If you have a taxable brokerage account with Fidelity, the 1099 you receive will not show what percentage of your ETF and mutual fund dividends came from U.S. government securities. Fidelity 1099 reporting only shows the total amount of your dividends received from your ETFs and mutual funds with no allocation for U.S. government securities income. Fidelity 1099 reporting can lead to missed state income tax deductions if additional research is not completed.

The Tax Deduction People Often Miss

U.S. government securities income is deductible at the state level. Because Fidelity 1099s do not show what percentage of ETF and mutual fund dividends comes from U.S. government securities, many investors miss important state income tax deductions when filing their state income tax returns.

Tax Research you Must Perform on Fidelity 1099

Investors must conduct research on each ETF and mutual fund they own at Fidelity to determine if the fund offers any state income tax deduction. Investors frequently neglect to perform this research and end up paying state income tax on a portion of their ETF and mutual fund dividends that should be tax-exempt at the state level.

For each ETF or mutual fund, you own in a Fidelity taxable brokerage account you must go directly to the fund manager’s website and review their published tax documents to determine the percentage of the fund’s dividend that came from U.S. government securities.

Tax Research Example with Fidelity Funds

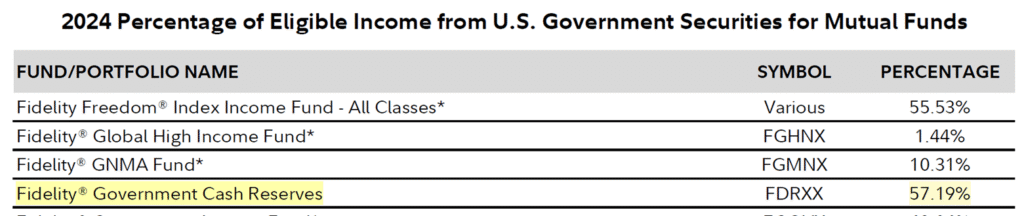

On their website, Fidelity provides a tax document titled, “Percentage of Income from U.S. Government Securities.” This document lists the percentage of the ordinary dividend for all Fidelity funds, which was earned from U.S. government securities.

In the example above, Fidelity shows in 2024 Fidelity Government Cash Reserves Fund (FDRXX) earned 57.19% of the dividend from U.S. government securities. To take advantage of the state income tax deduction, an investor needs to manually calculate the amount of their dividend that is state tax-exempt.

Example

| 2024 dividend from FDRXX | $50,000 |

| Percentage of FDRXX dividend from U.S. government securities | 57.19% |

| Amount of FDRXX dividend that is state tax-exempt | $28,595 |

An investor with $50,000 of dividends from FDRXX would be eligible for a $28,595 state income tax deduction. If the investor simply relies upon their Fidelity 1099 and does not perform this research that goes beyond the Fidelity 1099, they are likely to pay well over $1,000 of unnecessary state income taxes!

Ethan S. Braid, CFA

President

HighPass Asset Management

Denver, CO

This article is for education and illustrative purposes and is not tax, legal or financial advice. Your broker or advisor will charge you fees or commissions to make investments and therefore your returns will be less than indexes. For example, if you invest in the S&P 500 ETF, SPY, you will pay a fee to the company managing the ETF, State Street Global Advisors. Your return on the S&P 500 ETF, SPY, will be less than the SS&P 500 Index TR because of the fee paid to State Street Global Advisors. Additionally, you may pay a fee or a commission to your broker or financial advisor, further reducing your return, below the index. Consult your advisor or broker for a detailed list of their fees or commissions before you invest. Investing involves risk and you can lose money.