Investors in Schwab prime advantage money fund SWVXX need to know they have better alternatives for large cash holdings.

SWVXX is Expensive.

The fund costs .34% per year. That is a hefty fee for a low-risk money market investment.

SWVXX has Underperformed

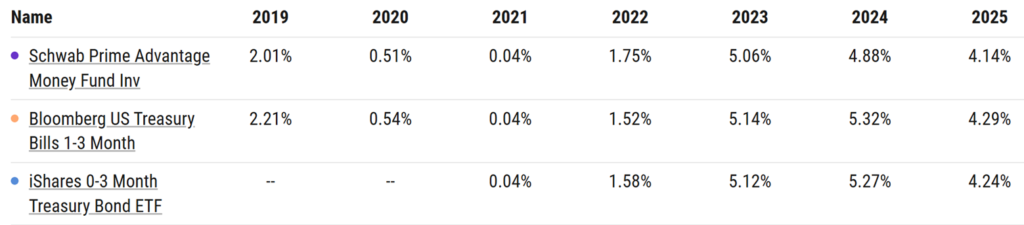

SWVXX has underperformed 1 – 3 month treasury bills and 0 – 3 month treasury bill ETFs like SGOV, for the last three years. The table below show that SWVXX trailed the Bloomberg US Treasury 1 – 3 Month Treasury Bill index and the treasury bill ETF, SGOV, for each of the last three years.

SWVXX Taxation – No Advantages

SWVXX imposes a state tax burden on the fund’s investors. SWVXX typically invests in commercial paper, cds, variable rate demand notes and repos. All of which are taxed at ordinary income tax rates by states with an income tax. If you live in a state with an income tax, then your SWVXX ordinary dividend is likely to be fully taxable at the state level.

Alternatives to SWVXX

1. Buy Treasury Bills

Investors can eliminate fees entirely by purchasing treasury bills directly from the US government through Treasury Direct. Moving money from SWVXX to treasury bills at Treasury Direct will save an investor .34% per year in fees.

2. Buy the Treasury Bill ETF, SGOV

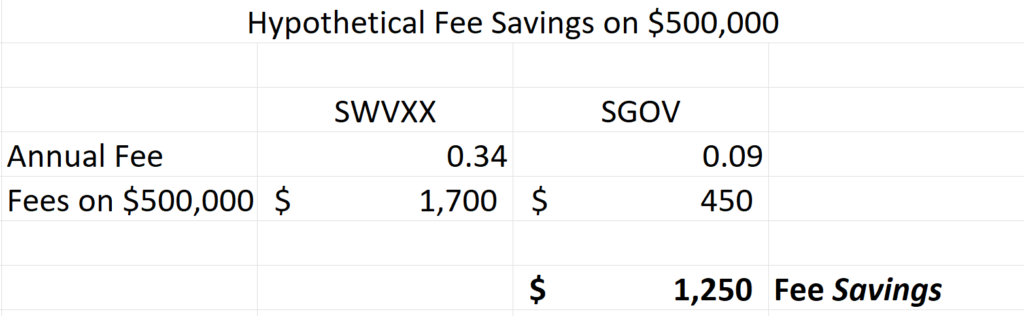

Investors who do not wish to purchase individual treasury bills should consider purchasing the treasury bill ETF, SGOV. Switching from SWVXX to SGOV will save investors .25% per year in fees. The table below shows how much an investor could save by switching from SWVXX to SGOV. For a $500,000 investment, an investor could save $1,250 per year in fees.

State Tax Benefits of Treasury Bills vs SWVXX

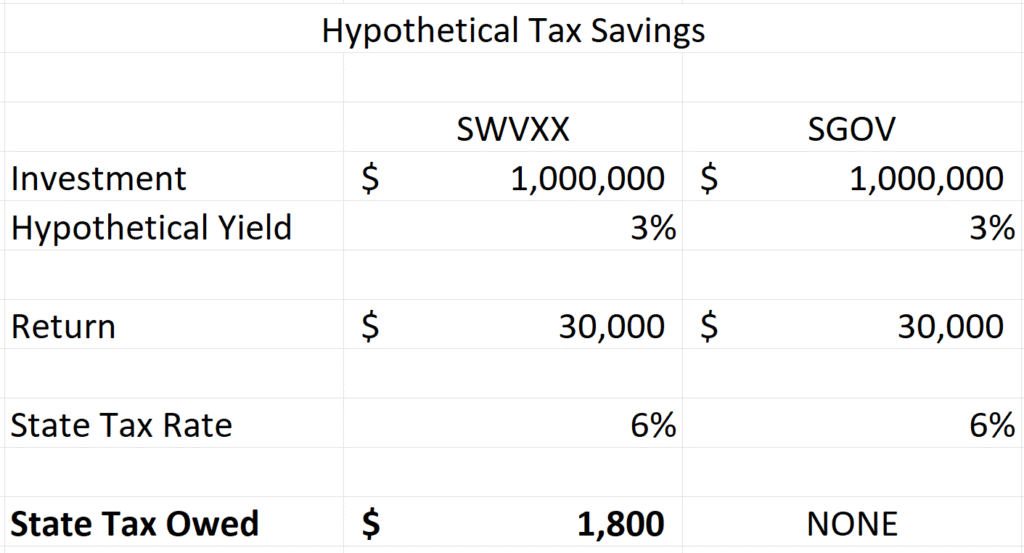

The ordinary dividend paid by SWVXX is likely to be fully taxable at the state level. Treasury bills and treasury bill ETFs like SGOV on the other hand are not taxable at the state level. Compare paying state tax on your SWVXX ordinary dividend to the state tax-free interest you would earn on treasury bills or treasury bill ETFs like SGOV. The table below shows the hypothetical tax savings an investor could receive on $1,000,000 by switching from SWVXX to SGOV. The illustration assumes the investor lives in a state with an income tax of 6% and earns a 3% return for both investments. If SWVXX and SGOV paid identical interest of 3%, the investor would end up with more after-tax return by owning SGOV. In this example, the investor would need to pay $1,800 in state taxes on SWVXX ordinary dividends. The SGOV ordinary dividend however would be state tax-free. SGOV earnings come from US treasury bills which are state tax-exempt.

SWVXX is a safe place to keep your cash. The fund does pay an attractive dividend. But given the high cost and state tax burden, investors holding large cash positions in after-tax accounts may want to consider purchasing treasury bills or treasury bill ETFs like SGOV. In the long run, by investing in treasury bills or treasury bill ETFs like SGOV you might end up with more money once you factor in your savings on fees and state taxes.

Ethan S. Braid, CFA

President

HighPass Asset Management

Denver, Colorado

This article is for educational and illustrative purposes and is not financial advice. Your broker or advisor will charge you fees or commissions to make investments and therefore your returns will be less than indexes. For example, if you invest in the S&P 500 ETF, SPY, you will pay a fee to the company managing the ETF, State Street Global Advisors. Your return on the S&P 500 ETF, SPY, will be less than the S&P 500 Index TR because of the fee paid to State Street Global Advisors. Additionally, you may pay a fee or commission to your broker or financial advisor, further reducing your return, below the index. Consult your advisor or broker for a detailed list of their fees or commissions before you invest. Investing involves risk and you can lose money.