Blog

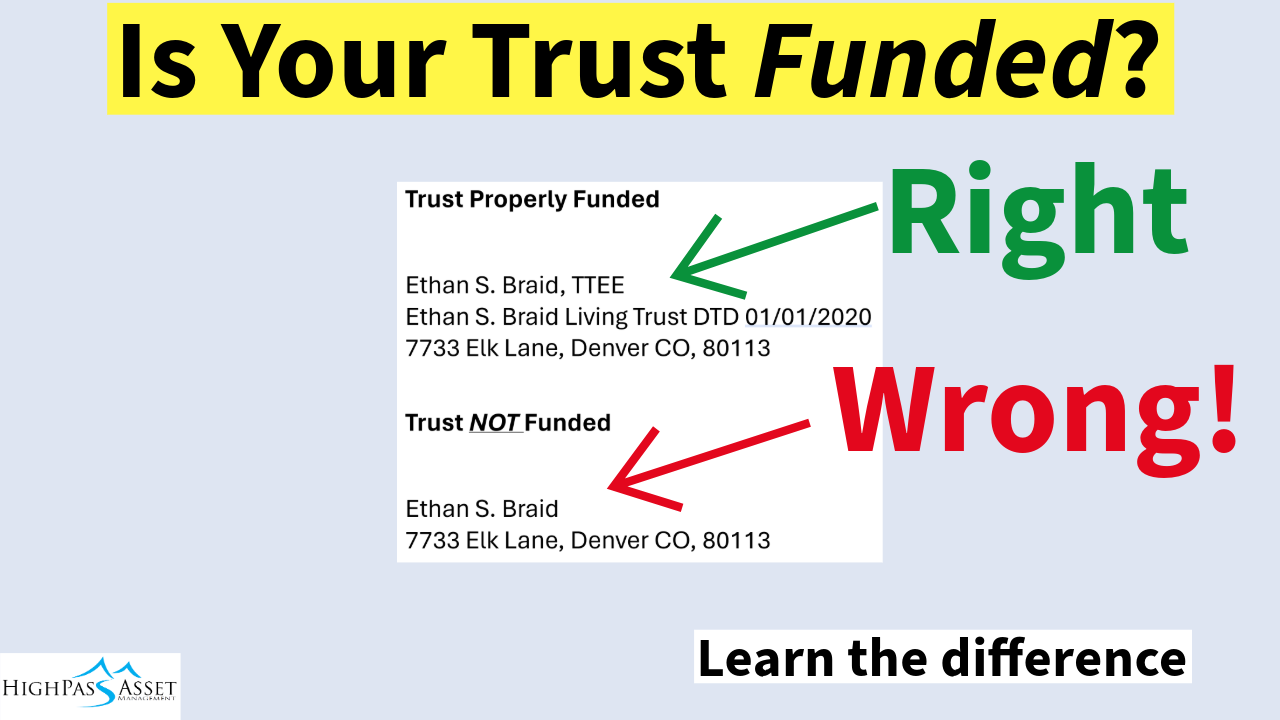

How to Tell if Your Trust is Funded. Fix Your Estate Plan!

Over my career as a financial advisor I have met with over 300 wealthy families to discuss their estate and retirement plan. About 80% of the time, assets that should be in a trust, are not in the trust. Trust funding is one of the most common estate...

Is my Financial Advisor a Fiduciary a Stockbroker or Both?

What is the fiduciary duty and why is that important? The fiduciary duty requires an investment adviser, by law, to act in the best interest of her clients, putting her clients’ interests ahead of her own at all times.[i] Under the fiduciary duty, an investment...

How to Fund Your Trust in Three Steps

Over the last 25 years I have advised hundreds of wealthy families with their estate plans. In my experience, around 80% of the time, there will be mistakes with trust funding. The most common mistake is simply not funding the trust. Many wealthy families assume that...

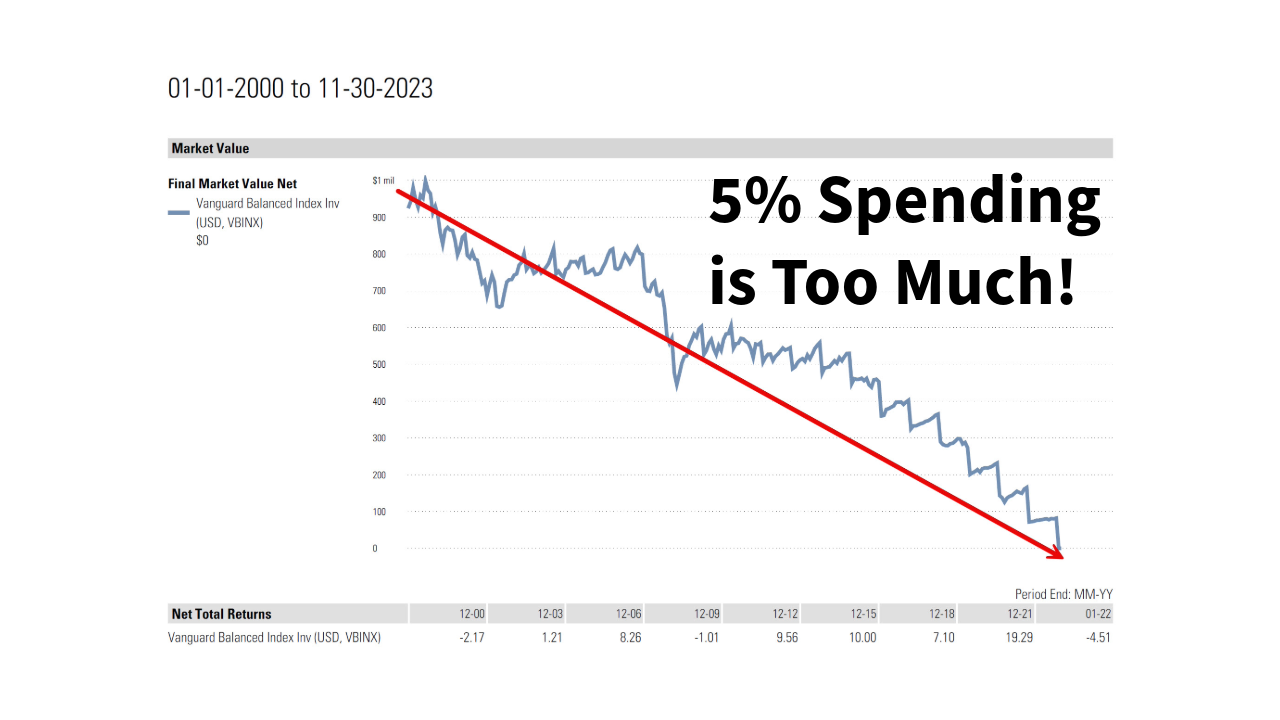

5% Retirement Spending is Too Much!

HOW MUCH CAN I SPEND IN RETIREMENT? This question is one of the most common questions people ask me when working on their retirement plan. I have often had people tell me that they were planning to spend 5% of their portfolio during retirement. For some reason, many...

How Long Does $1 Million Last in Retirement?

The number of years a $1 million dollar portfolio will last a person in retirement will depend on the following four factors: Asset Allocation Spending Rate Percentage Investment Selection & Performance Behavior ASSET ALLOCATION Asset allocation is a critical...

Common Estate Planning Mistakes

Over the last 25 years I have met with 300+ wealthy families to discuss their financial planning, investments and estate planning concerns. In my experience, 80% of the time, there are issues with an estate plan. Generally, the issues have nothing to do...