Blog

Asset Allocation Risks You Need to Know Now!

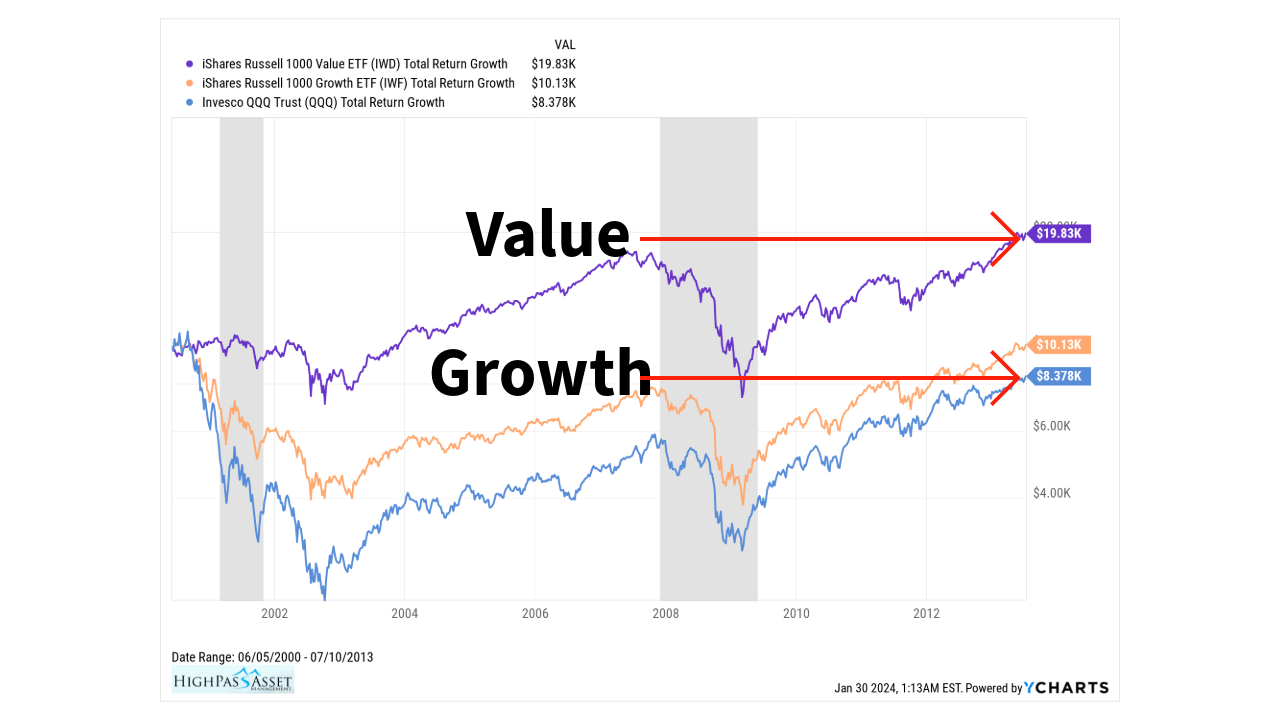

Stocks have been in a bull market for sixteen years. Many investors have forgotten what it is like to experience a recession. The current environment reminds me a lot of the year 2000. By the year 2000 the stock market had been in a bull market for eighteen years....

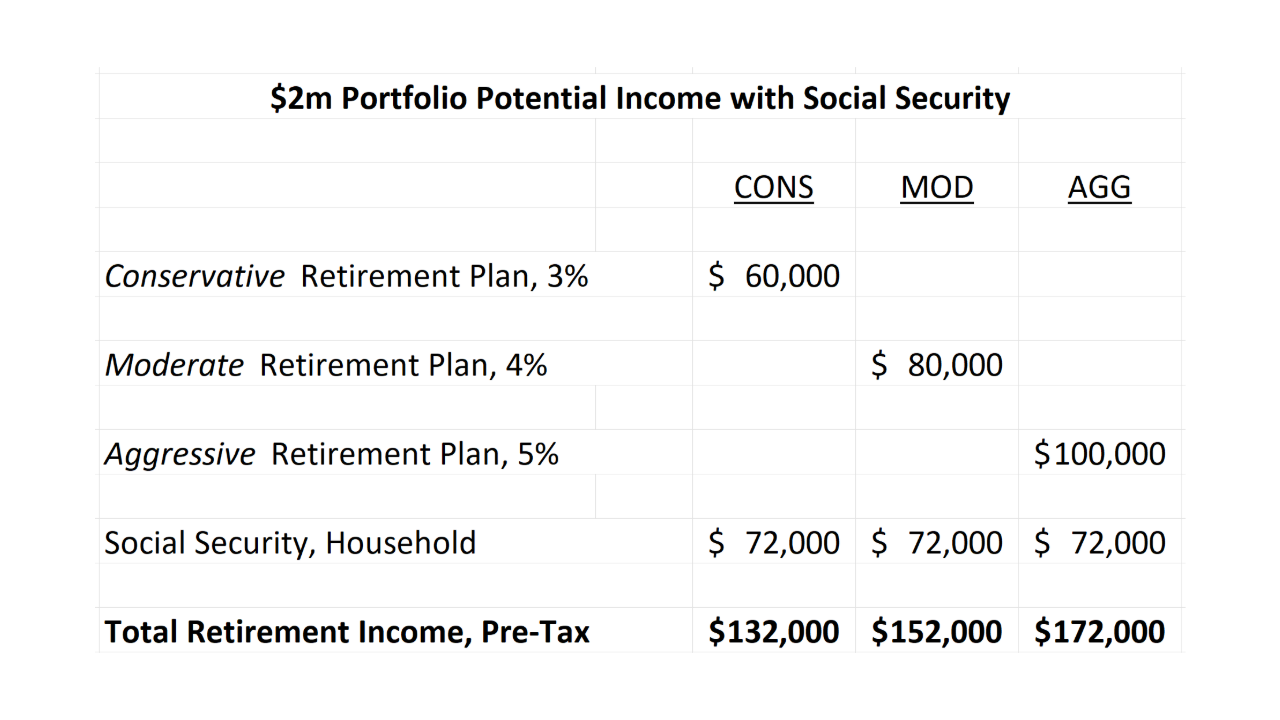

I am 60 with $2 Million Dollars. What Does my Retirement Income Look Like?

Over the last 25 years one of the most common questions I have received from clients is, “how much can I spend and not run out of money?” In my experience, many investors don’t know what a sustainable spending strategy looks like. Today’s article will be focused on...

Is $2 Million Enough to Retire?

Today I'm going to show you a simple way to quickly determine if $2 million is enough for your retirement. I've been a financial advisor for over 25 years and I have built hundreds of retirement plans. What I am about to show you is based upon that experience and that...

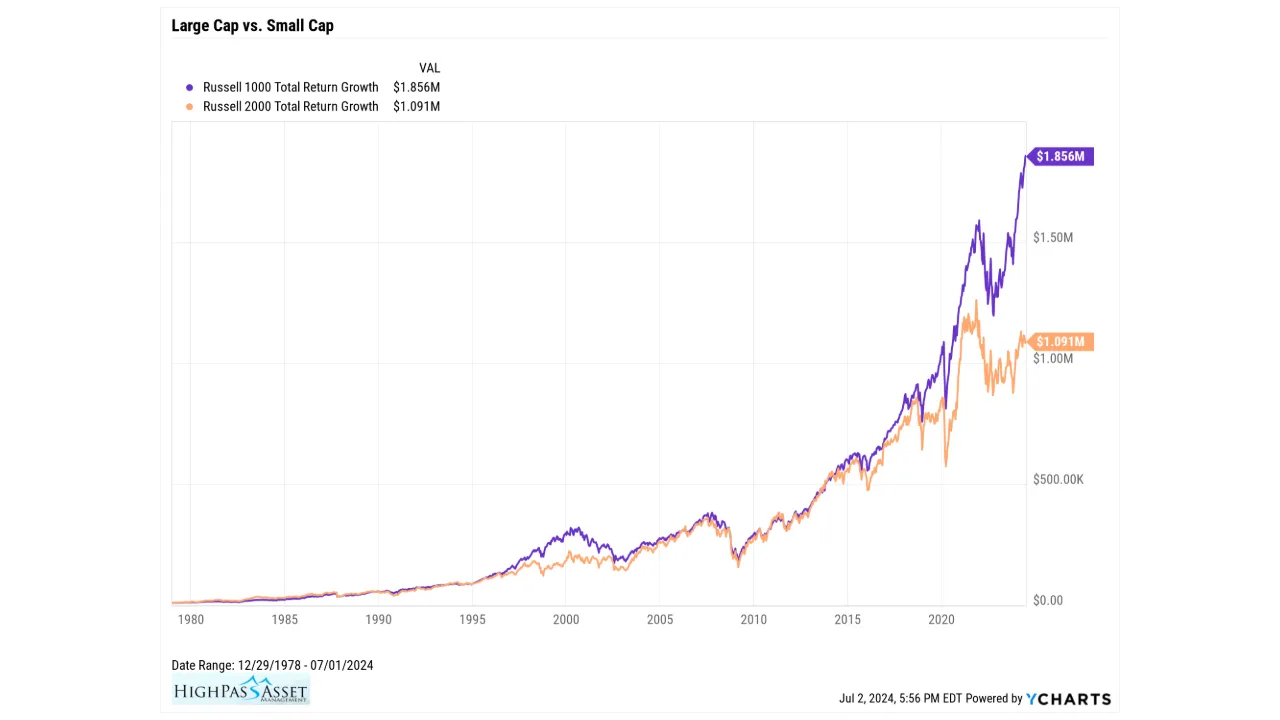

The Party in Mega-Cap Growth Keeps Going!

With half of 2024 in the rear-view mirror, the obsession for mega-cap growth stocks is alive and well. Enthusiasm for a handful of mega-cap stocks has yet to slow down. As investors continue to pile into Apple, Microsoft, Amazon, Nvidia et al, this extremely...

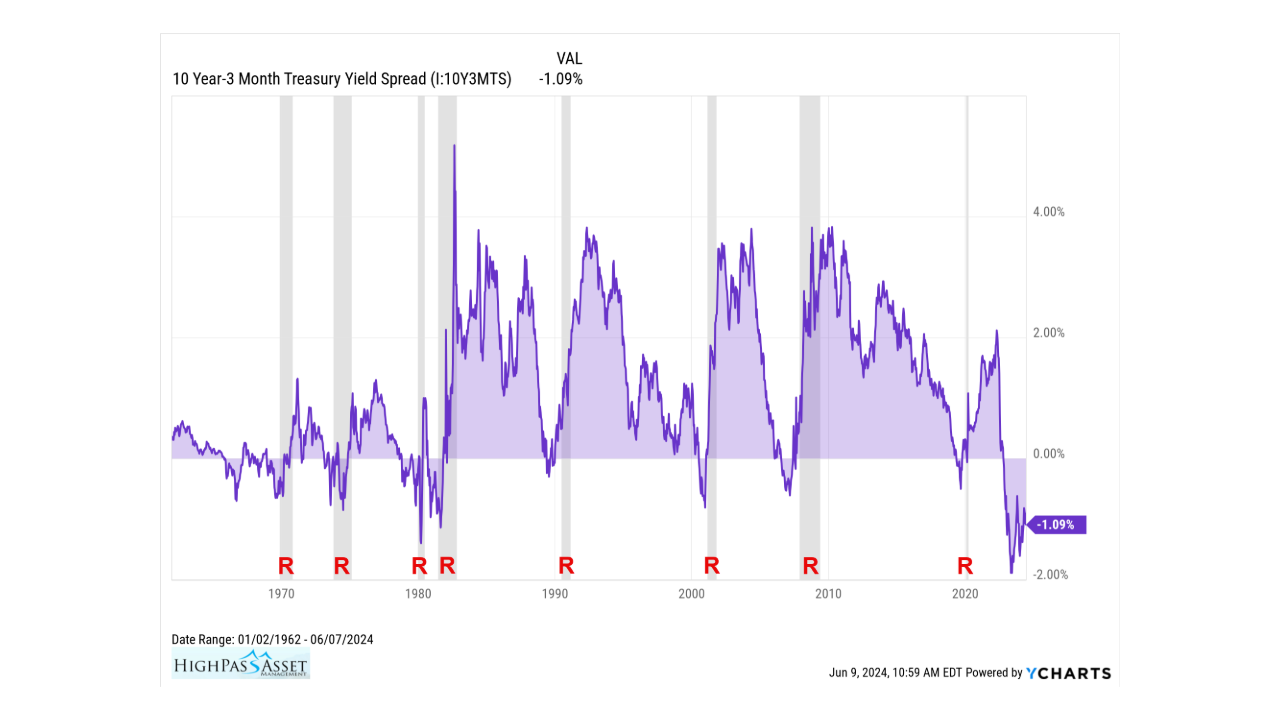

Yield Curve Inversion. Average Time to Recession.

The goal of this article is to help the reader understand yield curve inversion and the significance of yield curve inversion. We will review the last eight inversions so the reader can appreciate the importance of this recessionary indicator. What is Yield Curve...

How to Invest in a Recession and Secular Bear Market? Dividends and Value Stocks!

Recessions and bear markets are a normal part of the business cycle. There have been ten recessions in the past seventy years; with a recession occurring about every seven years on average. Bear markets come in two varieties, short term, and secular. Short term bear...