Blog

Why Estate Planning Attorneys Lie About Probate Court Being Easy

In a recent meeting with a wealthy family they told me their estate planning attorney recommended not even using their trust and allowing their $10 million dollar estate to pass through probate court when their kids inherit the family wealth. This lawyer told the...

Vanguard BETR Roth Conversion – Its Rigged

Vanguard BETR Roth Conversion Calculator Default Options The default options for the Vanguard BETR Roth Conversion calculator are set up in a way that will show almost anyone a favorable result for Roth conversion. The default option that you should be most critical...

Retire in Denver. What you Need to Know! Pros vs Cons.

Retire in Denver and you can have an amazing retirement, but Denver does have its challenges. I am going to review the pros and cons of Denver as a retirement city on twelve different factors. For each factor, I am going to give it a grade of Excellent, Good, Bad or...

Trust Planning – 80% of People Make This Mistake

The most common trust planning mistake wealthy families make is failing to fund their trust. Trust Planning Mistake I have met with 100s of wealthy families in my 25+ years in wealth management. My experience is that 8 out of 10 wealthy families do not fund their...

Schwab SWVXX Costs .34%. Sell it and Buy T-Bills or SGOV.

Investors in Schwab prime advantage money fund SWVXX need to know they have better alternatives for large cash holdings. SWVXX is Expensive. The fund costs .34% per year. That is a hefty fee for a low-risk money market investment. SWVXX has Underperformed SWVXX has...

60/40 Asset Allocation Retirement. Pros & Cons for Retirees.

The 60/40 equity-to-fixed-income asset allocation retirement portfolio is a great asset allocation strategy used by many retirees. Contrary to what some people think, this asset allocation strategy is still relevant and a perfect investment plan for some retirees....

Retirement Planning with Zero Coupon Municipal Bonds

Zero coupon municipal bonds are an excellent investment for retirement planning. Investors in high tax brackets can purchase zero coupon municipal bonds, to lock in great yields and predictable future cash flows. Zero coupon municipal bonds are simple, you buy them at...

Trustee Duties and Time Required

What is it really like to be a trustee? How much time will it take? What are my trustee duties and legal requirements? I have been in wealth management for over 25 years and have helped dozens of families with their trust planning. I have been a trustee myself for...

How 20 Years of Annuity Fees Can Cost $ Millions

What does twenty years of owning a variable annuity do to your ability to accumulate wealth for retirement? I think a lot of investors do not realize just how much a variable annuity can set them back when planning for their retirement. Variable annuities are commonly...

How To Build Your Own 5% Annuity, Without The Fees!

How do you build your own guaranteed cash flow stream, but without the fees of an annuity? Today I am going to show you how to build your own annuity for two different objectives. Method one will be to provide a guaranteed cash flow. Method two will be to provide a...

Retire on Dividends. Pros & Cons Explained.

Retiring on stock market dividends is a great way to retire but this approach is not for everyone. This article will review the pros and cons of retiring on dividends. The PROS are: Inflation protection Lower taxes Predictable Income Low volatility of your income....

Annuities are a Trap. Four Ways the Trap Happens.

Annuities are bad investments designed to hold you hostage for the duration of your life. Annuities are nothing more than a complicated trap that many investors fall victim to. Here are the four most common ways investors get trapped in annuities. Taxes Death Benefits...

Seven Reasons to Never Buy Alternative Investment Limited Partnerships

Alternative investment limited partnerships have never been more popular. I think investors should think twice before committing funds to alternative investment limited partnerships, especially if the investment is being sold by a broker (aka financial advisor). There...

Municipal Bonds. Are They Right for You?

Municipal Bonds, are they right for your portfolio? I am going to show you a process to determine if municipal bonds are a good deal for you. We are going to focus on two areas: Taxable Equivalent Yield Liquidity What Are Muni Bonds? First, let’s quickly go over what...

SGOV vs CDs

SGOV vs CDs, which is a better short-term investment? SGOV beats CDs, easily, in four key areas: Taxes Liquidity Yield Minimums Taxes Both SGOV and CDs are taxed at ordinary income tax rates. The key difference between these investments is that while CDs will be taxed...

All-Equity Retirement Portfolio – How to Win. Downturns, Distributions and Taxes.

The all-equity retirement portfolio strategy can certainly work for some retirees. There are three areas you need to focus on to win with this retirement investment strategy. 1). Downturns. 2). Distributions. 3). Taxes. Downturns The business cycle is real and...

Leveraged Loans aka Bank Loans – A Guide For Investors

Leverage loans also known as bank loans, offer investors a great opportunity for above average interest rates. This guide will introduce you to leveraged loans and give you an overview of important factors that must be considered when investing in leveraged loans....

SGOV Price Guide – How it Works and What to Expect

SGOV is a great alternative to traditional money market mutual funds like Fidelity SPAXX or Schwab SWVXX. If you are new to investing in an ETF like SGOV, you may be caught off guard by the price movement of the shares. SGOV uses the fair market value of the...

Money Market Accounts vs Money Market Mutual Funds

Money Market Accounts A money market account is a deposit account offered by a bank or credit union. Money market accounts are savings accounts that generally pay a higher rate of interest than traditional checking or savings accounts. Banks and credit unions that...

Three Retirement Planning Goals for Age 65

Retirement planning can be overwhelming. To simplify your retirement plan and increase your odds of success, break your retirement plan down into the following three goals: portfolio, housing, and estate plan. Instead of getting lost in a complicated software program,...

Fidelity 1099, What You Need to Know – Do Not Miss State Tax Deductions!

If you have a taxable brokerage account with Fidelity, the 1099 you receive will not show what percentage of your ETF and mutual fund dividends came from U.S. government securities. Fidelity 1099 reporting only shows the total amount of your dividends received from...

How To Talk to Your Kids About Trusts

You have done well in life and have a lot of assets. In your estate plan, you created trusts for your kids, but you are not sure how to talk about it with them. Do not worry, you are not alone. Many wealthy families avoid discussing trusts with their kids because they...

Fidelity SPAXX. Dump This Expensive Fund and Buy T-Bills or SGOV Instead

Fidelity government money market SPAXX is widely used by investors with $400 billion in the fund. I have often wondered how many of these investors realize they are paying .42% per year in invisible fees? High Fees High Taxes The problem with SPAXX is not just limited...

FDRXX vs SGOV. Why SGOV is Better For Short-Term Investors.

Investors looking for alternatives to Fidelity Government Cash Reserves fund, FDRXX should consider i-shares SGOV etf. SGOV may provide a better return, especially for taxable accounts. In this article we will compare FDRXX to SGOV to demonstrate why SGOV is the...

Spousal Lifetime Access Trust (SLAT) – Major Update You Need to Make to Your Financial Plan

A spousal lifetime access trust (SLAT) is an effective tool for saving money on estate taxes. When a SLAT trust is created, one spouse is the trust grantor, and the other is the beneficiary. The grantor spouse gifts assets to the irrevocable SLAT trust and files a...

Pour-Over Will with Testamentary Trust – Never Use One as Your Primary Estate Plan

A pour-over will with a testamentary trust should never be used as your primary estate planning document. A pour-over will is an estate planning tool that directs your assets to be put into your trust after you die. You can use a pour-over will to fund a testamentary...

T-Bills vs Money Market. Which is Better?

T-Bills and money markets are both popular choices for investors looking to earn interest from their cash. T-Bills are simple and straightforward. T-Bill interest is state tax exempt. Money markets are more complicated. Money markets come in two forms, money market...

Choosing a Successor Trustee

Have you been managing the family wealth yourself for a long time and your spouse is either not interested or not capable of managing the investments if you are gone? Do you fear that your spouse might be taken advantage of by an unscrupulous financial salesperson?...

Recession & Stock Crash Obvious Warning Signs

Recently stocks, particularly the Magnificent Seven stocks, have fallen off a cliff. A recession looks likely at this point. At HighPass,we have been warning investors since 2024 to update their risk tolerance, shift their portfolio away from tech stocks and over to...

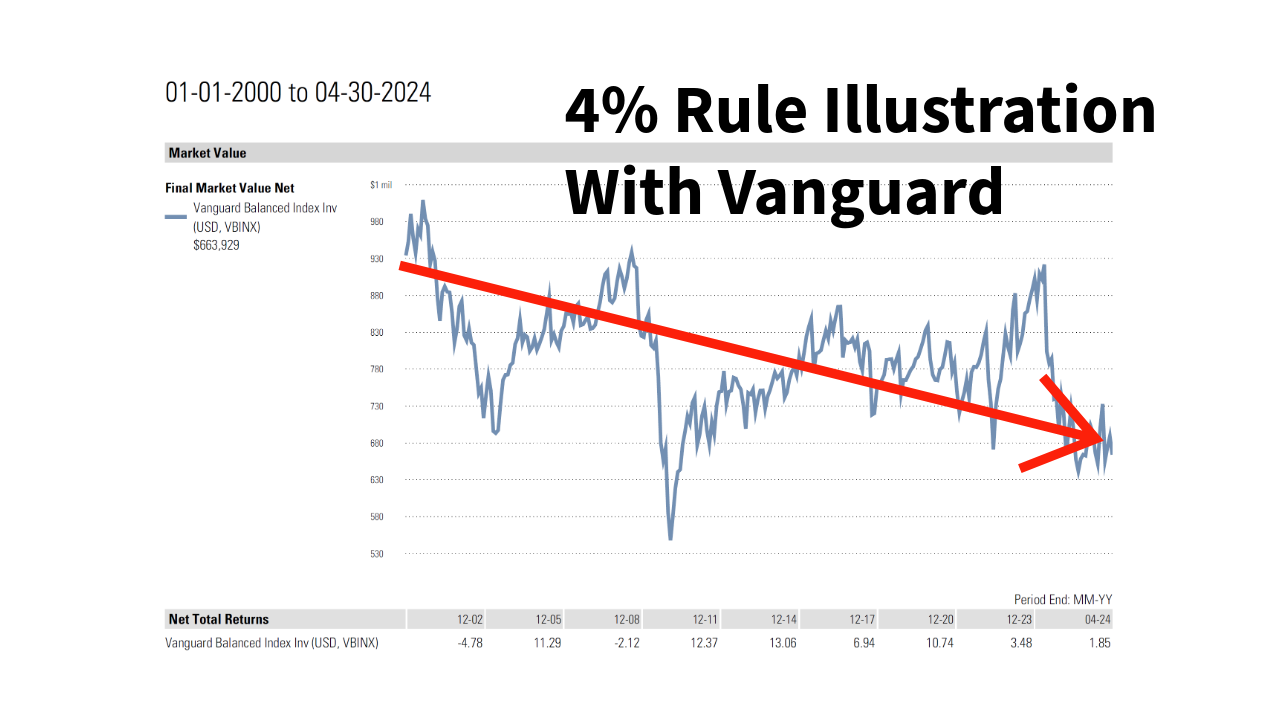

4% Rule with Vanguard Balanced Index Fund – 25 Year Illustration

How reliable is the 4% rule when using a 60/40 equity/fixed balanced investment strategy? Will you run out of money if you have bad timing and retire right before a recession? How will sequence of negative returns affect your retirement plan? To answer these questions...

4% Rule Using SPY – All Equity Retirement

Like what I saw in the year 2000, many investors are now touting the benefits of an all-equity retirement portfolio. I thought it would be fun to see how a hypothetical $2 million retirement portfolio would have performed using the 4% rule for retirement distributions...

Plan For Four Recessions During Retirement

Retirees should plan to encounter four recessions during a typical 25-to-30-year retirement. According to Fed Chair Jerome Powell during his March 19th, 2025, press conference, the unconditional probability of a recession is in the range of 1 in 4 at any time. Another...

Mistakes You Can Easily Make With Retirement Planning Software

Most people planning for their retirement will utilize software to develop their retirement plan. They might use a free retirement planning tool they find on the internet or hire a financial planner who uses software to develop their retirement plan. In either case,...

Nine Reasons to Never Buy Annuities

Annuities are among the worst investments an investor can make for their retirement. In this article, we will explore nine reasons why you should never buy an annuity. All Gains are Taxed as Ordinary Income Annuities do not qualify for favorable tax treatment in the...

The Year You Retire Matters More Than You Realize!

Retirement timing matters. The year you retire can make or break your retirement plan. Will you retire at a good time or a bad time? You cannot really know if you have bad timing until after the fact. If you retire at a bad time, right before a recession and crash in...

How to Build a Common Sense Retirement Plan

Most retirement planning is done with complicated software. Unless the user is highly trained both on the software and with math and investments, mistakes frequently occur and go unnoticed. Making a mistake when building a software-based financial plan is extremely...

Tax Planning for Investors and Business Owners -Three Simple Steps

If you own a business or are an active investor, tax planning can help you eliminate surprise tax bills. Over the last 25 years I have met dozens of investors and business owners who tell me stories of large, unexpected tax bills. The story is always the same, the...

All Equity Retirement Portfolio. A Critique of Beyond The Status Quo Research Paper

The recent research paper, Beyond The Status Quo: A Critical Assessment of Lifecycle Investment Advice, has created a lot of buzz since the paper was published. The authors advise an optimal retirement portfolio that is 100% equities with 33% in domestic stocks and...

Fidelity Government Money Market FDRXX You are Paying Too Much in State Tax!

Investors have invested over $230 billion in the Fidelity Government Cash Reserves Fund, FDRXX. Many of them end up paying state income tax on a portion of their dividend that should be tax-exempt at the state level. How the Tax Mistake Occurs For after-tax investment...

How Your Fee-Based Financial Advisor Hides Commissions

Fee-Based Financial Advisors, aka dual-registrants, have both a series 7 stockbroker license and a series 65 investment adviser license. Sometimes they have an insurance license too. According to FINRA, approximately 90% of financial advisors are fee-based dual...

Building a Diversified Portfolio – Three Signs Your Plan Will Fail

There is a simple litmus test to determine if you will fail when building a diversified portfolio will fail. Ask yourself the following questions. Do you understand every single investment in your portfolio? Do you know why you own every single investment in your...

T-bills vs CDs Which One is Better?

Investors looking for safety often put their money into certificates of deposit, aka CDs. But many of them would be better off if they purchased T-bills instead of CDs. In this article we will compare T-bills to CDs across three categories; taxes, fees and risk. Taxes...

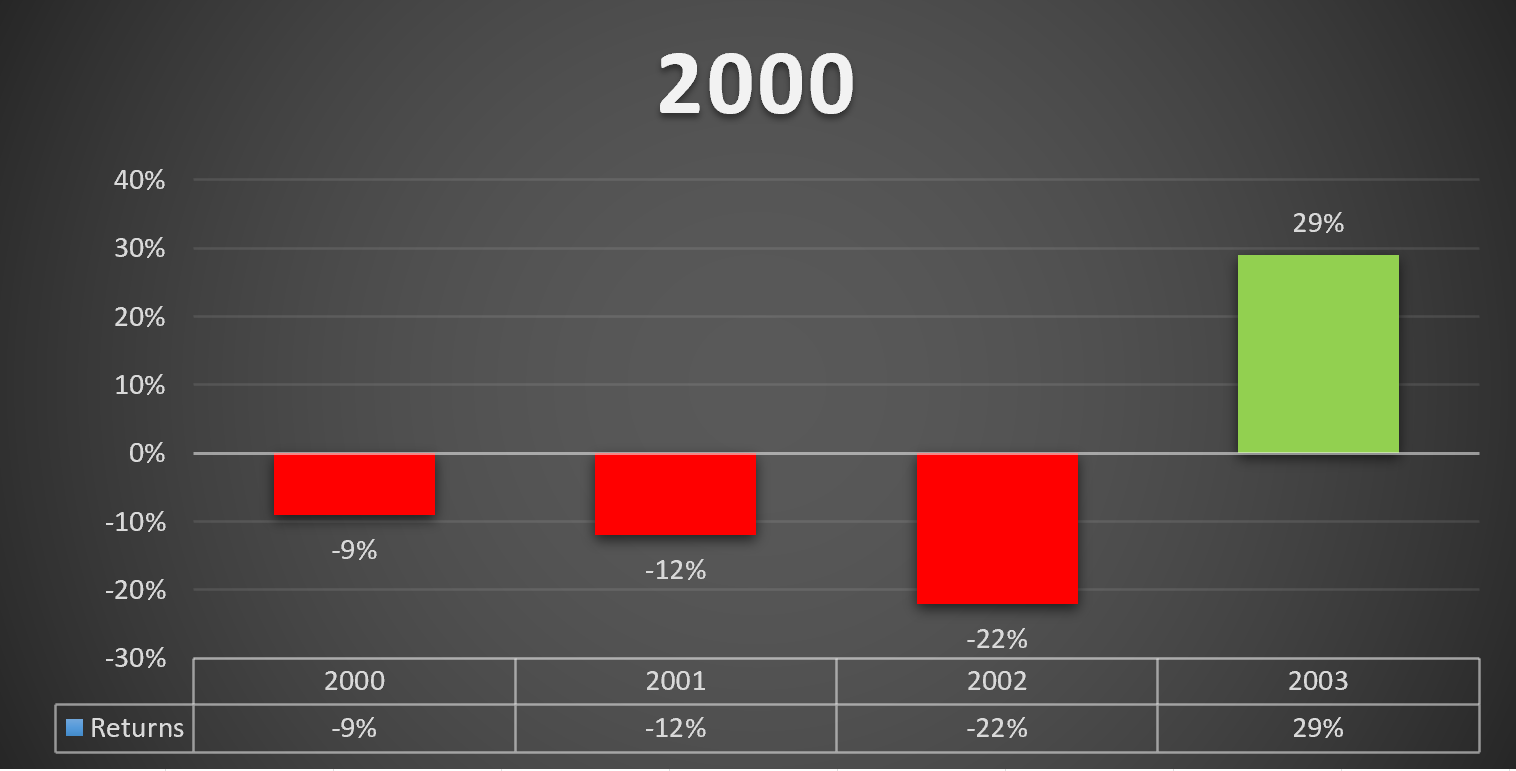

Sequence of Negative Returns Risk is Higher than you Think!

Sequence of negative returns risk is something that many investors fail to consider when planning their retirement or assessing their risk tolerance. Sequence of negative returns risk is the risk that at some point during your retirement, you will experience...

Bear Market Losses. What is the Average Loss in a Bear Market?

The stock market has been in an incredible bull market since 2009. We all hope it keeps going but history shows that secular bull markets eventually end and turn into secular bear markets. There are two types of Bear Markets Secular Bear Markets Short-Term Bear...

Never Buy an Annuity! No Stepped Up Basis. 100% Ordinary Income Tax.

There are many reasons you should never buy an annuity; high fees, limited investment options, and surrender charges to name a few. But the number one reason to never buy annuities with after-tax funds is the tax structure. When you purchase standard investments like...

Asset Allocation Mistakes You Can Avoid

There are many mistakes you can make when selecting an asset allocation strategy for your retirement. In this article we will review two serious mistakes an investor can make with their asset allocation strategy. Selecting an asset allocation that does not match...

Asset Allocation for Retirees

Choosing an asset allocation is a key decision in any retirement plan. With over 25 years of experience as a financial advisor, I have found that many retirees do not know how much they can make or lose with different asset allocations. The focus of this article will...

Asset Allocation Risks You Need to Know Now!

Stocks have been in a bull market for sixteen years. Many investors have forgotten what it is like to experience a recession. The current environment reminds me a lot of the year 2000. By the year 2000, the stock market had been in a bull market for eighteen years....

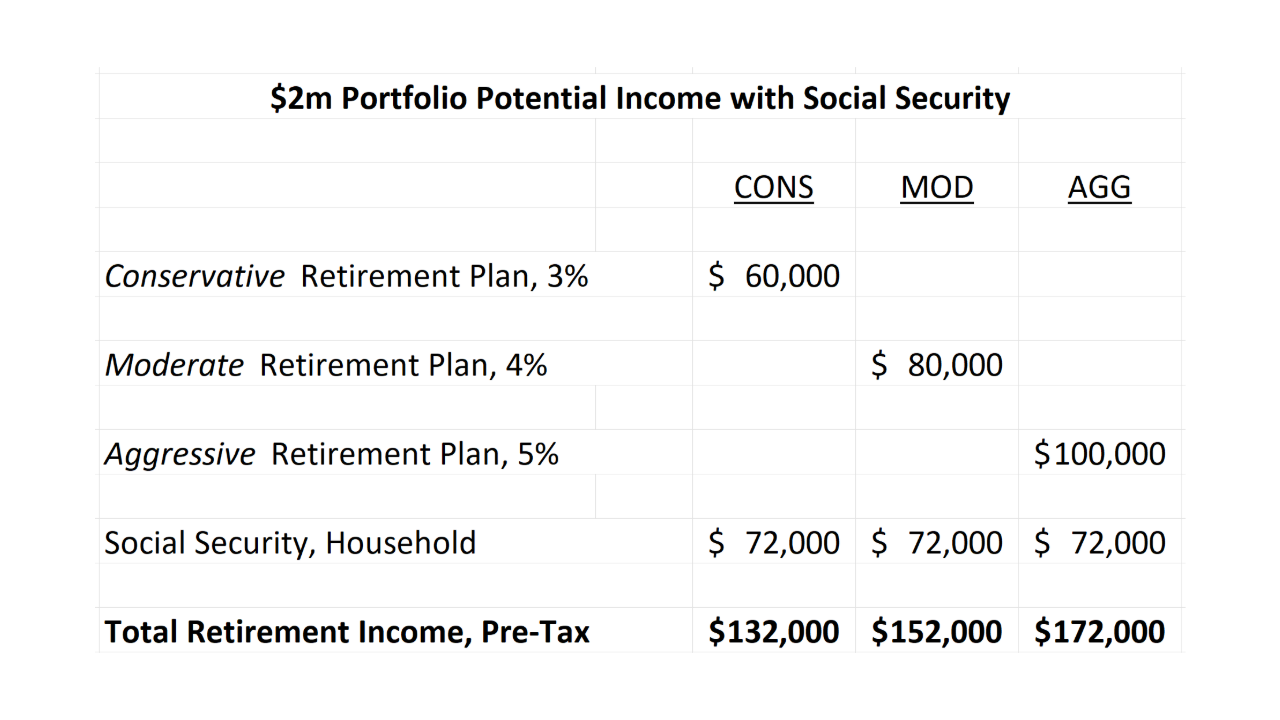

I am 60 with $2 Million Dollars. What Does my Retirement Income Look Like?

Over the last 25 years one of the most common questions I have received from clients is, “how much can I spend and not run out of money?” In my experience, many investors don’t know what a sustainable spending strategy looks like. Today’s article will be focused on...

Is $2 Million Enough to Retire?

Today I'm going to show you a simple way to quickly determine if $2 million is enough for your retirement. I've been a financial advisor for over 25 years and I have built hundreds of retirement plans. What I am about to show you is based upon that experience and that...

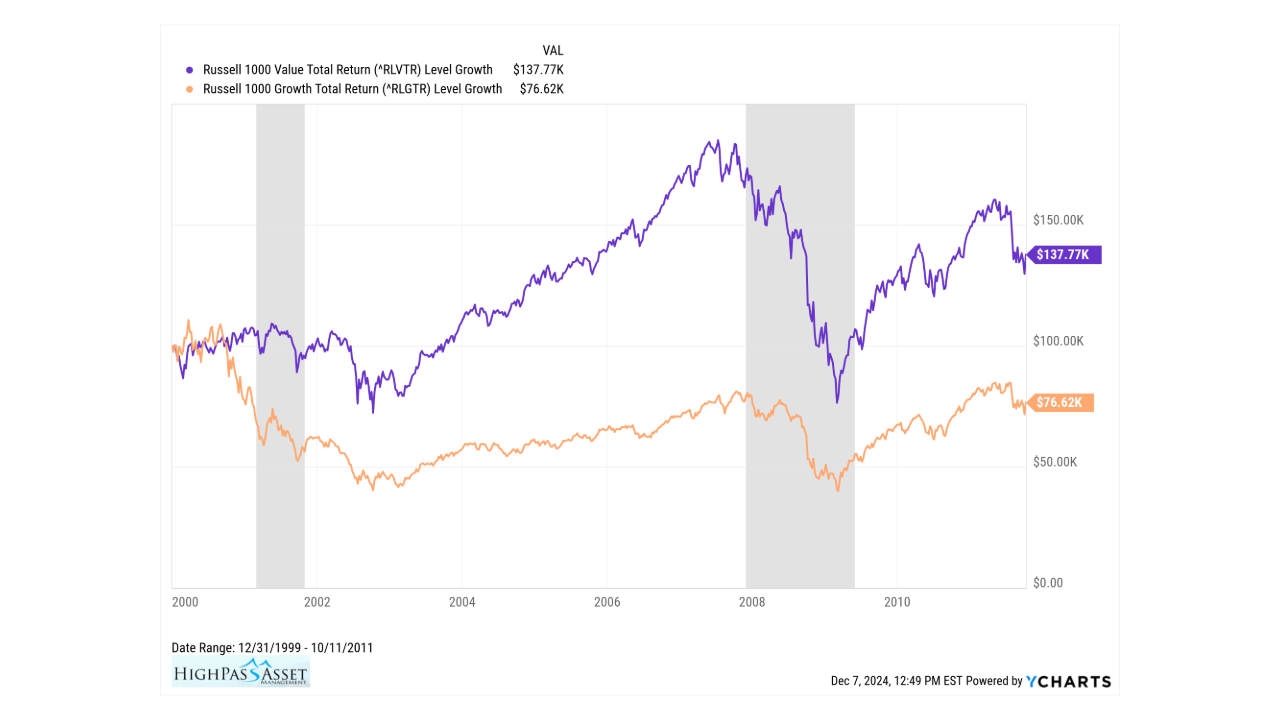

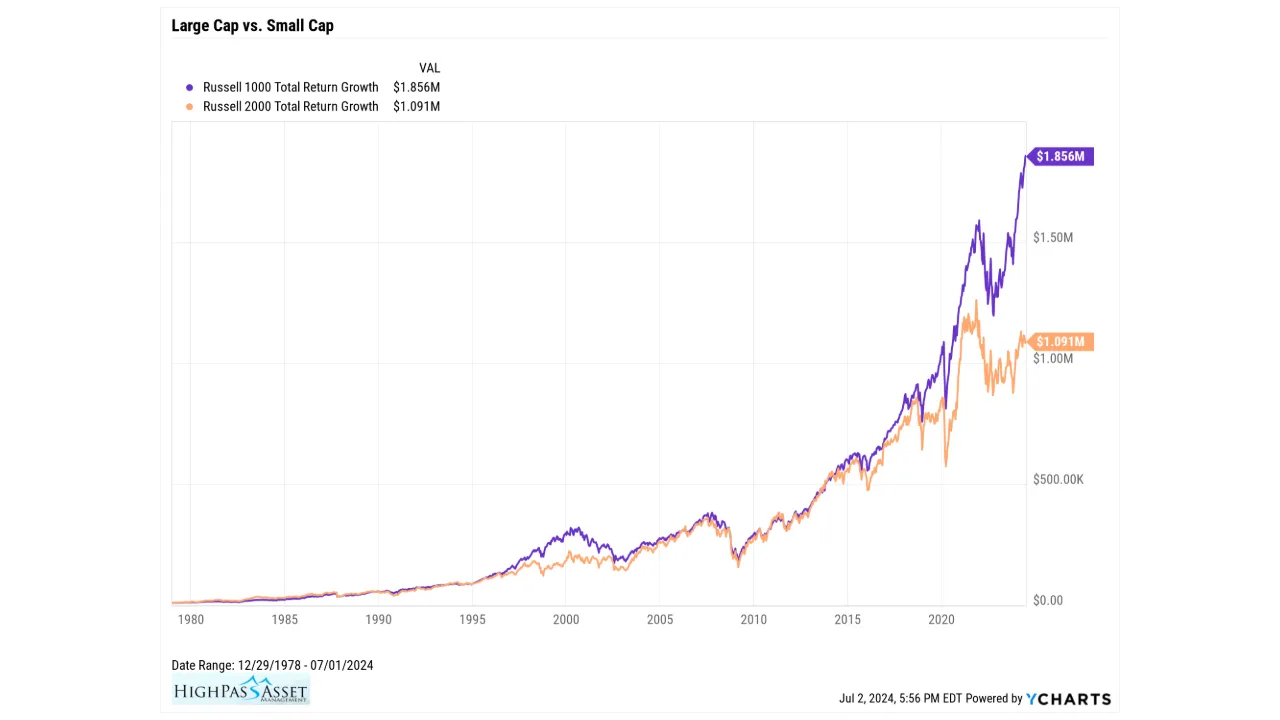

The Party in Mega-Cap Growth Keeps Going!

With half of 2024 in the rear-view mirror, the obsession for mega-cap growth stocks is alive and well. Enthusiasm for a handful of mega-cap stocks has yet to slow down. As investors continue to pile into Apple, Microsoft, Amazon, Nvidia et al, this extremely...

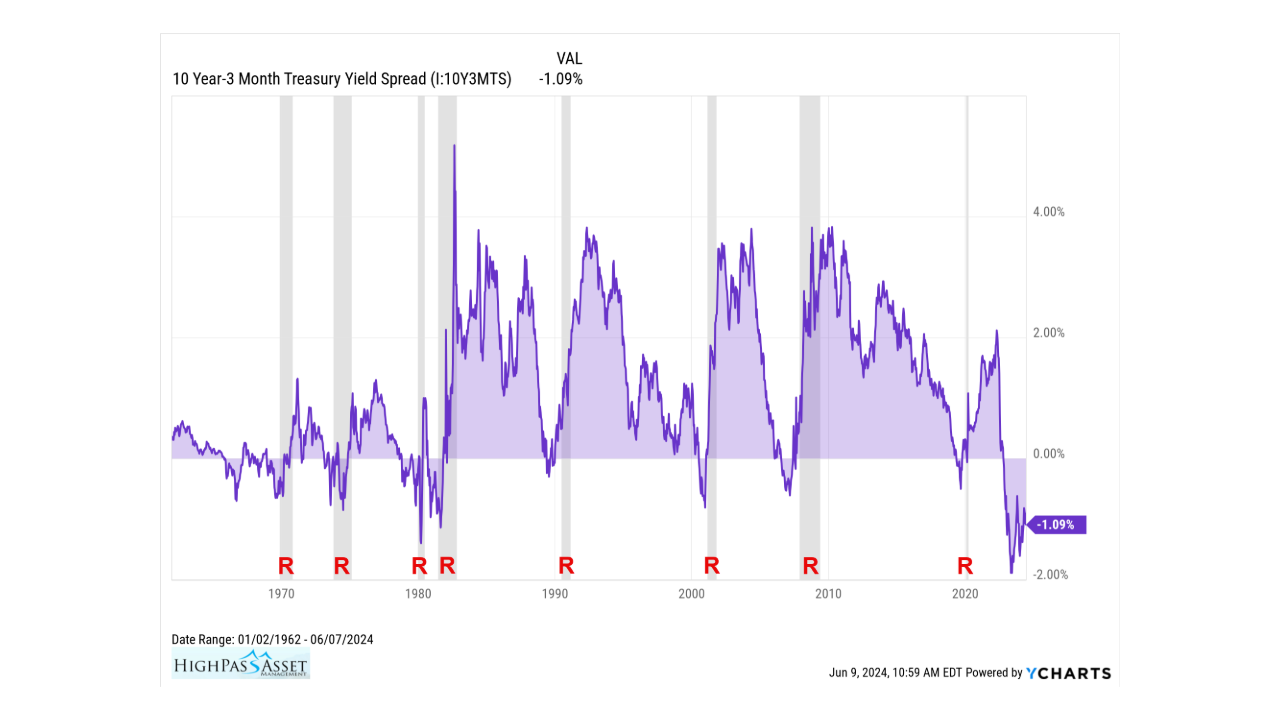

Yield Curve Inversion. Average Time to Recession.

The goal of this article is to help the reader understand yield curve inversion and the significance of yield curve inversion. We will review the last eight inversions so the reader can appreciate the importance of this recessionary indicator. What is Yield Curve...

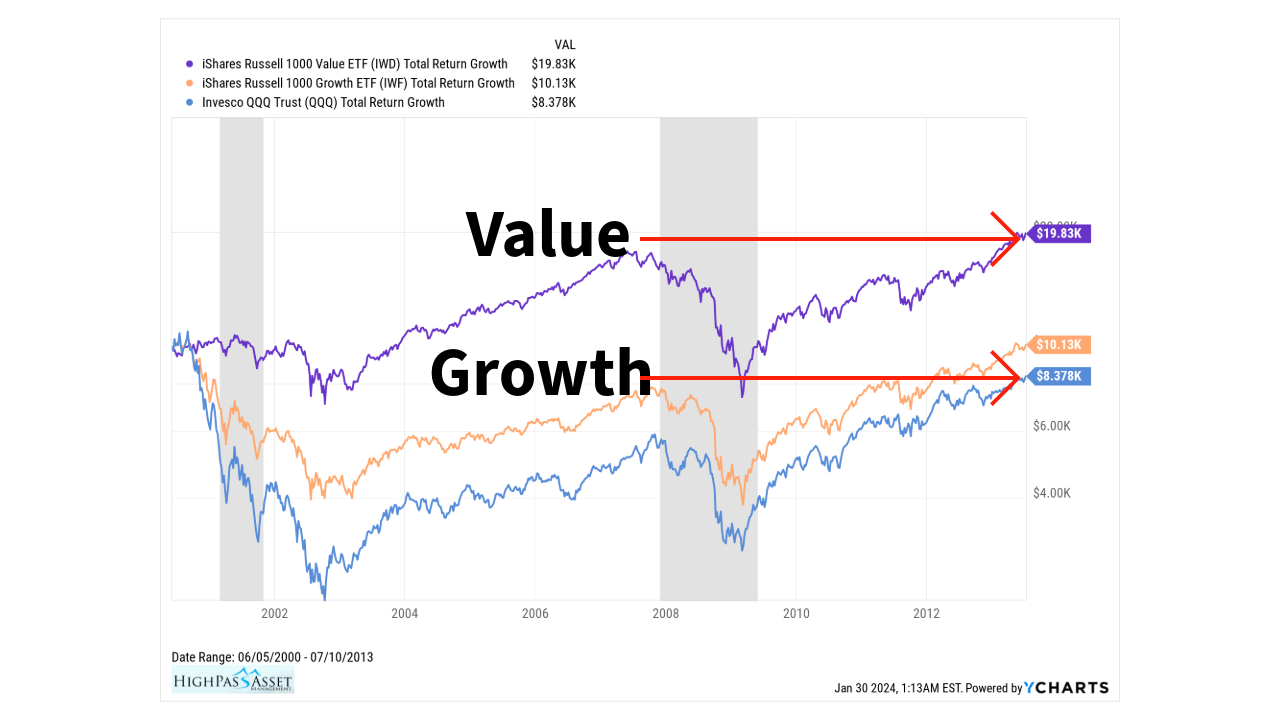

How to Invest in a Recession and Secular Bear Market? Dividends and Value Stocks!

Recessions and bear markets are a normal part of the business cycle. There have been ten recessions in the past seventy years; with a recession occurring about every seven years on average. Bear markets come in two varieties, short term, and secular. Short term bear...

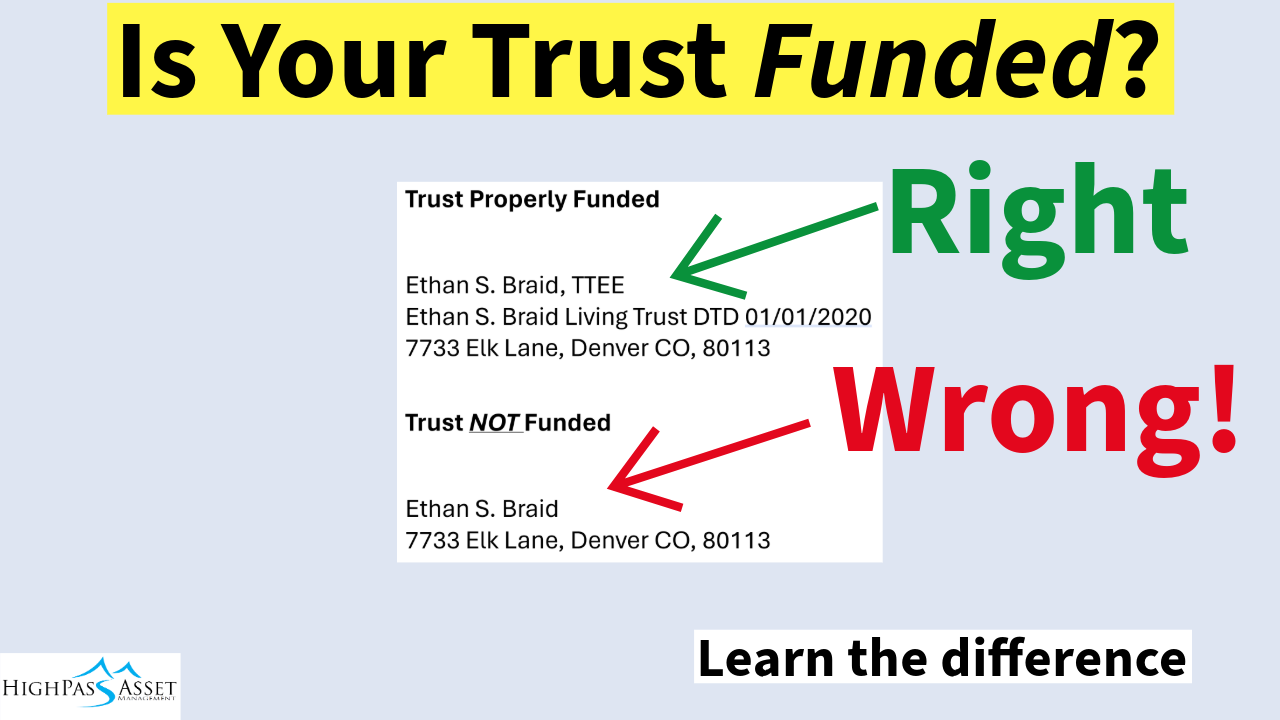

How to Tell if Your Trust is Funded. Fix Your Estate Plan!

Over my career as a financial advisor I have met with over 300 wealthy families to discuss their estate and retirement plan. About 80% of the time, assets that should be in a trust, are not in the trust. Trust funding is one of the most common estate...

How to Fund Your Trust in Three Steps

Over the last 25 years I have advised hundreds of wealthy families with their estate plans. In my experience, around 80% of the time, there will be mistakes with trust funding. The most common mistake is simply not funding the trust. Many wealthy families assume that...

How Long Does $1 Million Last in Retirement?

The number of years a $1 million dollar portfolio will last a person in retirement will depend on the following four factors: Asset Allocation Spending Rate Percentage Investment Selection & Performance Behavior ASSET ALLOCATION Asset allocation is a critical...

Is my Financial Advisor a Fiduciary a Stockbroker or Both?

What is the fiduciary duty and why is that important? The fiduciary duty requires an investment adviser, by law, to act in the best interest of her clients, putting her clients’ interests ahead of her own at all times.[i] Under the fiduciary duty, an investment...

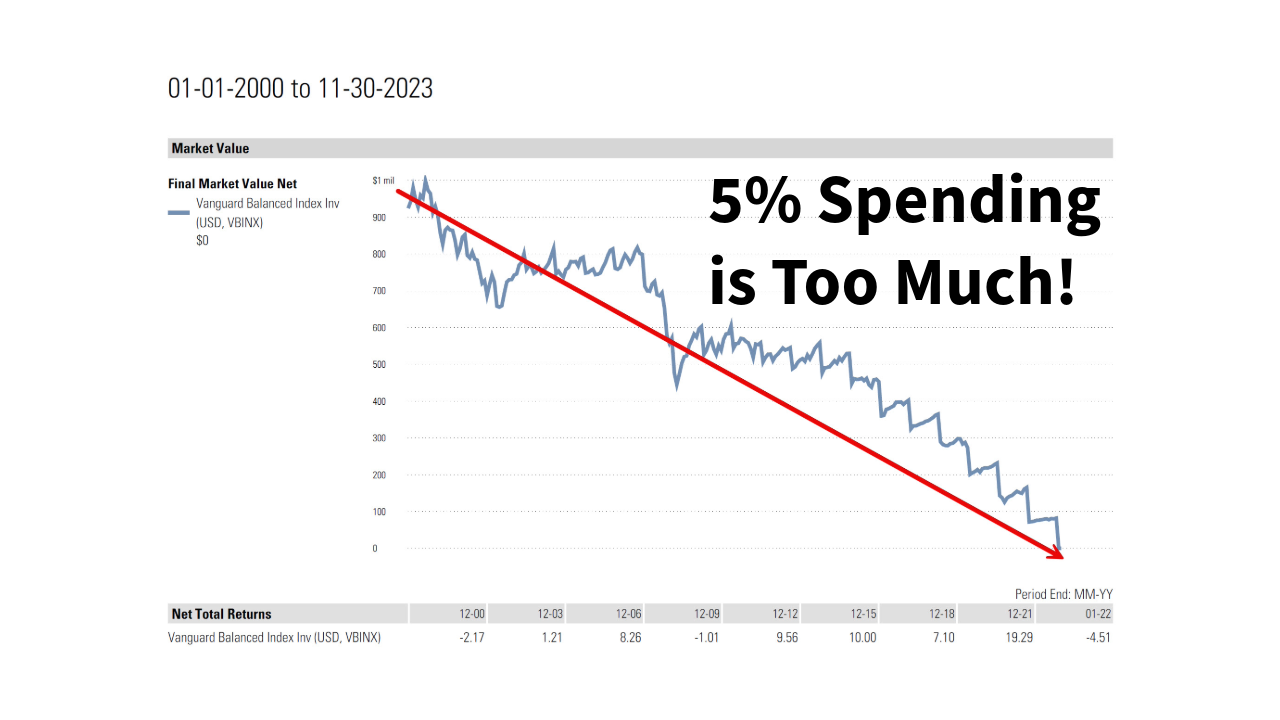

5% Retirement Spending is Too Much!

HOW MUCH CAN I SPEND IN RETIREMENT? This question is one of the most common questions people ask me when working on their retirement plan. I have often had people tell me that they were planning to spend 5% of their portfolio during retirement. For some reason, many...

Common Estate Planning Mistakes

Over the last 25 years I have met with 300+ wealthy families to discuss their financial planning, investments and estate planning concerns. In my experience, 80% of the time, there are issues with an estate plan. Generally, the issues have nothing to do...

The Three Worst Retirement Planning Mistakes

1.) SELLING YOUR PORTFOLIO AT THE BOTTOM OF A BEAR MARKET Over the last 25 years I have seen many, too many, retirement planning mistakes. One of the most serious retirement planning mistakes that you can make is to try to time the market and sell your portfolio at...

Investor Returns vs Unrealized Gain/(Loss) Cost Basis Reporting

Why am I losing money? In my role as an investment adviser, I have the distinct privilege of providing advice to clients who have achieved great success in their respective careers and businesses. Many have degrees from the top universities of the world. ...

4% Rule – Three Important Questions Before You Use It

The inflation adjusted 4% rule is a common retirement spending strategy. To follow the rule, you spend 4% of your portfolio in your first year of retirement and then increase your spending every year thereafter by 3% to account for inflation. To see if...

Does Your Fee-Based Financial Advisor Have Conflicts of Interest?

How Many Financial Advisors Have Conflicts of Interest? Approximately 90% of financial advisors are dual registrants which means they are both financial advisors and stockbrokers. Dual registrant financial advisors often market themselves as “fee-based." Fee-based...

Fee-Only vs Fee-Based Financial Advisors. Don’t Get Ripped Off!

Today we are going to look at the differences between a fee-only vs fee-based advisors.I am writing this article for all of you who are working with someone who tells you they are fee-based and they are probably ripping you off, hiding their commissions, selling you...

How Much Federal Tax Will You Pay on $150k of Retirement Income

Today we're going to look at how much federal tax you pay for $150,000 of retirement income. This is going to be a very helpful tax planning and retirement planning article. For those of you who are trying to get a handle on how much tax you are going to pay at the...