Zero coupon municipal bonds are an excellent investment for retirement planning. Investors in high tax brackets can purchase zero coupon municipal bonds, to lock in great yields and predictable future cash flows.

Zero coupon municipal bonds are simple, you buy them at a discounted price and they mature at $1,000 a bond. The interest that you earn is federally tax exempt. Interest will also be state tax exempt if you reside in the state the bond was issued in.

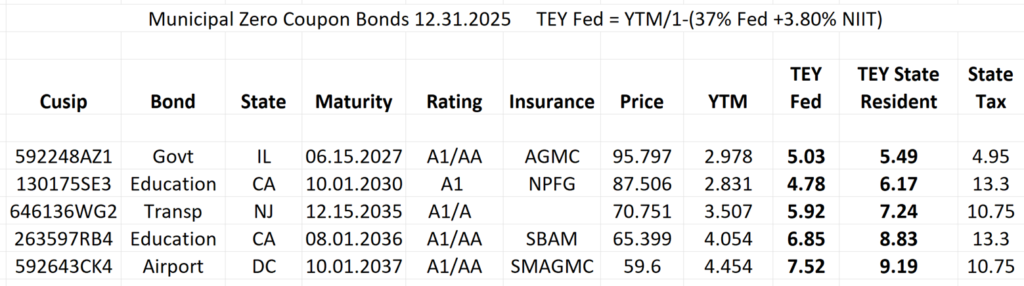

In the table below, I have listed five individual zero coupon municipal bonds from various states. The TEY columns stand for taxable equivalent yield. Taxable equivalent yield is calculated as ytm/(1 – tax rate). TEY Fed has been calculated using the highest marginal tax bracket of 37% plus the 3.80% NIIT. TEY State Resident is the TEY for a resident of the state the bond was issued in, assuming the resident is in the highest Federal tax bracket and the highest tax bracket for that particular state.

I am not recommending the bonds in this article. I am using them to demonstrate how you can incorporate zero coupon municipal bonds into your retirement plan.

Retirement Planning Example

If you lived in California and you knew that you wanted a $100,000 cash flow in 2036 as part of your retirement plan, you could simply purchase 100 zero coupon municipals maturing in 2036. The bond maturing in 2036 would cost $65,399 on 12.31.2025 for $100,000 of future value on 08.01.2036. For a California investor in the highest tax bracket, they would earn a TEY as a state resident of 8.83%; a great yield for investment grade credit!

When you buy zero coupon municipal bonds, you should plan to hold them until maturity. Always check the issue size of any bond you purchase and the tax-exempt status. Small issues may have limited liquidity, and some municipal bonds are taxable. If you need to sell your bond prior to maturity, you may have to do so at a steep discount to market value.

Ethan S. Braid, CFA

President

HighPass Asset Management

Denver, Colorado

This article is for educational and illustrative purposes and is not financial advice. Your broker or advisor will charge you fees or commissions to make investments and therefore your returns will be less than indexes. For example, if you invest in the S&P 500 ETF, SPY, you will pay a fee to the company managing the ETF, State Street Global Advisors. Your return on the S&P 500 ETF, SPY, will be less than the S&P 500 Index TR because of the fee paid to State Street Global Advisors. Additionally, you may pay a fee or commission to your broker or financial advisor, further reducing your return, below the index. Consult your advisor or broker for a detailed list of their fees or commissions before you invest. Investing involves risk and you can lose money.