Retiring on stock market dividends is a great way to retire but this approach is not for everyone. This article will review the pros and cons of retiring on dividends.

The PROS are:

- Inflation protection

- Lower taxes

- Predictable Income

- Low volatility of your income.

- Growth of your nest egg in retirement.

- Stepped-Up Basis for your beneficiaries.

- Buy & Hold

- Avoid Market Timing Errors

The CONS are:

- High Volatility

- More Capital is needed compared to other retirement strategies.

Now let’s take a deeper look at the pros and cons individually.

PRO – Inflation Protection

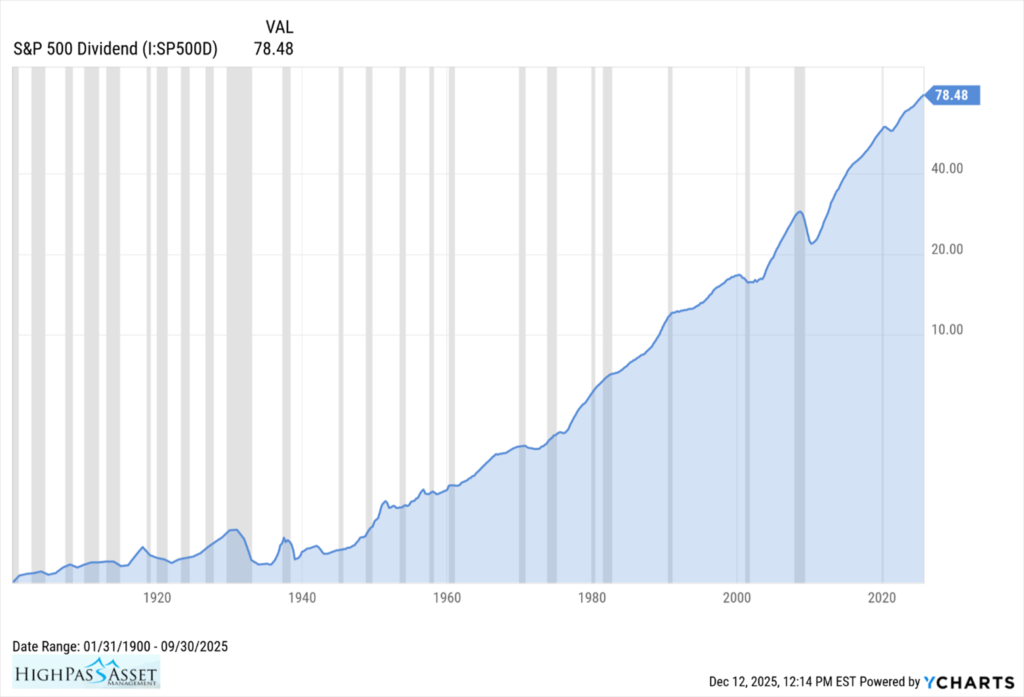

Since 1900, the S&P 500 and it’s predecessor index have compounded the dividend at 5%. Stock market dividends are an excellent source of inflation protection for your income stream.

PRO – Lower Taxes

Stock market dividends are taxed as qualified dividends. Qualified dividends are taxed at 0% for incomes up to $96,700 for married filing joint, 15% for incomes between $96,701 – $600,050 for married filing joint and 20% for married filing joint couples with income over $600,050. Paying qualified dividend tax rates vs paying income tax rates can save you a lot of money in retirement.

PRO – Predictable Income

Dividends are associated with stable, mature companies who are making a profit. Responsible management of dividend paying companies aim to pay dividends at a sustainable level so there is no interruption in the dividend payment. While dividend cuts do happen, a diversified portfolio of dividend paying stocks or a large index like the S&P 500 reduces the risk that an investor would see a drop in income from a dividend cut.

PRO – Low Volatility of Your Income Stream

The dividend for the S&P 500 tends to go up most years and has only come under significant pressure twice in the last century; the Great Depression of the 1930s and the Great Recession of 2008. Outside of these two events, the dividend has been stable and growing.

PRO – Growth of your Nest Egg in Retirement

A dividend-focused retirement income plan allows you to invest all your retirement portfolio in the stock market. Over long periods of time, the stock market has historically provided more growth than balanced portfolios, bonds, commodities and real estate. A standard retirement is 25 – 30 years which gives you plenty of time to keep growing your wealth with the long-term potential of stock market returns.

PRO – Stepped-Up Basis

Unlike non-qualified annuities and IRA accounts where your beneficiaries will inherit a tax bill, a dividend portfolio held in an after-tax brokerage account will qualify for stepped-up cost basis when you pass your wealth on to your beneficiaries. Stepped-up basis means your beneficiaries will inherit your wealth tax-free.

PRO – Buy and Hold

Dividend focused retirement strategies are buy and hold strategies. Many studies have shown that investors who use buy and hold strategies, especially when used with indexes, tend to have better performance.

PRO – Avoids Market Timing Errors

Market timing errors in retirement, like making the wrong rebalancing trades at a market high or market low, can wipe out five or even ten years of returns in the blink of an eye. Because the dividend focused retirement plan is mostly a buy and hold strategy with low turnover, market timing errors are avoided.

CON – Higher Volatility

Retirees using an all-equity, dividend focused retirement portfolio can expect significantly more volatility than if they were investing in bonds, balanced portfolios, annuities or real estate. For investors who fear seeing their portfolio value decline in retirement, especially by a large amount, the higher volatility that comes with the dividend focused retirement portfolio is a serious turn-off.

CON – More Capital is Needed

When compared to other retirement strategies like the 4% rule , spending 5% fixed with no inflation, and income annuities, the retiring on dividends strategy will require you to save more money for retirement. Not all retirees will be capable of building a large enough nest egg to retire exclusively on dividends.

Ethan S. Braid, CFA

President

HighPass Asset Management

Denver, Colorado

This article is for education and illustrative purposes and is not tax, legal or financial advice. Your broker or advisor will charge you fees or commissions to make investments and therefore your returns will be less than indexes. For example, if you invest in the S&P 500 ETF, SPY, you will pay a fee to the company managing the ETF, State Street Global Advisors. Your return on the S&P 500 ETF, SPY, will be less than the SS&P 500 Index TR because of the fee paid to State Street Global Advisors. Additionally, you may pay a fee or a commission to your broker or financial advisor, further reducing your return, below the index. Consult your advisor or broker for a detailed list of their fees or commissions before you invest. Investing involves risk and you can lose money.