Vanguard BETR Roth Conversion Calculator Default Options

The default options for the Vanguard BETR Roth Conversion calculator are set up in a way that will show almost anyone a favorable result for Roth conversion. The default option that you should be most critical of is how you pay the conversion tax. The calculator is set to a default selection of using cash outside your IRA to pay for conversion taxes. The other default selections you want to pay attention to are the period of twenty years until your first distribution, the 6% return on IRAs and the pre-tax yield of 2% on cash.

Too Much Hype

There are certified financial planners touting the way Vanguard BETR Roth conversion calculator frames the Roth conversion decision as the new rule of Roth conversion. There isn’t anything new here. I think these CFPs are either weak in mathematics, or they are selling the sizzle with no steak. Later in this article I will go over a spreadsheet example to show you the math behind the calculator so you can see for yourself why the default options for the calculator could be misleading.

Vanguard Promotes Tax-Efficient Investing

If you are a Vanguard investor then you are probably using their tax-efficient strategies which include indexing, ETFs and tax-managed funds. Vanguard promotes tax-efficient investing and they were the pioneers of indexing. Don’t you find it ironic that they would build a calculator that has the default option set for paying an investor’s highest assigned tax bracket plus state tax if applicable on the lowest performing asset, i.e. cash?

The Irony

If the default option in the Vanguard BETR Roth conversion calculator for paying the conversion tax was tax-efficient taxable account or IRA meaning you paid the conversion tax from inside your IRA account then for many investors the Vanguard BETR Roth conversion calculation would not be nearly as attractive and in many cases would show that you are better off sticking with your pre-tax standard IRA. For investors in a high income tax bracket now but who plan to be in a lower income tax bracket in retirement, the Vanguard BETR Roth conversion calculation generally falls apart when you select tax-efficient taxable account or IRA for paying the conversion tax.

The Truth

If you are in a high tax bracket now and plan to be in a lower tax bracket in retirement, there is no way around the likelihood that you might be hurting yourself financially by performing Roth conversion. I know that is not what you want to hear, but it’s the truth.

The Calculator Can be Useful, But…

I do think the Vanguard BETR Roth conversion calculator can be a useful tool. In an indirect way, this calculator shows you that leaving cash sitting around for twenty years or investing in a tax-inefficient manner for twenty years, can cost you a lot of money. The Vanguard BETR Roth conversion calculation starts to look good when you make these poor investment decisions.

How the Vanguard BETR Roth Conversion Calculator Thinks

The calculator is comparing alternatives to show you the end results. When you select cash for paying the conversion taxes, the calculator assumes that your alternative to Roth conversion is to leave the funds you would have used for the conversion taxes, in cash for the default period of twenty years. In my opinion, that is not reality. Most investors would invest those extra funds and if they listen to Vanguard, they would do it in a tax-efficient way. Using the default option of cash for paying the conversion tax is showing you a future ending scenario that is probably not going to occur. When you use the Vanguard BETR Roth conversion calculator, make sure you investigate all four options for paying the conversion tax so you can see a fair and accurate assessment of your situation.

Example – A Good Vanguard BETR Roth Calculation but Not Realistic

For an investor who is in the 35% tax bracket while they are working who plans to be in the 22% tax bracket in retirement and who uses the default option of “cash” to pay for the conversion tax, this investor is likely to see a Vanguard BETR Roth calculation that shows Roth conversion providing them with more money in the long run. But the extra funds they supposedly end up with are due to the poor after-tax performance of the money left in cash for twenty years. The delta between the low return on the after-tax cash and the higher return on the Roth IRA leads to a performance gap in favor of Roth conversion.

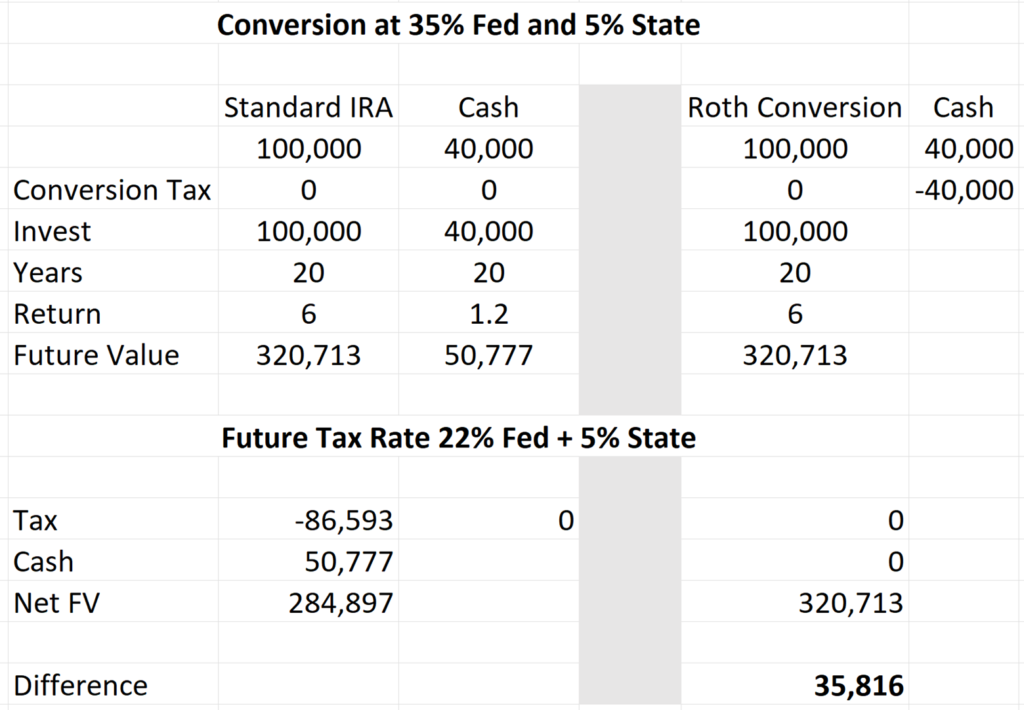

The spreadsheet example below demonstrates how the Vanguard BETR Roth conversion calculator changes the faming for Roth conversion for an investor who is in the 35% Federal tax bracket now but will be in the 22% Federal tax bracket in retirement. This framing is considered the “new way” of analyzing Roth conversion. I manually calculated the numbers in the spreadsheet below. If you enter my numbers into the Vanguard BETR Roth conversion calculator, you will get the same results. For this illustration, I have used the Vanguard BETR Roth conversion calculator’s default numbers of a twenty year period until the first distribution, a 6% return on IRA investments and a 2% pre-tax yield on cash. The conversion amount is $100,000. Note: the return on cash in the spreadsheet below shows 1.2% which is the net-of-tax yield for this investor based upon their tax bracket. This is equivalent to the default pre-tax cash yield of 2% found in the Vanguard BETR Roth conversion calculator.

Roth conversion supposedly puts this investor ahead by $35,816. The entire calculation is hinged upon the investor keeping $40,000 in cash at a very low return rate for twenty years. I do not believe that is realistic. Most investors will choose to invest their excess cash holdings vs leaving it sit for twenty years earning less than inflation. This is where the Vanguard BETR Roth conversion calculator can be misleading in my opinion. For the Vanguard BETR Roth conversion calculation to become real, the investor has to make ongoing poor investment decisions, like keeping a lot of money in cash for twenty years.

The “Old Way” Still Works

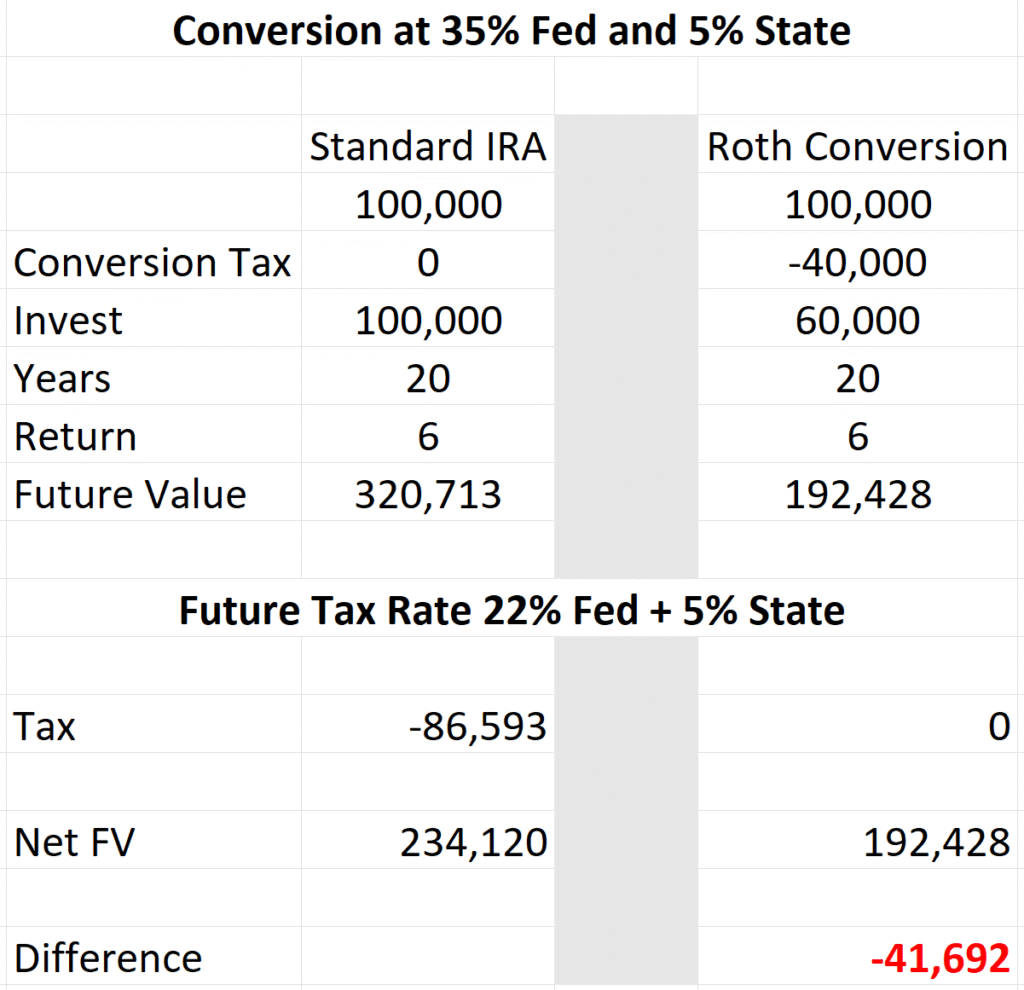

For the same investor as our previous example, I have calculated how Roth conversion might turn out if this person used their IRA to pay for the conversion taxes. This method is the “old way” of analyzing Roth conversion. If you enter my numbers below into the Vanguard BETR Roth conversion calculator, you will get the same results. Be sure to select “IRA” to pay for the conversion taxes.

The “old way” of analyzing Roth conversion shows this investor would be $41,692 behind in the long run by performing Roth Conversion.

Choosing Tax-Efficient Account to Pay the Conversion Tax

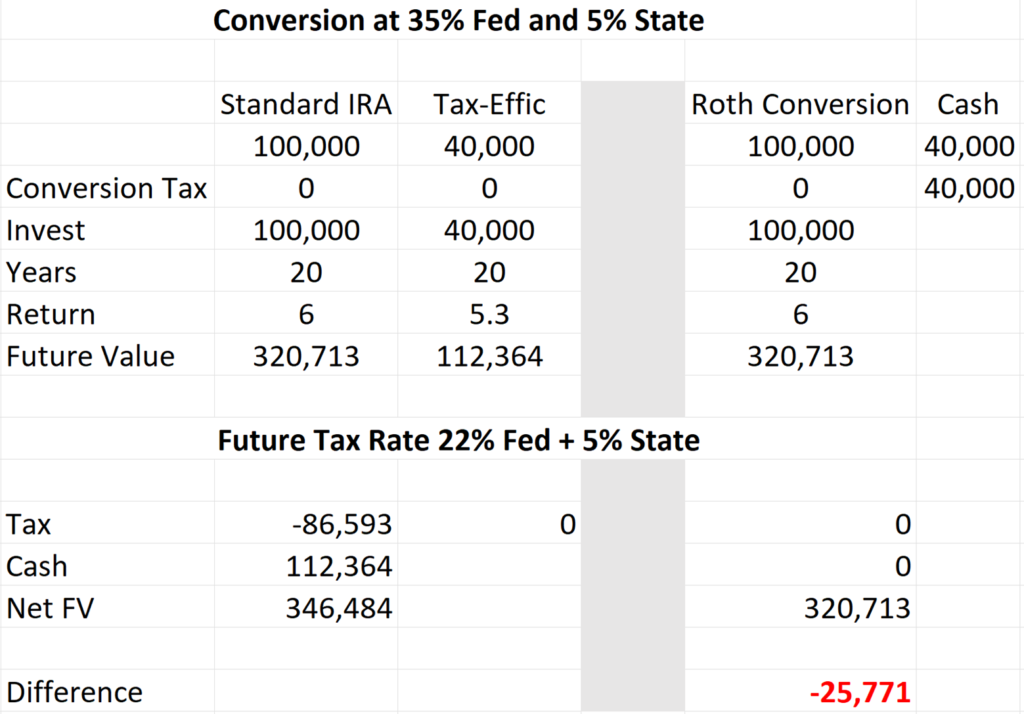

Most investors with investments outside their IRA will aim to maximize their after-tax return. The example below is for the same investor as the previous example but we have made one important change; instead of holding cash for twenty years they are investing in a tax-efficient taxable account with a 5.3% net-of-tax annual return.

When changing the conversion tax payment source to a tax-efficient taxable account at a 5.3% net-of-tax annual return, Roth conversion now costs the investor $25,771.

Summary

The Vanguard BETR Roth conversion calculator is a useful but complicated tool. The defaults are set up in a way that will show most investors are going to benefit from Roth conversion, but that might not be reality. Investors in high tax brackets should proceed with caution and be sure to analyze many different scenarios when using the Vanguard BETR Roth conversion calculator.

Ethan S. Braid, CFA

President

HighPass Asset Management

Denver, Colorado

This article is for education and illustrative purposes and is not tax, legal or financial advice. Your broker or advisor will charge you fees or commissions to make investments and therefore your returns will be less than indexes. For example, if you invest in the S&P 500 ETF, SPY, you will pay a fee to the company managing the ETF, State Street Global Advisors. Your return on the S&P 500 ETF, SPY, will be less than the SS&P 500 Index TR because of the fee paid to State Street Global Advisors. Additionally, you may pay a fee or a commission to your broker or financial advisor, further reducing your return, below the index. Consult your advisor or broker for a detailed list of their fees or commissions before you invest. Investing involves risk and you can lose money.