Investors have invested over $230 billion in the Fidelity Government Cash Reserves Fund, FDRXX. Many of them end up paying state income tax on a portion of their dividend that should be tax-exempt at the state level.

How the Tax Mistake Occurs

For after-tax investment accounts, Fidelity sends account holders a 1099 that details the total amount of taxable dividends generated by their investment holdings. For a money market, like FDRXX, form1099 will show the total amount of dividends received for a given year and will classify these dividends as ordinary. What form 1099 will not show however is the percentage of the fund’s dividend that was generated from U.S. government securities. U.S. government securities are state tax-exempt.

Many investors do not realize that they need to perform research beyond form1099, to properly determine how much of their FDRXX dividend should be state tax-exempt. Instead, they just enter the total amount of the dividend received when they file their state tax return and end up paying taxes on the entire dividend. For some people, this mistake could result in paying $1,000s of taxes at the state level they should not be paying!

How to Prevent the Tax Mistake

Go to Fidelity’s tax website: Fidelity.com/fundtaxinfo.

Open the file: Percentage of Income from U.S. Government Securities.

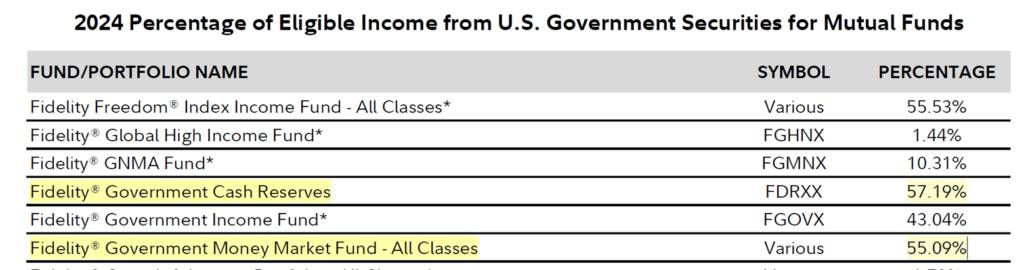

The table below shows the 2024 percentage of the fund’s dividend that is state tax exempt.

If you received $10,000 of FDRXX dividends in 2024, then $5,719 would be state-tax exempt.

Researching and then properly reporting your taxable dividends at the state level is not just limited to money market funds like FDRXX. You may have other mutual funds and ETFs that generate U.S. government interest that is state tax-exempt. The only way to properly file your state tax return is to research each mutual fund or ETF you own to determine what percentage of your dividend income is state tax-exempt. Unfortunately, many investors and their CPAs miss this critical reporting step and end up paying taxes they should not be paying.

Ethan S. Braid, CFA

President

HighPass Asset Management

Denver, CO

This article is for education and illustrative purposes and is not tax, legal or financial advice. Your broker or advisor will charge you fees or commissions to make investments and therefore your returns will be less than indexes. For example, if you invest in the S&P 500 ETF, SPY, you will pay a fee to the company managing the ETF, State Street Global Advisors. Your return on the S&P 500 ETF, SPY, will be less than the SS&P 500 Index TR because of the fee paid to State Street Global Advisors. Additionally, you may pay a fee or a commission to your broker or financial advisor, further reducing your return, below the index. Consult your advisor or broker for a detailed list of their fees or commissions before you invest. Investing involves risk and you can lose money.