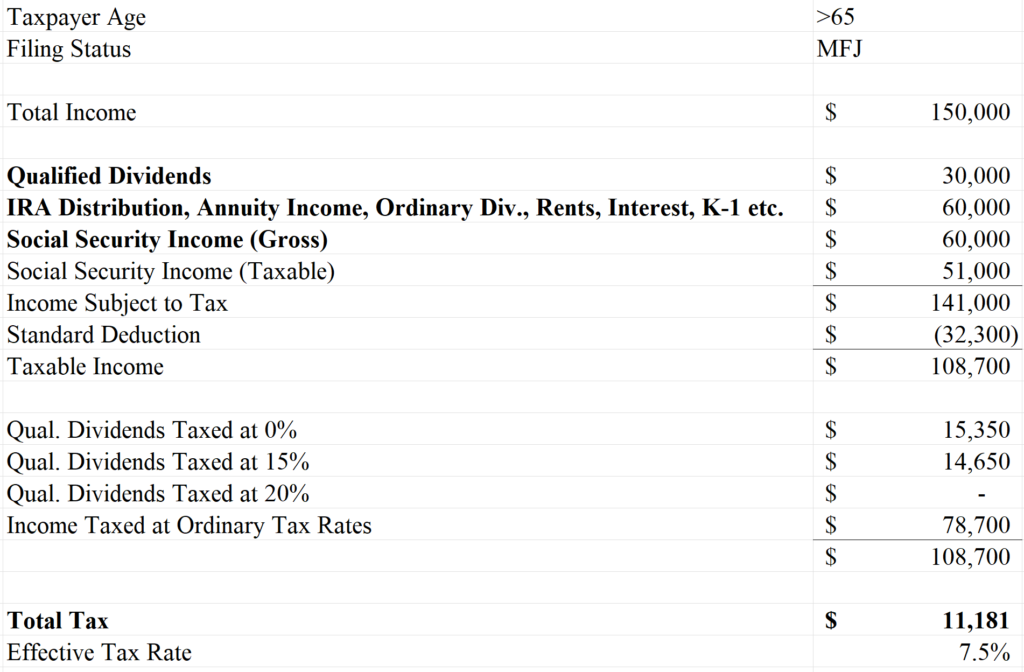

$30k Qualified Dividends $90k Ordinary Income $60k Social Security

In our second illustration for this couple, notice that the federal income tax bill has gone down by 20%.

How do we do it? We changed the character of the income. Instead of receiving $90,000 from an IRA distribution, annuity income, rental income, etc., we’re only receiving $60,000 and we’ve added in $30,000 of qualified dividends. The end result is that our federal income tax bill is going to be 20% lower and that is because $15,350 of the qualified dividends are going to be taxed at 0% and $14,650 will be at 15%.

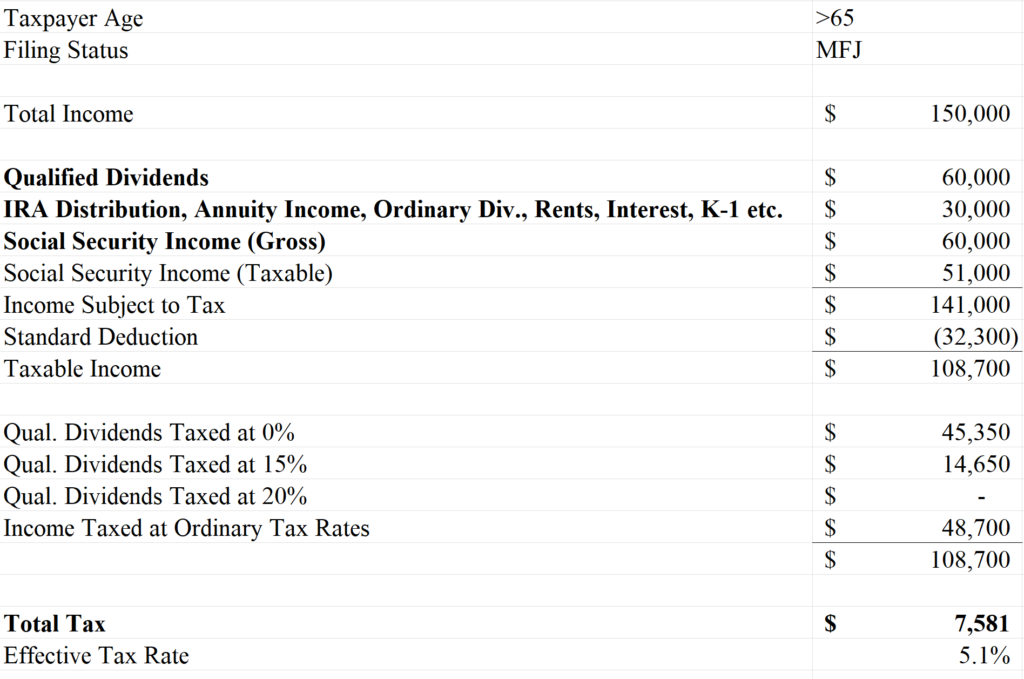

$60k Qualified Dividends $30k Ordinary Income $60k Social Security

In our third example, we’ve reduced our federal income tax bill nearly 50%.

All we did was increase qualified dividends to $60,000 and decreased rental income, IRA distribution, annuity income, etc., to $30,000. The end result is a big decrease in our tax bill. This move saves us almost $536 a month verse the high tax scenario. Notice also that $45,350 of our qualified dividends are going to be taxed at zero. $14,650 will be taxed at 15%. The result is the effective tax rate is now 5.1% on our $150,000 retirement income stream.

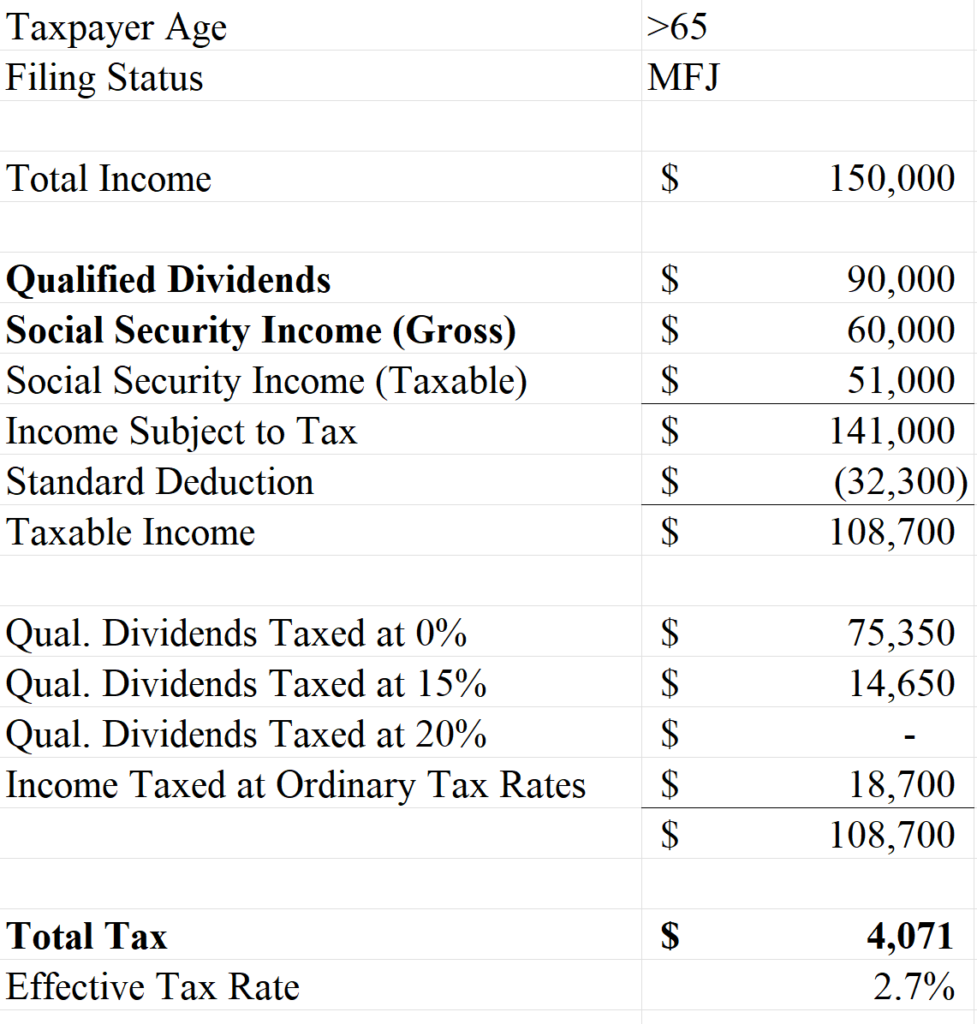

$90k Qualified Dividends with $60k Social Security

This illustration is our low federal income tax scenario.

The couple is now receiving only qualified dividends of $90,000 and Social Security of $60,000. The result is that $75,350 of the qualified dividends will be taxed at 0%. The remaining dividends of $14,650 will be taxed at 15%. Ultimately, we’re bringing the tax bill down by roughly 70%, again by just changing the nature and character of the income stream in retirement.

$90k Roth IRA with $60k Social Security

Our last example is the tax-free scenario for $150,000 of retirement income. If you only have Roth IRA and Social Security in retirement, then your federal tax bill will be zero!

Now that we’ve reviewed all five of those tax illustrations, let’s go back to the summary page.

Summary Table

Take a look at it and think about how a couple planning for a $150,000 retirement income stream might go about organizing their investments to keep their taxes low.

Looking at this summary page, it becomes very obvious that if you are building wealth in rentals, limited partnerships that provide K1 income, annuities, or IRAs, then you’re going to be in the highest tax scenario.

Most people will want to try to lower their taxes in retirement, so they have more money to spend.

So how do you get there?

You need tax diversification and good tax planning when it comes to investing and building your wealth. Make sure that you’re including investments that pay qualified dividends in your portfolio and consider using a Roth IRA. Those investment structures will help lower your tax bill and give you more money to spend in your retirement.

Integrating tax planning with your retirement plan and your investment strategy can put a lot more money in your pocket throughout the course of your retirement.

For example, if you could reduce your federal income tax bill by just $600 a month, that would save you $7200 a year. Over the course of a 25 year retirement you would have an extra $180,000 to spend. It really adds up over time.

So when it comes to your retirement planning, you want to be sure that you include tax diversification strategies as part of your retirement plan.

Ethan S. Braid, CFA

President

HighPass Asset Management

Denver, CO

www.highpassasset.com

This article is for education and illustrative purposes and is not tax, legal or financial advice. Your broker or advisor will charge you fees or commissions to make investments and therefore your returns will be less than indexes. For example, if you invest in the S&P 500 ETF, SPY, you will pay a fee to the company managing the ETF, State Street Global Advisors. Your return on the S&P 500 ETF, SPY, will be less than the SS&P 500 Index TR because of the fee paid to State Street Global Advisors. Additionally, you may pay a fee or a commission to your broker or financial advisor, further reducing your return, below the index. Consult your advisor or broker for a detailed list of their fees or commissions before you invest. Investing involves risk and you can lose money.