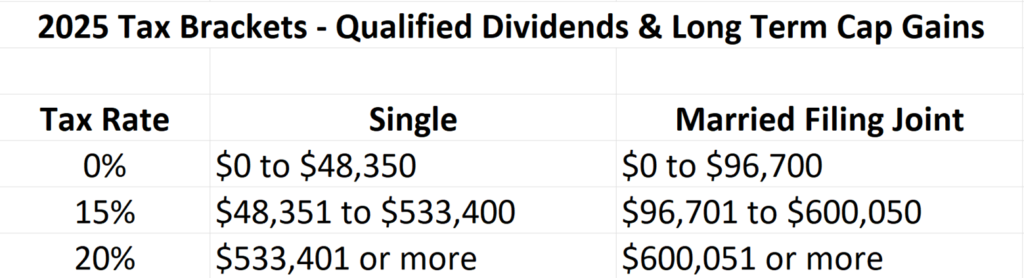

There are many reasons you should never buy an annuity; high fees, limited investment options, and surrender charges to name a few. But the number one reason to never buy annuities with after-tax funds is the tax structure. When you purchase standard investments like ETFs, mutual funds or individual stocks, your dividends are likely to be classified as qualified dividends and subject to a low tax rate. If you hold your investments for more than one year before you sell them, if there are gains when you sell then those gains will be taxed at long-term capital gains tax rates. Long term capital gains are taxed at the same rate as qualified dividends. The first tax bracket for long term capital gains and qualified dividends is 0%!

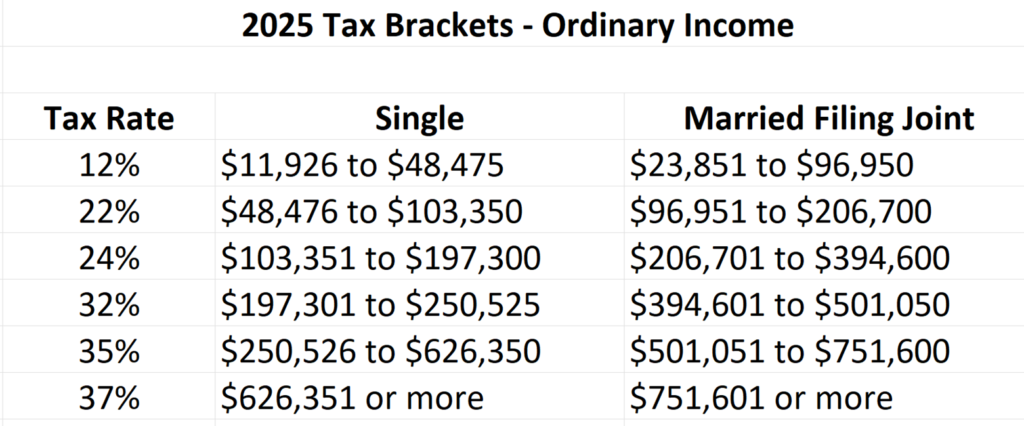

Annuities, however, are subject to ordinary income tax rates. All gains from an annuity will be taxed as ordinary income and those gains are immediately taxed at 12% or higher depending upon which tax bracket you are in. Comparing the tax brackets for qualified dividends and capital gains vs ordinary income clearly demonstrates that paying ordinary income on all your investments gains is going to cost you a lot more in taxes.

Tax Brackets for Annuity Income

Tax Brackets for Qualified Dividends and Long-Term Capital Gains

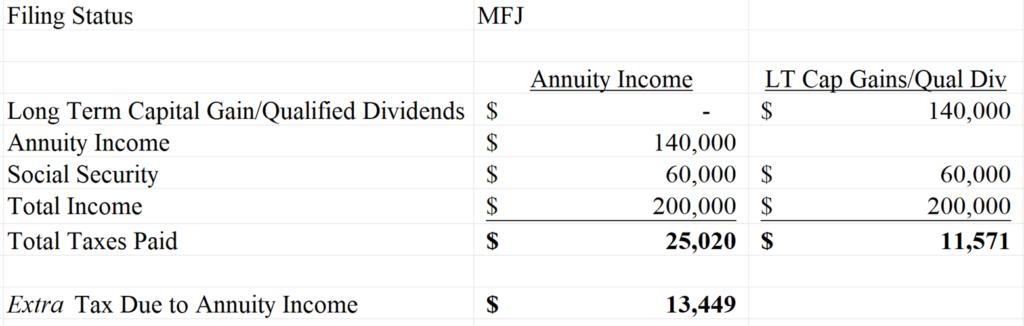

Annuity Income vs LT Cap Gains/Qual Dividends Taxation Example

The table below is an example for two retired couples both with $200,000 in total income. In the first column the couple has $140k of annuity income and $60k of social security. In the second column the couple has $140k of qualified dividends/long term capital gains and $60k of social security. The couple with the annuity income ends up paying an additional $13,449 in federal tax just because their income is from an annuity. Clear evidence that annuities put you at a tax disadvantage and impose significant tax burdens!

Annuity Estate Planning – No Stepped Up Basis!

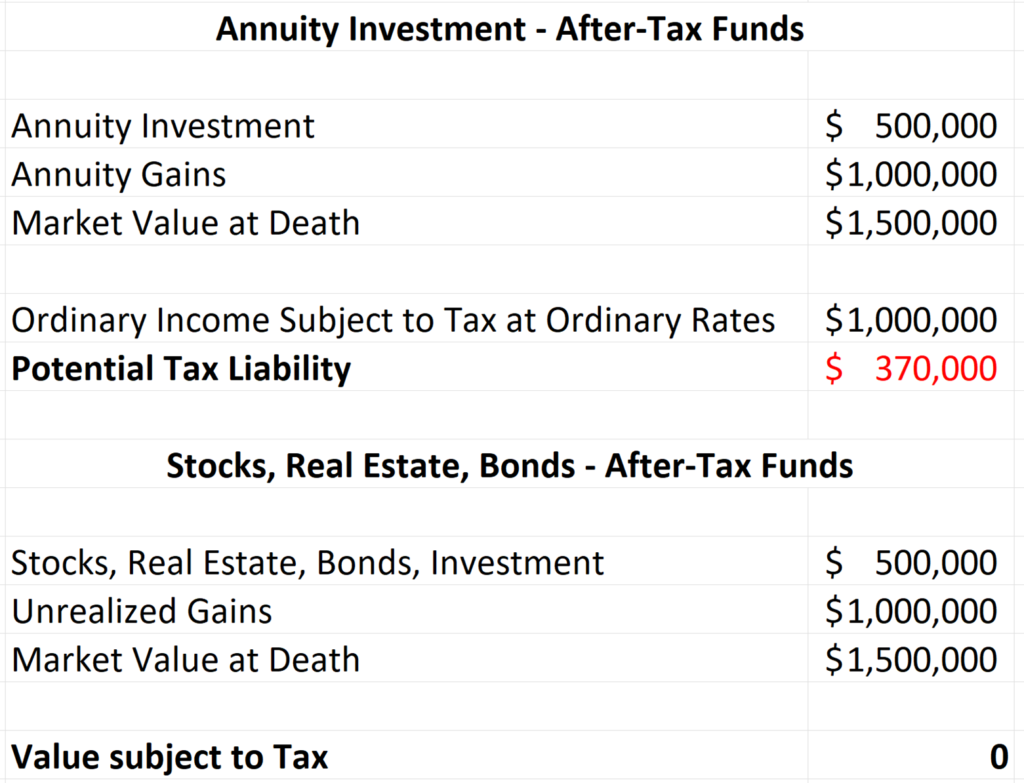

When you buy an annuity with after tax funds, you or your family will never escape the tax bill on your annuity investment. Ultimately either you or your heirs will pay income tax at ordinary rates for any gains in the annuity. Annuities do not qualify for stepped up basis. When your children inherit your annuity, if there are gains in the contract, they will be inheriting a tax bill too.

The table below compares after tax investments with an unrealized gain of $1 million at death vs an annuity contract with $1 million of unrealized gain at death. Your heirs would receive the after-tax investments tax-free due to stepped up basis but with the annuity, they could owe as much as $370,000 in federal tax.

The tax law clearly shows that annuities are a terrible investment for retirees.

Ethan S. Braid, CFA

President

HighPass Asset Management

Denver, CO